09 November 2012

Thomas Jefferson On the Danger of a Concentration of Power On Government

Thomas Jefferson, Collected Papers and Correspondence Vol. 12, Letter to George Logan:

Poplar Forest near Lynchburg, Nov. 12, 1816

Dear Sir,

I received your favor of Oct. 16, at this place, where I pass much of my time, very distant from Monticello...

Your idea of the moral obligations of governments are perfectly correct. The man who is dishonest as a statesman would be a dishonest man in any station. It is strangely absurd to suppose that a million of human beings collected together are not under the same moral laws which bind each of them separately.

It is a great consolation to me that our government, as it cherishes most its duties to its own citizens, so is it the most exact in its moral conduct towards other nations. I do not believe that in the four administrations which have taken place, there has been a single instance of departure from good faith towards other nations. We may sometimes have mistaken our rights, or made an erroneous estimate of the actions of others, but no voluntary wrong can be imputed to us.

In this respect England exhibits the most remarkable phaenomenon in the universe in the contrast between the profligacy of its government and the probity of its citizens. And accordingly it is now exhibiting an example of the truth of the maxim that virtue and interest are inseparable.

It ends, as might have been expected, in the ruin of its people, but this ruin will fall heaviest, as it ought to fall, on that hereditary aristocracy which has for generations been preparing the catastrophe.

I hope we shall take warning from the example and crush in its birth the aristocracy of our monied corporations which dare already to challenge our government to a trial of strength and bid defiance to the laws of our country.

Present me respectfully to Mrs. Logan and accept yourself my friendly and respectful salutations.

Thomas Jefferson

Net Asset Value Premiums of Certain Precious Metal Trusts and Funds

As noted earlier, the Sprott Physical Silver Bullion Trust announced a large follow on offering which priced at $13.15.

Category:

NAV of precious metal funds

Lauren Lyster Interviews Dan Ariely on Financial Fraud, Moral Hazard, and the Psychology of a Cheater

The problem is that there is little or no personal penalty these days for even the most egregious forms of financial misbehaviour and fraud. There is a fellowship of mutual corruption at the heart of the money system.

And as some have warned for years, political capture and moral hazard have broken the Anglo-American financial system with profound implications for the real economy. What I find appalling is when so called progressive economists dismiss this important principle for the sake of their models and expediency.

As you know, my theory on the cycles in society is that there is always a minority of people, perhaps ten percent, who are essentially amoral or immoral, whether from sociopathy or some other outlying behavioural tendency. They are often attracted to positions of power if they have the mind and education for it, and if not, then perhaps to various forms of crime.

But there are times when corruption and callous greed becomes more tolerated, and a larger segment of the population that is not amoral, but is perhaps morally ambivalent or suggestible, joins in on the action and tries to get theirs. And the guilt which they feel often turns into a mean-spirited contempt and anger against their own victims.

"Because of the increase of wickedness, the love of many grows cold."I found some of the examples of corporate accounting corruption in this discussion to be interesting. I have seen some of it first hand. This sort of corruption distorts markets, undermines the capitalist system of competition, and destroys whole companies and even industries.

I knew that Erskine Bowles was on the board of Morgan Stanley, but I did not know that his wife is on the board of JP Morgan. It is an interwoven world of mutual benefits and interconnecting interests at the top.

The current climate amongst the power elite is one of personal entitlement based on rationalization as described by Dr. Ariely, and assumptions of a natural superiority, self-portraying their actions even to the point of benevolence and civic spirit, guiding the poor helpless sub-humans who are incapable of self-governance and perhaps not even worthy of freedom: useless eaters. I call it the Tsar Nicholas complex.

It is a culture of narcissism, self-indulgence, exclusion, and self-reinforcement through separation from the other. The private discussions that were exposed in the recent presidential elections were a brief view into the mindset and groupthink. Their words betray them.

And it always ends, often badly.

Category:

moral hazard

Sprott Physical Silver Trust Prices Follow On Offering at $13.15

As we have watched the cash levels of the Sprott Physical Silver Trust drop below $7 million in the occasional Net Asset Value Premiums calculations posted here, I have been cautioning that they were going to be doing another follow on offering to raise cash and expand the silver inventory.

This offering is generally bullish for silver as it will take another large chunk of bullion out of the spin machine, further reducing the physical basis for leveraged paper silver.

The premiums have been reflecting that anticipation for some weeks now. The offerings tend to compress the premium on the fund for a period of time.

And here it is.

Press Release

Sprott Physical Silver Trust Prices Follow-on Offering of Trust Units In An Aggregate Amount of US$269,575,000

Nov 9, 2012

TORONTO, Nov. 9, 2012 /CNW/ - Sprott Physical Silver Trust (the "Trust") (NYSE: PSLV / TSX: PHS.U), a trust created to invest and hold substantially all of its assets in physical silver bullion and managed by Sprott Asset Management LP, announced today that it has priced its follow-on offering of 20,500,000 transferable, redeemable units of the Trust ("Units") at a price of US$13.15 per Unit (the "Offering"). As part of the Offering, the Trust has granted the underwriters an over-allotment option to purchase up to 3,075,000 additional Units. The gross proceeds from the Offering will be US$269,575,000 (US$310,011,250 if the underwriters exercise in full the over-allotment option).

The Trust will use the net proceeds of the Offering to acquire physical silver bullion in accordance with the Trust's objective and subject to the Trust's investment and operating restrictions described in the prospectus related to the Offering. Under the trust agreement governing the Trust, the net proceeds of the Offering per Unit must be not less than 100% of the most recently calculated net asset value per Unit of the Trust prior to, or upon determination of, pricing of the Offering.

The Units are listed on NYSE Arca and the Toronto Stock Exchange under the symbols "PSLV" and "PHS.U", respectively. The Offering will be made simultaneously in the United States and Canada by underwriters led by Morgan Stanley and RBC Capital Markets in the United States and RBC Capital Markets and Morgan Stanley in Canada...

Category:

Sprott Physical Silver Trust

08 November 2012

Bill Moyers and Tom Engelhardt On America's 'Supersized Politics' and the Age of Spectacle

"In the past thirty years it seems that Anglo-American culture has grown increasingly narcissistic. I do not know if there are more narcissistic individuals in society now, and perhaps there are not.

The Grandeur That Was Rome

But I do think that narcissism is much more widely tolerated, rewarded, and even admired now than it would have been in the period of 1930 to 1950 for example. And that is what makes all the difference. More people feel free to indulge their selfish and egotistical tendencies, and to cultivate them, in order to be fashionable and competitive.

As an aside, I think this also tends to explain the decline of literature and poetry in American culture, and the rise of reality shows and the preoccupation with extravagance. Literature calls us out of ourselves, ex stasis, in order to fill us with knowledge and the creative impulse, while spectacle merely panders, and flows in to fill the empty and undeveloped voids in our being."

Jesse, Empire of the Exceptional: The Age of Narcissism

Tom Engelhardt is the founder of TomDispatch.com and author of The End of Victory Culture and co-author, with Nick Turse, of Terminator Planet: The First History of Drone Warfare.

The impulse to evil is not the domain of any particular people or time, but a recurrent problem that must be confronted by each generation, and each individual person, in their own way and calling.

There is always the temptation to look upon injustice as insurmountable, and to simply turn away and to wash our hands with the thought that there is no use of trying, and even worse, in a descent into the apathy of relativism and uninvolvement saying, 'what is truth?'

That is the fate of those who who have ceased trying to be human, who have given themselves over to self-absorption, addictions, or despair, who are dying inside, and who when the time comes will make beasts of themselves, to escape the painful fragility of their own insubstantial being.

If there was any good news in the recent elections it is that so many well funded corporate efforts to promote particular candidates and their own agendas failed, despite the expenditure of hundreds of millions of dollars in slickly deceptive advertising campaigns.

This was a small victory for the American people, as the sputtering Karl Rove and the more cynical among the corporate interests went down to a general defeat, even as they were unable to accept or even comprehend that not everyone will play the fool for money, all the time.

But the more general problem of the corruption of the political parties by big money remains, and reform is the ingredient without which there will be no progress, and no sustainable economic recovery.

Gold Daily and Silver Weekly Charts - Rally Day for the Precious Metals

"You can fool some of the people all of the time, and all of the people some of the time, but you can't fool all of the people all of the time."

Abraham Lincoln

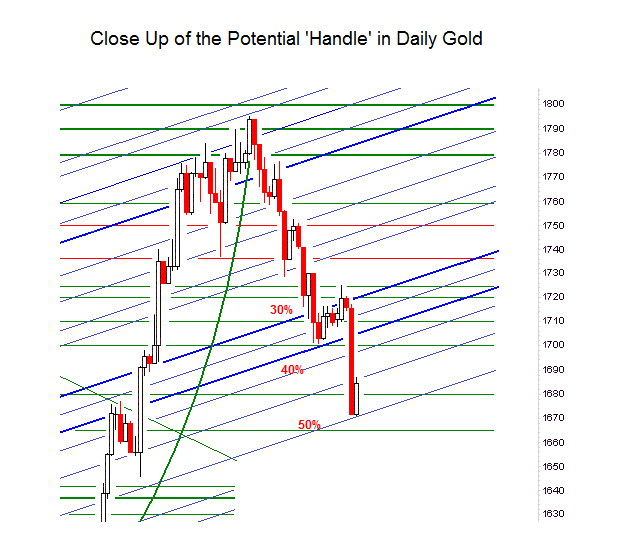

The precious metals had an exceptional rally today, given that it was in the face of another sharp decline in the equity markets. This is constructive for the bullish case.

I have closed out the 'short stocks' portion of my stocks-bullion hedged trade today. There may be more downside ahead for equities, but it looks to be a bit overdone, at least in the short term. I also took some of the bullion positions down as I had taken it to a maximum on that big decline shortly before the US Presidential election. Now it is at a more comfortable 'running' level. As always, this is with regard to my 'trading positions' as I do not touch or even look at my long term holdings.

Gold has moved very nicely through the resistance around 1720 and 'stuck a close' for today over 1730. We *might* see a test of that resistance at 1720, which is now support below the current price. But if this is a handle in a cup-and-handle formation, then that does not matter, and it is playing out very well. However a clear break above 1800 is key.

The central banks are printing money to rescue the Western banking system. There is an enormous macro event taking place in the global currency as the US dollar reserve currency agreement, in place since World War II, has been changing for at least the past ten or more years, first slowly but soon with increasing speed.

Very few people understand what is happening, even amongst economists. Those who stand against this sort of change will find themselves swimming against a rather powerful secular tide. There is nothing cyclical about this financial crisis or the economic ills that have accompanied it in the conventional economic sense, unless one wishes to start looking at very long, generational cycles of human wickedness and folly.

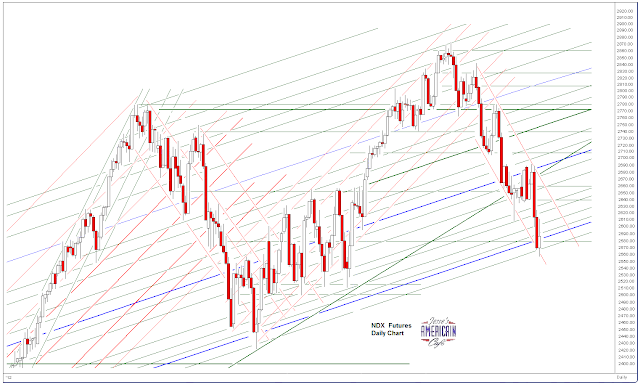

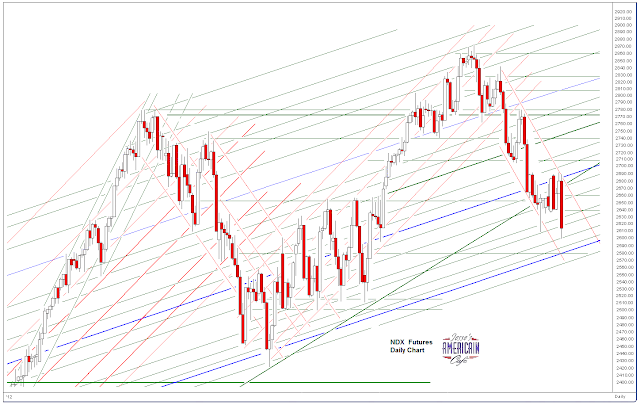

SP 500 and NDX Futures Daily Charts - Another Down Day

Stocks continued to give it up on price as AAPL is a drag on big tech, and earnings overall appear a bit weak based on sluggish demand.

The problem is not 'uncertainty,' or 'the fiscal cliff.'

The problem with the economy is very weak aggregate demand by the large bulk of consumers who are seeing a very weak median wage, which is a structural problem that has been years in the making.

The problems in the western economies are intimately involved with the global currency war, and a rogue element in the Anglo-American financial system that has wounded the principles of market capitalism with the same old systemic frauds and a foul partnership with the political leadership.

I suspect this stock market downturn has run much of its course by historical standards of elections in which the incumbent wins re-election, but we will have to see if it can find its footing. There are some intense negotiations going on behind the scenes as the monied interests scramble to promote their policy positions.

07 November 2012

Gold Daily and Silver Weekly Charts - Good To Be Back Again

“First you destroy those who create values. Then you destroy those who know what values are, and who also know that those who have already been destroyed were in fact the creators of values.

But real barbarism begins when no one can judge or know that what they are doing is barbaric."

Ryszard Kapuscinski

Sometimes one does not really appreciate what they have until it is gone.

It is good to be back again.

Gold has certainly had a volatile trade here in what appears to be the 'handle' of a cup and handle formation.

This is reflective not only of the volatility of a potential turning point ahead of a big move, but also the relative artificiality of the markets overall.

A storm has a gathered intensity within it that becomes unleashed in big events, as the northeast of the US has recently seen. The same can be said of the big changes that occur in the events of humankind.

The great events of life bring out the best and worst in people. I have seen this undeniably proven again and again, but especially in the last week.

People are the oddest mix of a strange transcendent nobility and self-denial, and a pure cussed meanness and ignorant aggressiveness, with a callous, almost brutish, disregard for others.

But even in the face of the most blindly self-destructive arrogance of a few, the goodness in life, its tender mercies, seems to appear again and again, and remains resilient. And this is what gives us hope, always.

"What keeps faith cheerful is the extreme persistence of gentleness and humor. Gentleness is everywhere in daily life, a sign that faith rules through ordinary things: through cooking and small talk, through storytelling, making love, fishing, tending animals and sweet corn and flowers, through sports, music, and books, raising kids—all the places where the gravy soaks in and grace shines through.Let's see how the trade in precious metals progresses over the next few days, to see if the handle 'sets' and a cup and handle formation is confirmed with a breakout.

Even in a time of elephantine vanity and greed, one never has to look far to see the campfires of gentle people. Lacking any other purpose in life, it would be good enough to live for their sake."

Garrison Keillor

The area where the price swings settled today, around 1720, is a key resistance area. The breakout will be achieved if gold can break up and out through 1800.

Category:

cup and handle formation

SP 500 and NDX Futures Daily Charts - The Morning After

As you may recall, I said some time ago that if Obama was re-elected the equity markets would sell off.

That was almost a no brainer, if one looks at the historical market action after a win by an incumbent. But more importantly, the implications for tax selling this year with the reasonable expectations of higher taxes next year.

So what next? We may see a choppy, sideways market, as some things are uncertain, but again, the fundamentals of the markets are foul. The economic recovery is weak, because demand and the median wage are weak.

There will be no sustained recovery until there is genuine reform.

05 November 2012

Daily Gold 'Cup and Handle' Chart Update

A "Cup and Handle" is a bullish continuation pattern in an uptrend.

The greatest factor working against this current gold chart as a cup and handle is that it appears during a consolidation pattern in a broader uptrend.

The 'cup' is best shaped as a "U" and the broader the bottom the better.

The 'handle' is a retracement when the right side of the 'cup' reaches its prior highs. The handle often resembles a bullish pennant.

The retracement usually does not exceed 30% of the advance of the cup to its second high, but can go as deep as 50% in a volatile market.

The cup and handle formation will not be activated until the price of gold rallies about the 'rim' of the cup which is at 1790.

If this correction exceeds 50% then we must consider that gold is in a broad trading range.

Category:

cup and handle formation

SP 500 and NDX Futures Daily Charts

No comments. I have limited access to the news of the day.

The US is expecting a rather close Presidential election. It will be interesting to see how and when the markets may move in response to the final results, which may be delayed depending on the usual factors in a close race.

04 November 2012

31 October 2012

There Will Be No Updates Until Monday - Update Fri Nov 2

There will be no updates until Monday, perhaps as late as Wednesday.

Thank you for your concern but I am fine, just out of pocket as they say.

Please do not email until I start posting again.

Bought some additional gold positions on Friday afternoon for my balanced hedge.

Otherwise just catching up on reading, and counting blessings.

"Lead, Kindly Light, amidst th'encircling gloom,

Lead Thou me on!

The night is dark, and I am far from home,

Lead Thou me on!

Keep Thou my feet; I do not ask to see

The distant scene; one step enough for me."

J. H. Newman

Have a pleasant weekend.

29 October 2012

SP 500 and NDX Futures Daily Charts

The US equity markets were closed today but the electronic futures markets were open from yesterday at 6 PM until 9:15 AM today.

The volumes were very light as one would expect.

The US equity markets will be closed as well tomorrow.

The gold and silver futures were also open, which enabled a calcuation of a spot price off the front month. The volumes were so light I am not going to bother with chart updates until tomorrow.

Have a pleasant evening.

Greg Palast: Billionaires and Ballot Bandits

Greg Palast on the Koch Brothers, Karl Rove, and their buddies.

Subscribe to:

Comments (Atom)