21 August 2015

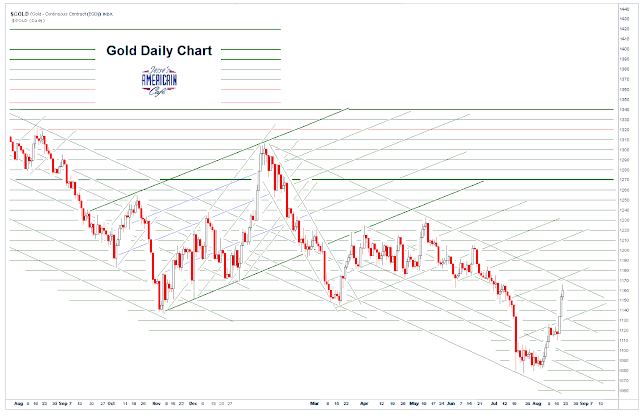

Gold Daily and Silver Weekly Charts - Capped - Option Expiration Next Week

"MIT and Wharton and University of Chicago created the financial engineering instruments which, like Samson and Delilah, blinded every CEO. They didn't realize the kind of leverage they were doing and they didn't understand when they were really creating a real profit or a fictitious one."

Paul Samuelson

The precious metals were remarkably quiet again at The Bucket Shop®.

There were no gold contracts taken, and although there were 242 silver contracts stopped, customer to customer, which is much more than we have seen so far in this off month for silver, I don't see any particular significance to it. Sometimes some metals sites do go overboard with trumpeting these little jiggles. Maybe something is there, but not that we can see yet.

There was intraday commentary last night about the setup for a short squeeze in the metals titled Spec Flambe. I do think that we will see more about this, and I will be watching the Commitments of Traders composition a bit more carefully for the next few weeks.

It is unusual for the private speculators to be so short this market, and it generally gives the commercials, the professional market makers and takers, to give them a bit of a run.

I suspect today was a lot of gold bulls taking profits ahead of the weekend. Profits have been so scarce that one can hardly blame them.

I have included the economic calendar for next week below. GDP seem to be the biggest thing.

We will have a precious metals option expiration on Wednesday the 26th which may be more of a thing for silver than for gold.

We had a nice rally off an oversold bottom this week. Follow through is everything, so eyes on next week.

It is hard to believe that the end of Summer is nearly in sight, and the harvest time. We will be reaping what we have sown soon enough.

Please try to remember the poor, and those who have none to care for them. And for each other, in our daily thoughts and prayers. Life can be hard for everyone, but particularly for those who are burdened by the emptiness of their own hardened hearts, broken by disappointment, and lost in a misunderstanding of what it is to be human and to love. Theirs is the greatest poverty of all.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - Option Expiration - Ten Percent - She's Come Undone

"Life is a school of probabilities."

Walter Bagehot

For those who are caught in a time warp of the recent present, what we are seeing in US equities is known as a 'ten percent correction.'

We have not seen one of those ever since the Fed decided to inflate financial paper three or more years ago.

The selling in Europe continued over into the US sessions, and once support was broken it seemed to be just a matter of how much downside traders could tolerate while bailing out of positions ahead of the weekend.

VIX spiked up to a high we have not seen since last October.

I am somewhat pleased that I was determined enough to carry those low points for so long on the charts, along with their trendlines, because they proved to be very handy. I have extended them on the updated charts below.

We also see an actual chart formation work on a chart. We have not seen that since the Fed started playing with the markets in quite some time. Stock broke down out of a nicely formed symmetrical triangle formation, a topping formation as I have noted previously.

What was nice about it from a chartist's perspective is that the formations called out a target price very close to a 'ten percent correction' which I have also marked on the charts.

These are charts of the futures markets. The actual numbers may be slightly different on the cash indices.

We hit it almost on the nose with the NDX, which as you may recall led the way up, and so led the way back down again, with its narrow concentration of playable names that the players played.

The SP 500 futures have a little way yet to go, if they are indeed going to hit an even ten. But they are close enough for wet work on the Street.

And do not forget that today was an option expiration that helped to add some spice to the grift.

Now we are at the bottom, or near the bottom, of a long term trend channel. So a bounce of some sort next week, after perhaps a little more malingering here, might be expected.

One of the most ominous formations to watch going into the September-October timeframe is a market break followed by a rally back up that nears but does not exceed the highs, and then fails, badly. If we see that a cascade lower may follow.

It might be tougher than I even imagined for the Fed to ignore the real economy and raise rates off the zero bound in September, and perhaps even December, but they would certainly like to do so. And it would be very dramatic if they tried to pump asset prices back up to give themselves cover, and then the markets failed after the rate hike, as in the scenario described above. Policy error, par excellence.

Janet's plans may have come undone.

Have a pleasant weekend.

Subscribe to:

Comments (Atom)