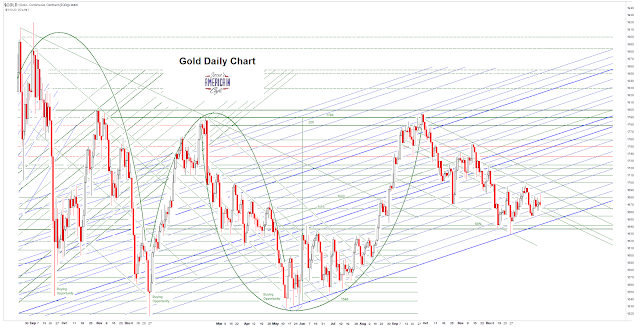

Gold was pushed back hard from its attempt to break out above its 50 DMA which is around 1684.

Silver held its ground a little better.

Cap, cap, cap.

C'est la guerre monétaire.

I found this comment from a reader on the equity markets to be resonant with my own thoughts.

"High frequency trading software that focuses on feedback loops is a useful diversion to hide front-running, short squeezing, and other parasitic activities. The current BS about rotation out of bonds is merely an attempt to attract retail because they’ve run out of shorts to squeeze to take the markets higher.

If you can put aside your moral outrage, this strategy is a thing of beauty – disgusting, evil, and fraudulent but beautiful in its execution."

Frauds R' Us. Its the major growth industry, and the dominant export of the US and UK.