"Efficient market theory (markets are naturally good, requiring little to no regulation) is a fraud, and further deregulation is little more than a license to steal. It is no coincidence that the gap between the wealthy few and the public is at levels not seen since the last Great Depression. This is the mark of a very unhealthy kleptocracy based not on merit but on position, power, and payoffs.

The corruption in the system acts like a huge tax on the real economy, diverting resources, labor, and investment away from productive activity and towards monopolies, cartels, and the fraudulent accumulation of wealth through the manipulation of financial assets, making money from money. There will be no sustainable recovery until there is substantial, genuine reform of the financial and political systems, both of which have been tainted by big money and corporate power promoting a very narrow and self-servingly destructive agenda.

Agree or not, things will continue to get worse, even if in a long, dwindling cycle of decay and despair, until change comes. And it will come, one way or the other. And the longer it takes, the more volatile the outcome."

Jesse, 7 September 2012

"If derivatives are Weapons of Mass Destruction, then the Credit Default Swaps market is the H Bomb. Credit Default Swaps, if they start unwinding, can develop a chain reaction that will take out a fair chunk of the real economy, in addition to two or three big name corporations.

Aren't you glad we have men [Ben Bernanke] so familiar with the mistakes the Fed made in 1929 to 1932 with regard to Fed Policy? We wish they had at least audited the courses covering the Fed's mistakes from 1921 to 1929. Sure, they are the experts; we're just concerned that they may be preparing to fight the last war."

Jesse, 1 Decemer 2007

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

You can add ideology and bias to salary in that formula.

I probably gave them, and others I am sad to say, far too much credit.

It is disappointing to look back and see how many have fallen away, and for so little.

The madness is pervasive, and serves none but itself.

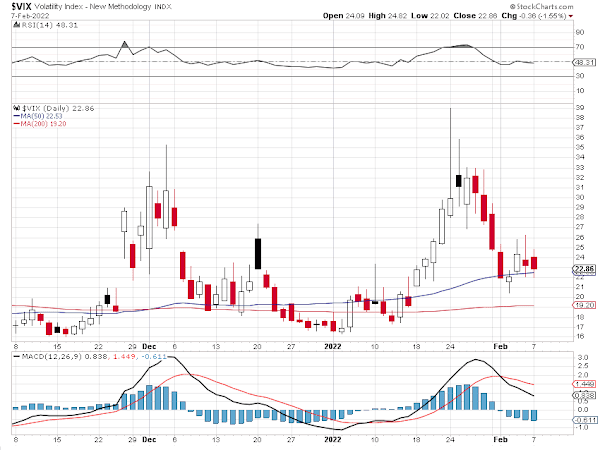

Stocks drifted lower today, weighed upon by geopolitical and economic uncertainty.

Are we in the post bubble top phase of diminishing expectations?

We did get a failed rally after a blow off top on the NDX, so the scenario of a bubble bursting in a destructive manner is in play.

Who could have seen it coming?

Gold and silver rallied today, even as the Dollar chopped sideways.

Too soon to draw any serious reactions and expectations, but the attitude towards risk is worth watching.

And the beat goes on.

Have a pleasant evening.