"Gold is unique among assets, in that it is not issued by any government or central bank, which means that its value is not influenced by political decisions or the solvency of one institution or another."

Salvatore Rossi, Chief of the Central Bank of Italy, 30 Sept 2013

"SVB [Silicon Valley Bank] has a host of problems associated with its specialty: The startup scene that is now facing a mass-extinction event. Other banks don’t have that kind of exposure to startups.

What rattled folks today was that SVB lost $1.8 billion on the sale of $21 billion of “available-for-sale” securities. It sold them because it needed to raise liquidity and to “reposition” its balance sheet.

Its depositors are startups that once had a huge amount of cash on deposit at the bank that they’d obtained from venture capital investors. But those startups are burning cash like there is no tomorrow, and they aren’t getting new funding, and so they’re draining their deposits from the bank. And the bank has to fund those cash withdrawals."

Wolf Richter, Between a Rock and a Hard Place as Banks Run Out Free Money, Mar 9, 2023

"It [Nixon closing the gold window on a Sunday evening in 1971] was one of the most dramatic economic events ever, a very big deal and I was at the epicentre of it on the floor of the New York Stock Exchange. He [Nixon] was spinning political speak, but what he was saying was that the U.S. has defaulted on its debts. And it got me thinking about what money is. What are dollars if they are not tied to gold?

I saw how the government lied or certainly spun things in a certain way. I had all these philosophical questions, like ‘Whom do you believe? What is actually truthfully going on?’ All of this pulled me into the global macro markets. The currency markets would be important to me for the rest of my life."

Ray Dalio

"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

Bernard Baruch

"Through the mills of God grind slowly,

yet they grind exceeding small;

Though with patience He stands waiting,

with exactness grinds He all."

Baron Friedrich von Logau, Sinngedichte

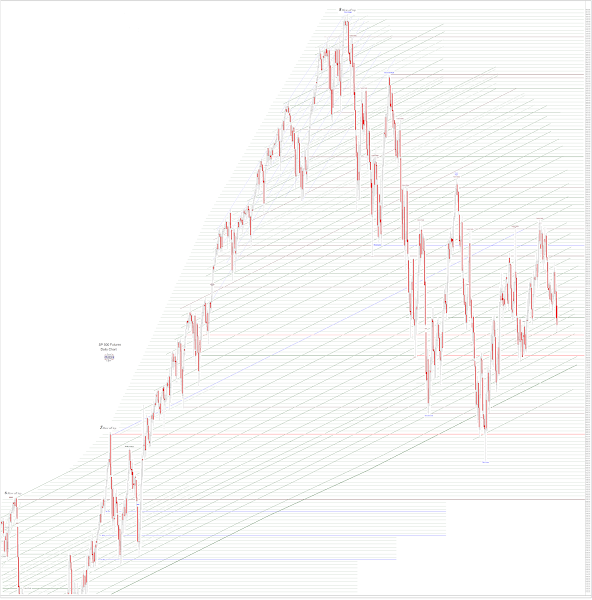

The equity markets got hit with a double barreled shot of risk reassessment this morning.

The Jobs Report came in smoking hot this morning, which shattered the fanciful notions of a Fed pivot, yada yada.

And the Silicon Valley Bank joined Silvergate and gave up the ghost, sending shock waves of contagion and suspicion through the banking sector.

Neither event ought to have been all that much of a surprise, but given the superficial and self-serving fluff that passes for analysis on the Street and financial media, it was.

And of course there is the ongoing backdrop of the slow crumbling of the crypto house of cards.

Gold caught a legitimate flight to safety after its recent pounding lower, and went out near the highs.

Silver also rallied but gave some of it back in sympathy with equities.

The Dollar gave back a little of its recent gains.

The VIX rocketed higher, but also fall back somewhat as happy thoughts were spread around.

Next week we will have the March option expiration quad witching event.

So more volatility is likely.

People are concerned that the regulators are asleep at the switch, having been plied with industry opiates and congressional laissez-faire ideology.

In summary, markets remain fragile and susceptible to shocks.

It's not a matter of intelligence so much as of willfulness.

Have a pleasant weekend.