skip to main |

skip to sidebar

Gold and silver had another rally today on the inflationary assurances from Mario Draghi of the ECB this morning that excited a stock market rally.

Real economy numbers continue to appear weak, based on weak consumer demand.

GDP number for Q2 is out tomorrow. A weak number will provoke more talk of QE.

Amazon and Starbucks both guided lower on weak earnings reports.

Facebook beat by a penny.

Mario Draghi cheered the markets this morning by pledging that the ECB would do whatever it takes to support the Euro.

Tomorrow the US reports its advance GDP number for the 2Q. According to Briefing.com the consensus of economists is 1.2%. I would not be suprised to see a sub one percent print, and more talk of QE at the next Fed meeting.

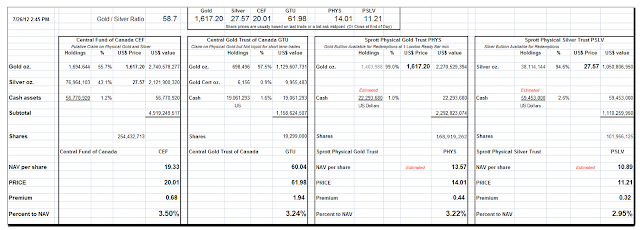

The PSLV premium seems on the historically cheap side, but the fund is still digesting their latest shelf offering that added units and is still adding silver it appears.

The cash level is high.