“Engage people with what they expect; it is what they are able to discern and confirms their projections. It settles them into predictable patterns of response, occupying their minds while you wait for the extraordinary moment — that which they cannot anticipate.”

Sun Tzu, The Art of War

“Hubris calls for nemesis, and in one form or another it's going to get it, not as a punishment from outside but as the completion of a pattern already started.”

Mary Midgley

"I have seen the moment of my greatness flicker,

And I have seen the eternal Footman hold my coat, and snicker,

And in short, I was afraid."

T. S. Eliot, The Love Song of J. Alfred Prufrock

Stocks declined sharply today, from their recent lofty heights, on a sudden feeling that we are not destined to enjoy a permanent series of new highs, no matter how outsized, guaranteed by the Fed.

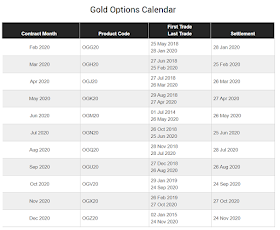

Despite the obvious flight to safety, and new recognition of risk reflected in the VIX and the Dollar, gold and silver were carefully managed, no doubt with respect to the precious metals option expiration on the Comex tomorrow.

Despite all the selling in stocks, marked by a huge gap down on the open, there was remarkably little fear apparent in the trading of the day, and the commentariat in the media. There was more of a sense of resentment that the entitlements our our elites to new highs were going to be delayed by some very rude act of nature. Ignore it, and it will simply go away. It is an epidemic of careless indignation born of arrogance.

There will be ups and downs, ebbs and flows as we once again encounter our mortality. We have only just begun to dine on the banquet of our consequences.

Have a pleasant evening.