"The IMF has put Monetary gold right at the top of the global reserve assets list – above SDRs. The IMF writes, '…The gold bullion component of monetary gold is the only case of a financial asset with no counterpart liability.'"

Koos Jansen

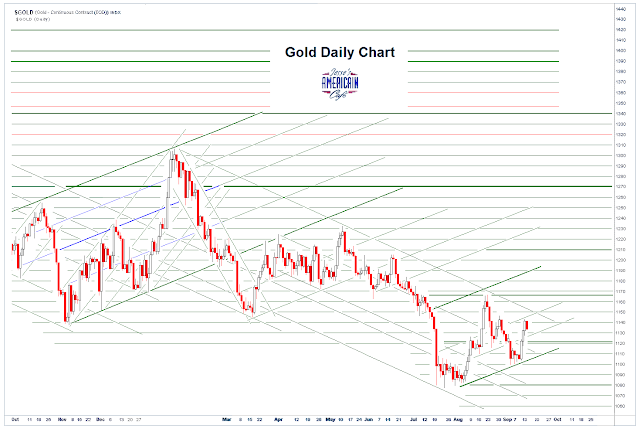

Gold took a light hit on the London PM fix and the opening of The Bucket Shop this morning. Silver took a hit as well but managed to bounce back up and finish positive on the day, probably because it is in an 'active month' at the betting parlor on the Hudson.

I read an analyst talking about the old 'gold vs. silver' argument over the weekend. In my opinion it is a fruitless argument to consider in the abstract, and so I don't.

Gold and silver are both precious metals, but have some not so subtle differences. Silver has a much higher beta, meaning it will go up more and down more than gold.

So if you can handle the volatility then silver is fine. If you would like less volatility and more 'insurance' then gold is more suitable. Gold has less of a component of industrial use than silver, but there is generally more free floating silver around than gold, and much of it is produced as a byproduct of mining base metals.

There is a place for both in any diversified precious metals portfolio. Arguing about the merits of one versus the other is like arguing about which is better, a screwdriver or a hammer. You have to consider the job at hand for yourself. And you can have a use for both of them.

I am personally persuaded by a growing amount of circumstantial evidence that there is a potential short squeeze developing in physical gold in London and New York, fueled by excessive paper trading and the insatiable demand in Asia.

It was electrifying last week when Jim Rickards said that the gold trade at the LBMA in London is wholly unallocated, and they hedge those positions on the Comex. I had thought it was a split trade at the least. If this is indeed the case, the public slipups admitting that the LBMA trade is running at 100:1 leverage implies that there is an enormous exposure to a shortfall of physical bullion for delivery and an unwinding of that leverage.

New York really trades overwhelmingly on a non-physical basis these days, so The Bucket Shop is more likely to be a late stage 'tell' and collateral damage than an actual precipitant of a short squeeze. And as a physical hedge it seems about as useful as fur coat in a flood.

London is the real Occidental bullion hub, and they tend to shroud their leverage and pricing antics behind a curtain of privileged secrecy. But London and Switzerland are the pivot points where the physical bullion of the West is flowing East.

Let's see how the bullion banks deal with this as we muddle on towards the final months of the year that are historically difficult for the gold pool.

There was intraday commentary about A Currency War That Few Economists and Analysts Notice, Much Less Understand.

Let's keep a close on the gold and silver markets in terms of physical supply, because that is the weak point of all late stage gold pool operations, or any pooling operation that deals in leverage.

Koos Jansen considered an interesting question today about London Bullion Market and the International Gold Trade.

I have kept myself aware as possible of the global gold bullion flows through Nick Laird of goldchartsrus.com. His site is an invaluable source of information.

There is clearly more work to be done as Koos has suggested, and I await Ronan Manly's final analysis. I hope that he is able to sort through enough of it to provide us some meaningful data.

What sort of efficient market arrives at price discovery by hiding the details of available supply?

In a nutshell there is an enormous demand for physical gold (and silver) in India, China, Russia and the Mideast. And it appears that, at least in the short term, the physical demand is running close to or even possibly outrunning the short term physical supply AT THESE PRICES. Should they allow the price to rise and free up more bullion for sale, or just keep increasing the leverage on the supply that they have?

Let's see how this works out. The central banks apparently bailed the gambling crowd out before from a tight squeeze when Sir Eddie George stared into the abyss, or at least there are indications to that effect. They may do so again, if they need to, and IF they can. Even the mighty central banks cannot make real gold out of their folly.

But you know what? I have come to believe that I can write about the market data all day long, and give people 'timely cautions,' and just a few will really notice or do anything. And the paperati apologists will keep spouting their nonsense, until the price of gold jumps $100 overnight and starts running to $2,000, and silver takes out $20. And then the markets and the greater mass of traders will begin to wake up.

Until then. lol.

Have a pleasant evening.