“He who makes a beast of himself gets rid of the pain of being a man.”

Samuel Johnson, Anecdotes of the Revd. Stockdale, 1809

"I met a traveller from an antique land

Who said: Two vast and trunkless legs of stone

Stand in the desert. Near them, on the sand,

Half sunk, a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them and the heart that fed:

And on the pedestal these words appear:

'My name is Ozymandias, king of kings:

Look on my works, ye Mighty, and despair!'

Nothing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away."

Percy Shelley, Ozymandias, January 1818

"While some of the crowd were speaking about how the temple was adorned with costly stones and offerings, he said, 'All that you see here, the days will come when there will not be left a stone upon another stone that will not be thrown down.'

Then they asked him, 'Teacher, when will this happen? And what sign will there be when all these things are about to happen?'"

Luke 21:5-7

Cruelty has a Human Heart

And Jealousy a Human Face

Terror the Human Form Divine

And Secrecy, the Human Dress

William Blake, A Divine Image, Songs of Experience, 1789

"And they said to him, 'Where will this happen, Lord?' And He said to them, 'Where death is, there a gathering of vultures will be.'”

Luke 17:37

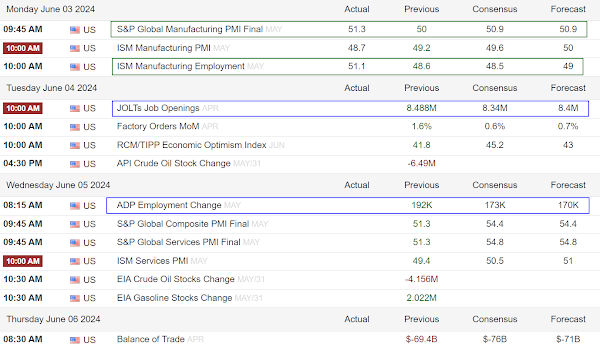

The Non-Farm Payrolls Report came in hot this morning, and so the markets decided, in their bipolar wash and rinse fixation, that a rate cut will not be forthcoming.

And so the Dollar rallied sharply.

Stocks initially fell, rallied back to the green, and then faded into the weekend.

Gold and silver were brutally and deliberately slammed, going out near the lows.

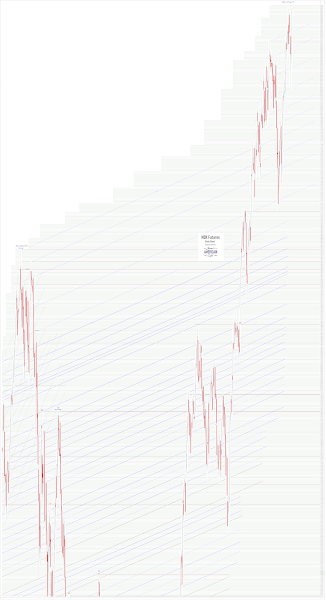

You might note from the chart that two interesting things have occurred.

The first is that the base for an ascending W pattern is now set. I have market it with a support line

And secondly, both legs of the formation are standing on a low set with the Non-Farm Payrolls report.

I believe I mention the NFP a few times. I even put its designation on the chart ahead of time at the approximate location where I though the smackdown was intended. I had it a little high, but not far off.

Might makes right, at least to some people of heavily dislocated ideological persuasions. Its all the fashion in the Capitol these days, I hear. In District 12, not so much.

So what next.

A lot depends on how much bullion buying the adults in the rest of the world will be doing at these lower prices.

Silver I think is a virtual no-brainer given industrial demand, but stranger things have happened.

One ought never underestimate the boldness of a nest of vipers when cornered, and their time is passing.

Some have even been known to precipitate crises of distraction, that kill and maim innocent people.

This is the darkness of their hardened hearts. Damned for the world.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.

.JPG)