skip to main |

skip to sidebar

Apparently since Blair the FSA has been soliciting financial business by advertising the loosest regulatoary morals on either side of the Atlantic.

Not that the US is any paragon of virtue. Timmy is known as the go-to head boy for the biggest banks.

But this is no surprise, because as Kansas City Fed governor Hoenig said, for the past twenty five years the selection of the US Treasury Secretary has been done by a de facto private auction to the biggest banks.

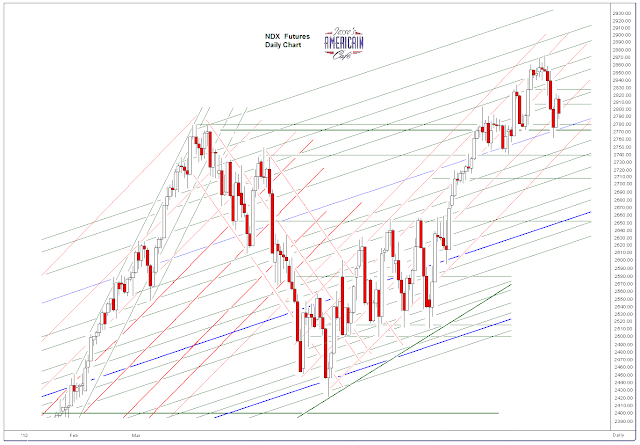

Not much of a pullback but still stuck at resistance.

It appears that September has come and gone without the CFTC saying 'peep' about the manipulation in the silver markets.

Let's see how next week goes.

Have a pleasant weekend.

I was a bit surprised to see the paint slipping off the tape today, in the face of slack domestic US economic news. People cannot spend what they do not have.

High Frequency Trading, as it now stands, is institutionalized corruption of the markets, and it is killing them. The SEC is looking at it, but it is hard to imagine that they will do anything meaningful in the way of reform.

Those who 'own' the exchanges are operating them as their personal casinos, front running and skimming customers at every turn, and they generally get their way with these regulators in the States.

The market was sluggish today. Let's see if the bulls can whistle up a rally next week on these light volumes.