Gold and silver paused today, after bumping their heads for most of the New York trade against overhead resistance.

The dollar rallied back a bit today, at least as measured by the DX index. Why? Because the euro was lower, based on the European stance towards additional easing and a weaker currency to aid German exports.

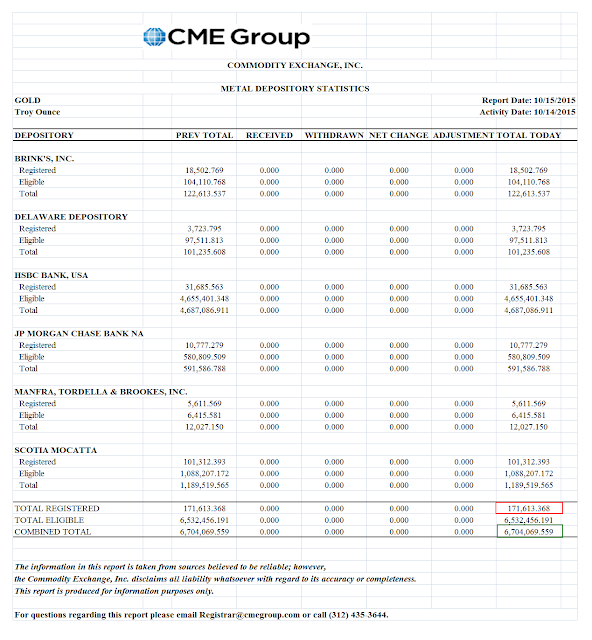

The Bucket Shop was deadly quiet on deliveries, and the gold warehouses continue to look like wax figures in Madame Tussauds'. See how paper gold used to be hypothecated and traded in the 20th century.

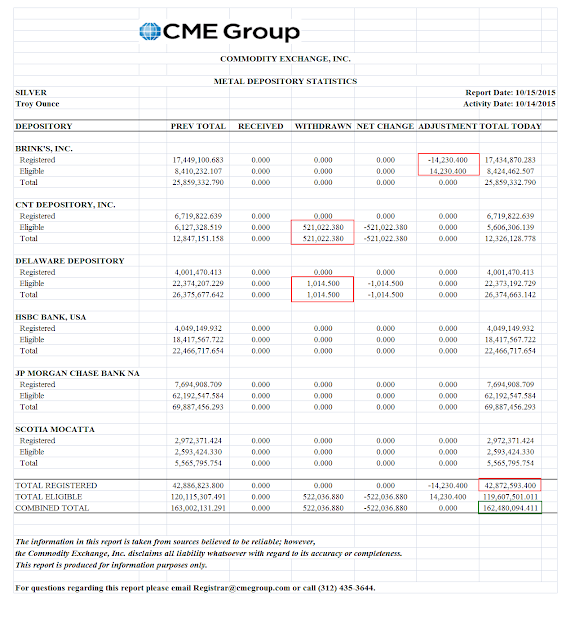

There was the usual slow leakage of silver bullion.

Let's see if the metals can form a new base here and consolidate their recent gains.

Have a pleasant evening.