"While everyone enjoys an economic party the long-term costs of a bubble to the economy and society are potentially great. They include a reduction in the long-term saving rate, a seemingly random distribution of wealth, and the diversion of financial human capital into the acquisition of wealth.

As in the United States in the late 1920s and Japan in the late 1980s, the case for a central bank ultimately to burst that bubble becomes overwhelming. I think it is far better that we do so while the bubble still resembles surface froth and before the bubble carries the economy to stratospheric heights. Whenever we do it, it is going to be painful, however.”

Larry Lindsey, Federal Reserve Governor, September 24, 1996 FOMC Minutes

“I recognise that there is a stock market bubble problem at this point, and I agree with Governor Lindsey that this is a problem that we should keep an eye on....We do have the possibility of raising major concerns by increasing margin requirements. I guarantee that if you want to get rid of the bubble, whatever it is, that will do it.”

Alan Greenspan, September 24, 1996 FOMC Minutes

"And in some ways, it creates this false illusion that there are people out there looking out for the interest of taxpayers, the checks and balances that are built into the system are operational, when in fact they're not. And what you're going to see and what we are seeing is it'll be a breakdown of those governmental institutions. And you'll see governments that continue to have policies that feed the interests of -- and I don't want to get clichéd, but the one percent or the .1 percent -- to the detriment of everyone else."

Neil Barofsky, 2012 interview with Bill Moyers

Stocks were in meltdown mode, relatively speaking, to the insouciance with which they have greeted most negative economic news this year.

That recovery on Friday reeked of bravado and phoniness. But it went less noticed because there is so much of that going around lately.

There was special coverage and a wave of happy talk this morning on bubblevision, that seemed to fade into quiet desperation and calls for a rate cut to rescue the markets.

But there was really no panic, despite the fact that both of the gaps in the equity indices have now been filled, as we had suggested that they would be. For this is no breakaway gap in a booming economy. This was a gap in a highly cynical, very technical, asset bubble following the debacle in December.

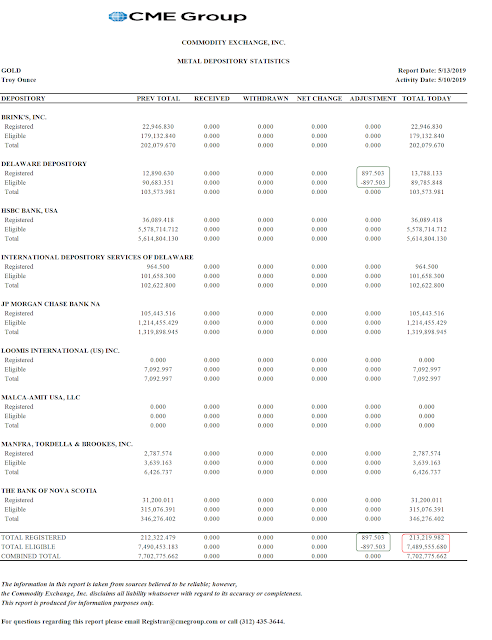

Gold was a clear beneficiary of this, banging up to the $1300 level. The dollar and silver were both fairly flat.

We may get a tweet fueled rebound of sorts. But it is unlikely to last.

There will be a stock market option expiration on Friday.

Just a quick mention as the eight year saga of Game of Thrones staggers to a close. A friend of ours sent us the following diagram of the series from China, which is included below. It is remarkably insightful. I have seen other versions floating around the circles where these things are discussed.

I am given to understand that the writers for these last few seasons of GoT are moving on to become the writers of a new Star Wars trilogy.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.