There was some intraday commentary on the metals here.

The bucket shop delivery and warehouse reports were quiet.

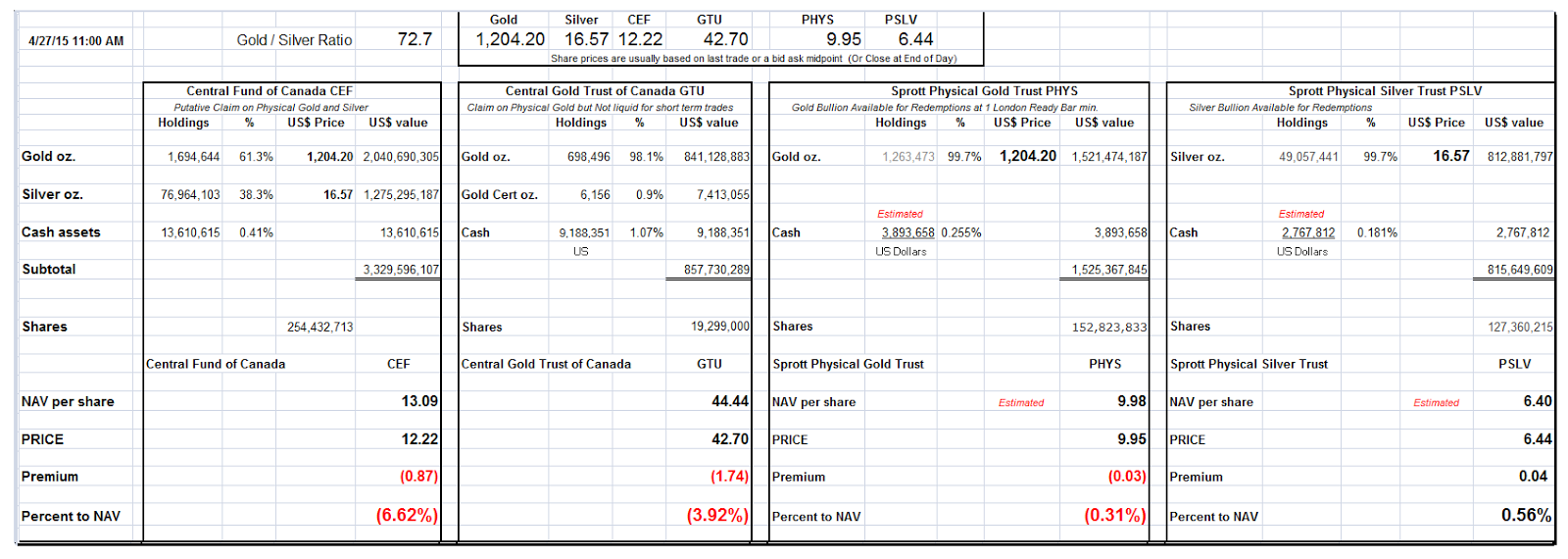

Gold and silver had a sharp rally this morning. Some would ascribe it to a perception that the Fed will not be raising rates anytime soon.

I think we have played that tune many, many times. Too many to matter much anymore.

Let's see what happens.

Have a pleasant evening.