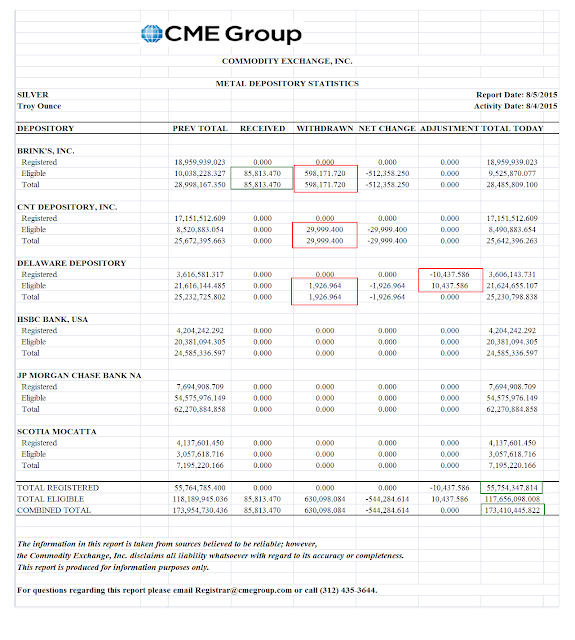

There was intraday commentary here about a large number of ounces of gold taken in delivery yesterday, and JP Morgan's heroic attempt to fill the gap between paper and physical bullion at the last minute.

And yet these numbers are barely rounding errors compared to the global physical markets centered in Europe, the Mideast and Asia. That is what seems so insane about this 'pricing discovery.'

The US financial system looks like an accident waiting to happen-- again

We bailed out the perpetrators who crashed the financial system, quickly made them even larger, and then stood by while they continued to commit serial financial frauds and market manipulation, politely referred to as 'rigging,' in most of the global markets.

See: Citigroup's Unchecked Crime Wave

How nuts is that? How would you explain the reason for something like this?

Eric Hunsader of Nanex says that he can now prove that the US exchanges favor one class of trader over the others. Why would the stock market be any different than all the other arrangments we see in our crony capitalist society amongst the pigmen.

Speaking of favoring a special class, want to end a corporate welfare tax loophole and subsidies that would save the US billions and help rebuild the national infrastructure? Read this.

Have a pleasant evening.

Time for a demagogue break? Too bad this time we do not have a chance for a 'New Deal.'