Gold and silver took a hit around noon EST as Mexico's Central Bank raised its interest rate by 50 bp, and Fed Chair Yellen said she sees a rate increase in our own future.

Nothing about either of those two events was unexpected. The Mexican CB wants to fight the peso weakness for their own reasons, and the Fed has been keen on raising rates for their own policy purposes for quite some time.

Part of their excuse for doing so will be the Trump tax cuts for the wealthy and corporations, and the fiscal stimulus package on infrastructure that he has promised.

All of this will be justified by 'dynamic modeling' which will assume that tax cuts and fiscal stimulus will pay for themselves with increased GDP.

Where have we heard this before?

Well, I am keeping an open mind. But I have a very bad feeling about all of this.

Of course, when you are picking between two evils, what else might you expect?

The speculation of who will staff what Cabinet positions under The Donald continues to be in a bull market, with the emphasis on 'bull.' So far just about any Republican with an even number of arms and legs seems to be in the running. I think he is just playing nice with the denizens of the swamp for now.

Tomorrow is a stock option expiration.

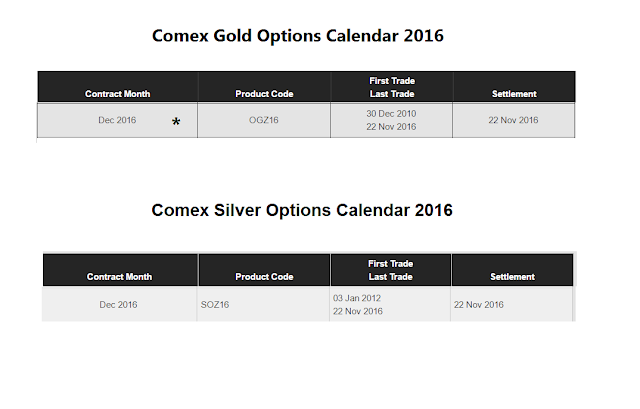

Next Tuesday the 22nd is a key Comex option expiration.

Need I say more?

Have a pleasant evening.