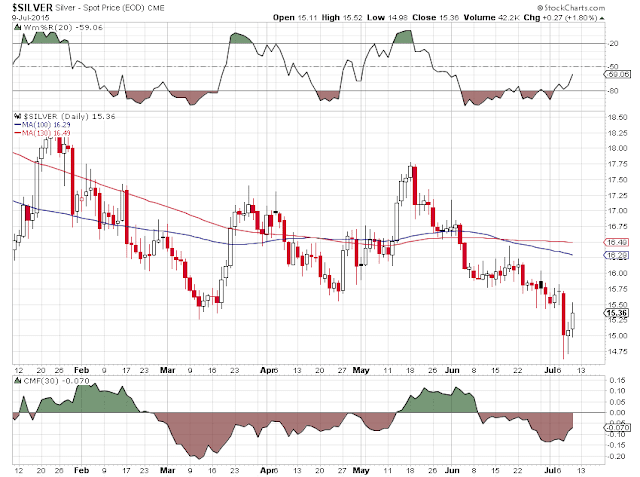

As I mentioned the other day, this is now the kind of market where it makes sense to take profits if you have them, and hold more cash until the mispriced risks resolve themselves. I am holding mostly cash and precious metals for myself, and am looking carefully at a couple equity plays along the lines of the precious metals, but not with any particular conviction. This market crisis needs to resolve.

The biggest drivers of global risk are the collapsing China asset bubble and the inherently unstable governance of the Eurozone, manifesting as it is now in Greece, and all the uncertainty that this brings.

But Spain, Portugal and Italy face similar challenges. German hubris is destroying the Eurozone which itself is not a particularly durable model of organization economically and politically.

One of most difficult issues is the unreliability of the media and the political and economic class to tell the truth, particularly as the quadrennial power struggle called the Presidential elections approaches. Spin and deception are flying hot and heavy. And unfortunately most of the captains and crew of the ship are busy packing goods into their personal lifeboats.

Speaking of unsustainable, take a look at the spike in new unemployment claims and the high continuing claims number in the US economic data. And the Fed is still biased towards raising rates, and continuing to pump the top down stimulus into a broken system. Madness.

As for the Congress and the Administration, politically the US has not been this badly led for quite some time, and I vividly remember the Nixon years.

So, let us protect ourselves, both financially and spiritually, with an eye towards the things that really matter. This is really all one can do for now.

Have a pleasant evening.