I enjoyed this recent essay by Michael Hudson. It is a nice overview of the financialization process, and how the economic hitmen, who had ravaged the Third World, started coming home.

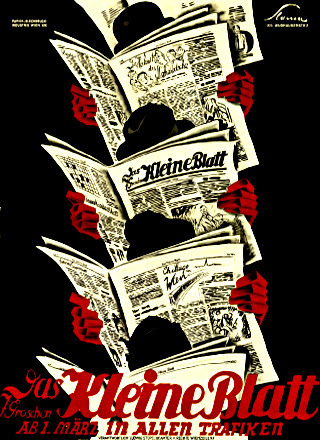

Of course I do not necessarily agree with everything in it. But the things he says make some real sense, and provide a balance to the prevailing economic mythos, and some would say propaganda, that comes out of the mainstream media in support of the financialization process.

Reality economics

A review of Norbert Häring and Niall Douglas, Economists and the Powerful (London: Anthem Press, 2012).

“Whom the gods would destroy, they first make mad.”

And if they would destroy economies, they first create a wealthy class on top, and let human nature do the rest. The acquisition of power soon leads to its abuse, to economic and social hubris. By seeking to protect its gains, perpetuate itself and make its wealth hereditary, power elites lock in their position in ways that exclude and injure those below. Turning government into an oligarchy, the wealthy indebt and shift the tax burden onto the less powerful.

It is an ancient tale. The Greeks got matters right in seeing how power leads to hubris, bringing about its own downfall. Hubris is the addiction to wealth and power, an arrogant over-reaching that involves injury to others. By impoverishing economies it destroys the source of profits, interest, capital gains, and even recovery of the original savings and debt principal.

This abusive character of wealth and power is not what mainstream economic models describe. That is why economic theory is broken. The concept of diminishing marginal utility implies that the rich will become more satiated as they become wealthier, and hence less addicted to power. This idea of progressive satiation returns gets the direction of change wrong, denying the basic thrust of the past ten thousand years of human technology and civilization.

Today’s supply and demand approach treats the economy as a “market” in a crudely abstract way, as quantities of goods (already produced), labor (with a given productivity) and capital (already accumulated, no questions asked) are swapped and bartered with each other. This approach does not inquire deeply into how some people get the capital to “swap” for “labor.” To top matters, this approach gets the direction of technological growth and basic business experience wrong, by assuming conditions of diminishing returns and diminishing marginal utility. The intellectual result is a parallel universe, whose criterion for economic excellence is merely the internal consistency of its abstract assumptions, not their realism. (Life imitates models lol - Jesse)

Häring and Douglas show that the economics discipline did not get this way by accident. They are leading organizers of the World Economic Association, which emerged from the Post-Autistic-Economic movement intended to provide an alternative to mainstream neoclassical and neoliberal economics. (Häring is co-editor of the World Economic Review.)

Toward this end they provide a wealth of references tracing how economics was turned into a propaganda exercise for financiers, landlords, monopolists, insiders, fraudsters and other rent-seeking predators whom classical economists sought to tax and regulate out of existence. This state of affairs reflects the century-long drive of these free lunchers to fight back against classical economics by sponsoring self-serving fictions that depict them as earning their fortunes not in predatory and extractive ways, but by contributing to output as “job creators.”

Any given distribution of wealth and income is treated as an equilibrium reflecting voluntary choice, without examining the organizational and social structures of workplace hiring, production and distribution. The authors provide an antidote to this tunnel vision by pointing to the real invisible hands at work: insider dealing, anti-labor and anti-union maneuvering, and outright looting and fraud. What they mean by power is employers hiring strikebreakers, lobbying for special favors and insider deals, and backing the election campaigns of lawmakers pledged to act on behalf of the 1%.

Criticizing the textbook theory of the firm, they point out that that most production has increasing returns. Unit costs fall as fixed capital investment is spread over more output. As a producer with nearly zero marginal cost, for instance, Microsoft obtains a rising intellectual property rent on each program sold. On an economy-wide level, raising the minimum wage would enable most firms to benefit from increasing returns, by increasing demand.

Firms use political leverage to make sure that anti-labor referees are appointed to the courts and arenas that arbitrate disputes about employment, working conditions and firing. Capital-intensive industries outsource low-skill jobs to small-scale providers using non-union labor. Privatizing public utilities also aims largely at breaking labor union power. Marginalist supply and demand theory implies that each additional worker that is hired increases wage rates, prompting business to oppose full employment policies in order to keep wages low, even though this limits the market for their output.

So technology and diminishing terms are not the reason why wages have been pressed down – or why financial and other non-production costs have been rising for most Western economies. These cost increases are headed by debt charges for leveraged buyouts and corporate raiding, plus CEO salaries, bonuses and stock options. Labor also faces high costs of living as a result of the soaring mortgage debt taken on to obtain housing, student loan debt to obtain an education as a precondition for middle-class employment, and credit-card debt to maintain consumption standards, and rising wage withholding for Social Security and Medicare as taxes become regressive.

This personal debt service (including housing costs) and various taxes absorb more than two-thirds of the typical paycheck. So even if workers did not have to buy any of the goods and services they produce – food, clothes and other basic consumer needs – they still could not compete with labor in less financialized and debt-ridden economies.

At the corporate level, financial engineering is more about raising stock prices than new tangible capital investment. Even this is not being done in ways that serve stockholders’ long-term interest or that of the economy at large. Häring and Douglas give a scathing review of “motivating” managers by paying them in stock options. Managers maximize the value of these options by spending corporate revenue on stock buy-backs instead of new direct investment to expand their business. Even worse, companies borrow to buy their stock or even to pay out as dividends to bid up its price. The “capital” in this gain is financial, not industrial. It also turns out to be anti-labor, as loading companies down with debt enables corporate raiders use the threat of bankruptcy to demand pension downgrades and wage givebacks. The problem with financial planning is its short hit-and-run time frame aiming at extracting income rather than taking the time to invest in new production and develop markets. Concealing this short-termism with Enron-style “mark to model” accounting fictions, managers take the money and run, leaving bankrupt shells in their wake.

Debt leveraging is encouraged by taxing asset-price gains at much lower rates than earnings (wages and profits), and permitting interest to be tax-deductible. This fiscal subsidy is by no means an inherent feature of markets. It reflects the financial sector’s capture of tax policy, along with regulatory capture to disable the government’s oversight so as to make fortunes by deregulating, privatizing, and popularizing the idea that economies can get rich by going into debt. Neoliberal doctrine demonizes government as the only power able to regulate and tax unearned income and prosecute fraud. This inverts the idea of free markets away from the classical meaning of markets free from unearned economic rent, to connote today’s arena free for predatory rentiers.

This strategy is capped by the power to censor. The misleading and deceptive depiction of the economy drawn by financiers, real estate speculators and monopolists is careful to conceal their own behavior from sight. This is the ultimate power of today’s mainstream economics: to shape how people perceive the economy. The starting point is to distract the public from noticing (and hence regulating or taxing) the real-world power structures at work. They prefer to make themselves invisible, above all the financial power to indebt the economy. It is by financial means, after all, that finance has shifted economic planning out of the hands of government to Wall Street and similar banking centers abroad.

Lobbyists for the 1% popularize a view that today’s economy is a fair and indeed natural inevitable product of Darwinian evolution. As Margaret Thatcher put it: There Is No Alternative (TINA). This narrow-mindedness is enforced by a censorial policy: “If the eye offend thee, pluck it out.” Häring and Douglas describe the academic process of weeding out any offending eyes that might introduce more realism when it comes to predatory behavior and rent seeking.

The prime directive is to depict financial planning as better than that of public agencies. In contrast to the Progressive Era’s endorsement of public infrastructure keeping costs down so as to better compete in global markets, the financial sector seeks to privatize public enterprises – on credit, preferably at distress prices to create new fortunes. The task of today’s mainstream economics, as the authors describe it, is to distract attention away from Balzac was more realistic, in observing that behind every family fortune lay a great, usually long-forgotten theft.

They focus on domestic power rather than spelling out the international dimension of how economic power is wielded. The IMF, U.S. Government and European Union bureaucracy wield foreign-debt leverage to impose the neoliberal Washington Consensus. This is how the European “troika” imposes austerity on Greece to replace democratic government with “technocrats” whose policies serve the 1% in today’s class war. This path leads in due course to the targeted assassinations by which the Chicago Boys imposed their kleptocratic “free market” on Chile under Pinochet, elaborated by Operation Condor assassinating labor leaders, land reformers and Liberation Theology priests and nuns throughout Latin America and in the United States itself. But I can understand that the authors evidently decided that they had to draw the line between economics and its military tactic somewhere, focusing on the economic core itself.

Finance has become the modern mode of warfare. It is cheaper to seize land by foreclosure rather than armed occupation, and to obtain rights to mineral wealth and public infrastructure by hooking governments and economies on debt than by invading them. Financial warfare aims at what military force did in times past, in a way that does not prompt subject populations to fight back – as long as they can be persuaded to accept the occupation as natural and even helpful. After indebting countries, creditors lobby to privatize natural monopolies and create new monopoly rights for themselves....

Read the entire essay here.