"What is at stake is a rather heroic rebellion by a very beleaguered people against a doctrine which has been destroying their lives— the austerity doctrine and the whole neoliberal project."

James K. Galbraith

Although Jamie was speaking about Greece, this can be applied across the developed nations.

There was another big delivery day for NY gold yesterday, at least by Comex historical measures, as HSBC led the delivery of over 100,000 ounces of gold at 1,249, with the house account and mystery customer at JPM as the big stoppers.

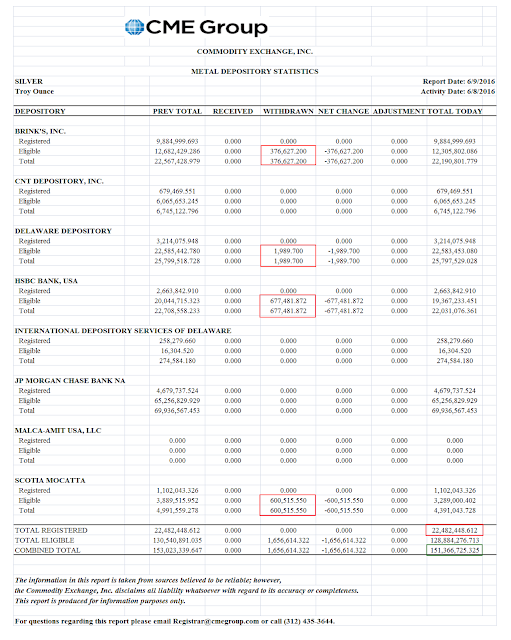

Silver is not so active this month, due to the nature of its June contract, but bullion keeps trickling out of the warehouses. Denver Dave has suggested that this might be an arbitrage play between NY and Asia.

Gold is banging its head against the big resistance at 1,270. If it takes out that level then the next battleground will be for the breakout around 1300.

As a reminder there will be a highly watched FOMC meeting next Tuesday and Wednesday.

President Obama endorsed Her Royal Hillary Clinton today. What a surprise. Her campaign slogan could be 'more of the same, but with a corporate servility even more brazen and tawdry.'

I am not sure which of the two candidates is more fraught with risk. As you may have gathered I do not care for either of them. Well, that is just me perhaps.

I am expecting it to be a rough four years no matter which of these two chuckleheads are elected. The 'establishment' is not going to give up its good thing easily, and we seem to be nearing a 'break point.' As John K. Galbraith put it so well:

"People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right."

John Kenneth Galbraith

Let's see what happens. Whatever may come, it may be a good idea to hang on tightly to one's integrity, as well as their wallet.

Have a pleasant evening.