"Today we commemorate, not the whole history of St. Paul, nor his Martyrdom, but his wonderful Conversion...

It taught him not to despair of the worst sinners, to be sharp-sighted in detecting the sparks of faith amid corrupt habits of life, and to enter into the various temptations to which human nature is exposed. It wrought in him a profound humility, which disposed him to bear meekly the abundance of the revelations given him; and it imparted to him a practical wisdom how to apply them to the conversion of others, so as to be weak with the weak, and strong with the strong, to bear their burdens, to instruct and encourage them...

Now, observe, I do not allege that St. Paul's previous sins made him a more spiritual Christian afterwards, but rendered him more fitted for a particular purpose in God's providence,—more fitted, when converted, to reclaim others...The Pharisees were breakers of the Law; the Gentile reasoners and statesmen were infidels. Both were proud, both despised the voice of conscience.

All sin, indeed, when repented of, He will put away; but pride hardens the heart against repentance, and sensuality debases it to a brutal nature."

John Henry Newman

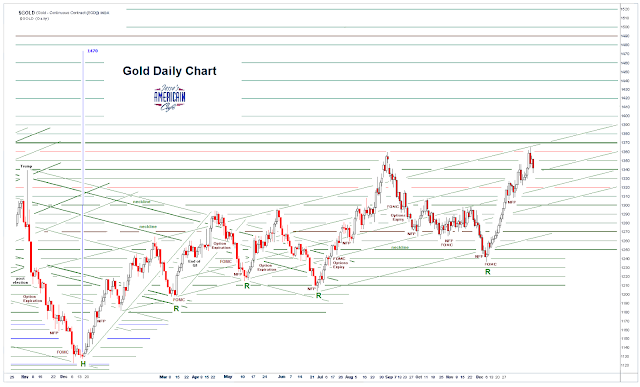

The US dollar was swooning this morning, and stocks were in a light rally. The cause of this was the ongoing policy of the Trump Administration for a weaker dollar. The weak dollar increases the price of imports, and decreases and makes more competitive exports, priced in dollars.

Treasury Secretary Mnuchin had just affirmed that policy from Davos, and Wilbur Ross added some 'trade war' friendly comments to boot.

I wrote about this intraday

here.

I was a little surprised at the metals strength, because today is an option expiration on the Comex for the precious metals, particularly significant for gold. And I thought that my lowball bids to buy more gold were just going to go unfilled for the day.

And lo and behold, President Trump issued a statement from Davos in the afternoon saying that he 'supports a strong dollar' and that furthermore, Secretary Mnuchin's remarks were 'taken out of context.'

And so the Dollar started rallying, erasing all its losses for the day. And gold and silver were immediately punched lower for a loss, reversing the entire rally which had come up to key resistance.

And my lowball bid was filled (silver lining perhaps).

Is it reasonable to believe that President Trump's remarks were credible enough to justify a major market reversal in the metals and currency markets, not to mention the stocks which also reversed and moved lower?

Don't bother answering because that is a rhetorical question. And maybe an IQ test.

Of course the remarks were not credible They were obvious rubbish, and totally at odds with everything that they have done from day one. Trump spins out literally incredible whoppers like a fast and loose New York real estate developer. How unusual.

And Trump and some Congressmen seem to be pursuing

a strategy of saying that 'everyone is dirty,' and there is no rule of law, no objective morality, so that anything goes.

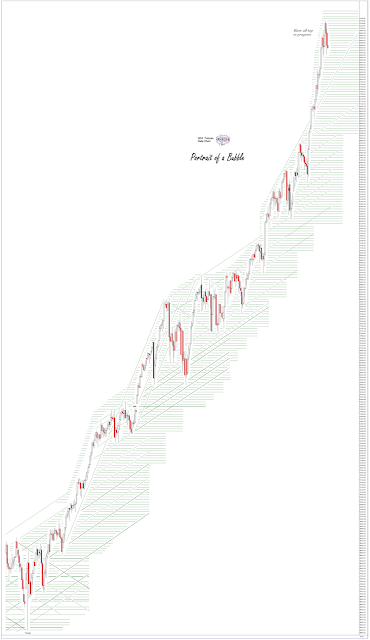

It is foolish to believe that these markets, as they are now regulated and constructed, need any genuine fundamental reason to value anything. They are pushed and shoved in the ways that benefit the insiders and the Banks, with the willing cooperation of the exchanges. We have all seen it.

This is how it goes, at least in the near future. But that does not make it right, or just, or sustainable. Our markets are not square, and out elite are increasingly shameless and amoral in serving power and breaking oaths. There is just no other way to put it.

Maybe sometimes people can become so proud, so headstrong, so blinded by a dedication to power, with the human element be damned, that they have to get knocked off their high horse and brought down low, to get back to earth. And when they hit bottom, they may relent and seek the healing restoration of repentance, and of the humanizing touch, also known as grace.

Or, as Martin Luther King put it, when he was speaking truth to exceptionally abusive power shortly before he was martyred, "God has a way of standing before the nations with judgment, and it seems that I can hear God saying to America, 'You're too arrogant! And if you don't change your ways, I will rise up and break the backbone of your power, and I'll place it in the hands of a nation that doesn't even know my name. Be still and know that I'm God.'"

Have a pleasant evening.