"The filing of this lawsuit now by Weber officially begins the raging clusterfuck portion of the story, as he and his lawyers are releasing lurid details not only about Kotz and Maloney, but about a host of other SEC and SEC IG officials.

It's very strong stuff: the only things missing from this lawsuit are tales of SEC officials running white-slavery rings and snorting brown-brown off the corpses of strippers with West African rebels...

It's hard to say how all of this will shake out. Certainly, from a P.R. standpoint, it'll be ugly for the SEC. One other storyline to follow: If the Weber retaliation claims are true, they fall within an ongoing and increasingly disturbing pattern of federal whistleblowers who have come forward and experienced reprisals themselves instead of having their claims investigated properly."

Matt Taibbi, SEC Rocked By Sex and Corruption Scandal

Hell hath no fury like a whistleblower fired, ridiculed, and scorned in the national press. As you may recall, earlier this year Mr. Weber was labeled a dangerous crank for allegedly wanting to bring a gun to work. He was subsequently cleared in an investigation but was fired nonetheless.

I do not recall hearing about this unfolding scandal at the SEC on the mainstream medias. But I tend to get most of my serious financial news and commentary from Rolling Stone magainze and the Comedy Central network these days anyway.

The story about this lawsuit came out quietly last week in the wire services with non-descript headlines like: Ex-SEC Investigator Sues Agency, Seeks Damages of $20 Million. There was a more in-depth story from Thomson Reuters that portrayed Weber's allegations as 'hard to swallow in their entirety' here.

The Taibbi piece is an interesting read. Matt has an outré phraseology that puts a sharp point on his stories. If there is a Congressional investigation about this I would imagine that C-Span would receive a significant boost in the number of viewers for some of the live testimony. Americans do not care much about financial corruption, or even gross abuses of justice and individual rights including torture, unless it involves sex.

As you may recall there was a minor scandal a couple of years ago when it was revealed that there was a propensity amongst some at the SEC to spend most of the quiet intervals between trips through the revolving door between Washington and Wall Street by surfing the web with a bias towards porn sites.

Apparently not all regulators were so sedentary in their pursuit of kicks, bangs, and thrills of the belly button and below. You can read the details from Taibbi here.

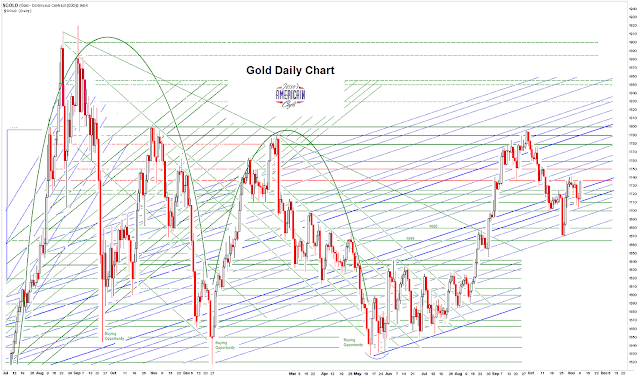

The continuing development of a potential 'cup and handle formation' was discussed intraday here.

As I pointed out last week, the markets were being taken much too far to the sell side, and it appeared to be tax-selling as the VIX failed to show any real fear that was driving the market. It was more of a financial calculation.

So what next. This is a holiday market in the States, and is going to be thinly traded. There are the 'fiscal cliff' which is artificial, and the continuing conflict in Gaza, which is a destabilizing influence on the region and a human tragedy for all concerned. And thirdly there is the economic instability in Europe and the adoption of the bank bailouts "Japanese model" which is crippling the real economy.

All three of these present a situational risk to markets should they take an unfortunate turn for the worse. There could be an associated divergence between stocks and bullion as they may not present as liquidity events but as a risk trade.

Let's see how the market makes its way into December.

Have a pleasant evening.