31 July 2014

30 July 2014

Gold Daily and Silver Weekly Charts - All Along the Watchtower

“We’ve had a lot of bombs being thrown around the world, and this is America throwing a bomb into the global economic system. We don’t know how big the explosion will be — and it’s not just about Argentina.”Joseph Stiglitz

Gold took a little hit today, and silver held its price.

Very anti-climactic given such an impressive sign of recovery in the real economy!

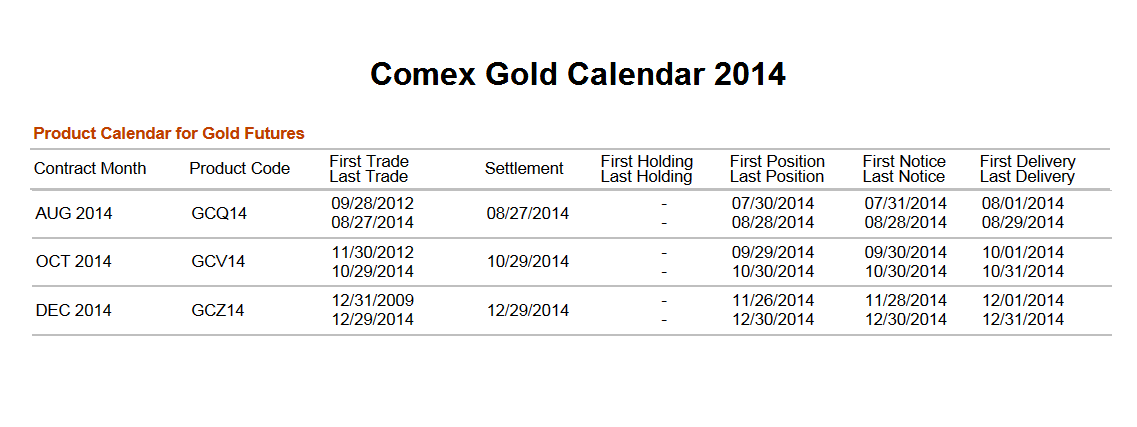

Nothing much happened on the Comex exhibit at Madame Tussaud's. The clearing report for all metals (gold, silver, platinum, copper) was simply 'no data' as shown below.

The tragicomedy that is the Argentine debt default continues on 'to the wire.'

As for the markets, there will be a lot of noise created, the stock and bond touts will all be out there making their pitches, but the bottom line is that the death and misery of the hoi polloi will leave the markets unfeeling, and the Fed isn't going to be doing anything except to continue to taper, but provide easy money for the fortunate few for quite some time.

The currency war has taken a hotter turn than I might have expected at this stage, with the US out banging the war drums very actively as a distraction. I suppose that one might not be so surprised. The privileged will do almost anything rather than surrender the status quo.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Triumph of the Swill

GDP was 'better than expected' this morning, coming in at 4.0% growth.

Well, it was not better than expected if you read my forecast about what they would do with it and the revisions.

They even improved the fourth revision of that anomalous one-off please ignore it Q1 to only -2.1% vs. a -2.9% decline. Progress!

The tech bulls are riding high, laughing it up on bubblevision.

It's a new paradigm, don't you know? They are feeding this bubble on swill.

Have a pleasant evening.

Subscribe to:

Comments (Atom)