The Comex is a bucket shop, but the question remains how much of a bucket shop have the major equity exchanges become in the hands of the High Frequency Teasers?

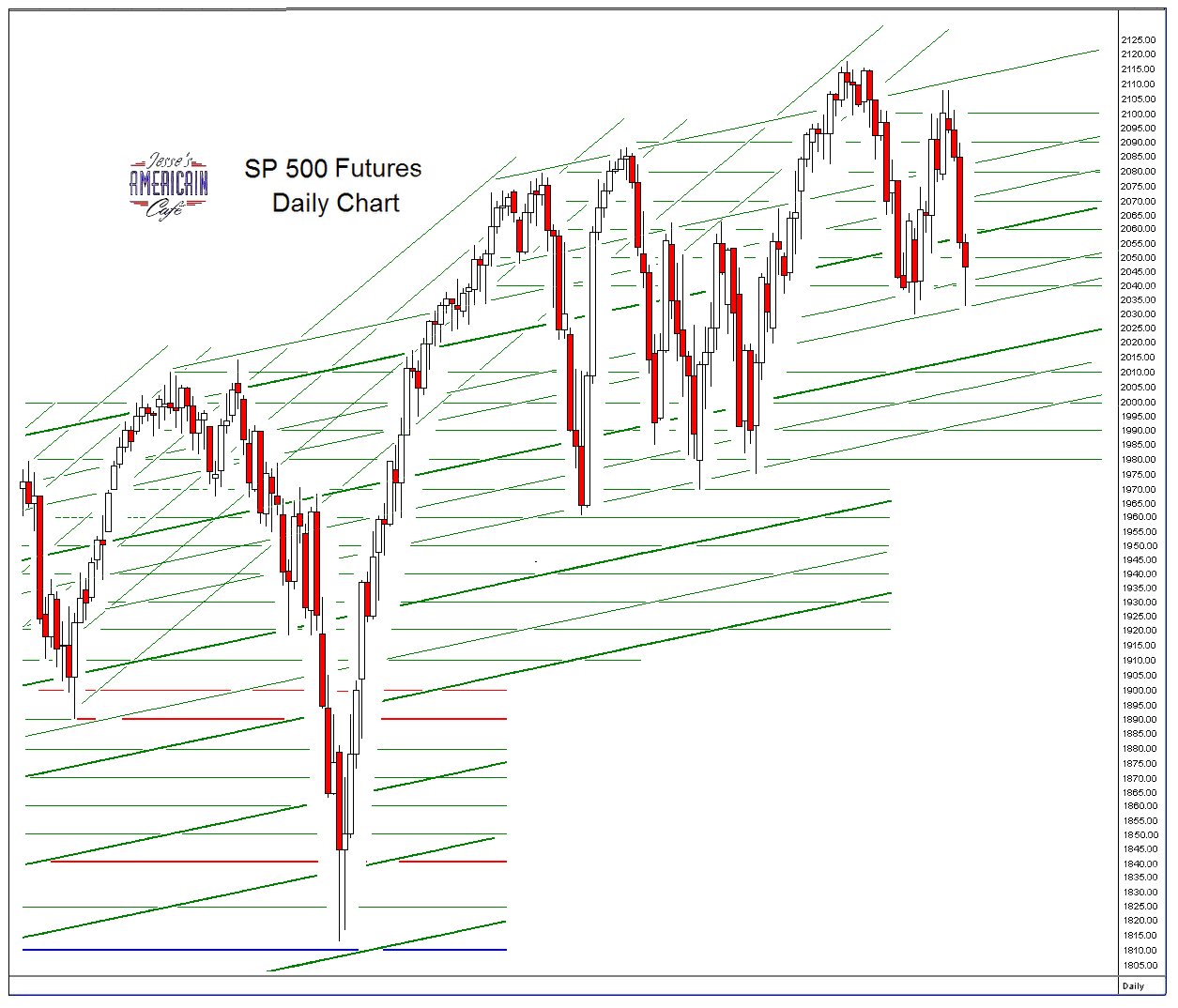

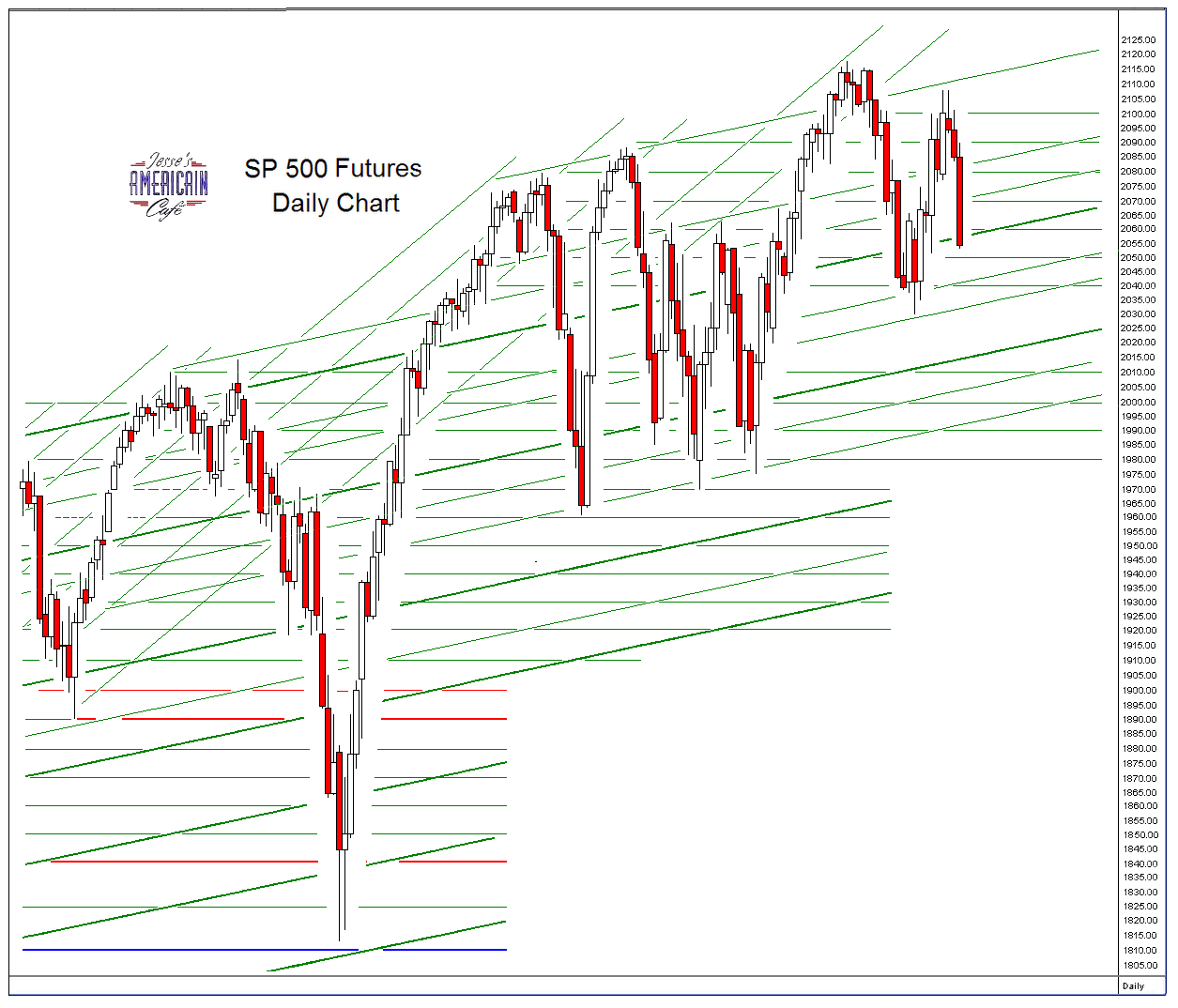

So far the decline may be a bit exhilarating for the largely clueless 'buy and hold' crowd, but as shown in the SP 500 cash chart below it has dropped to familiar territory around the 100 DMA.

The stock market has been known to find the energy to shift from rinse cycle to a spin dry around here, and then run up again for another wash in the wash-rinse=spin cycle that is the new capital allocation system in the great NY Laundromat, second only to the bucket shop in sheer brazen manipulation.

So let's see if it holds here, or the Yellen put kicks in at the next stop on the cycle, at the 200 DMA.

The game here is to keep pumping the Banks with plenty of cash, allowing it to be used by the one percent to basically buy everything up on the cheap, turning the remainder of the country into serfs.

Anti-trust? What's that? The only thing not to trust in is the rule of law. Knock down all the laws, and then when the cold winds of private tyranny blow across the lands, what then will stop them?

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

Have a pleasant evening.