"A horse walks into a bar, the bartender says, 'Why the long face?'"

And so we had both an FOMC and a precious metals option expiration on the Comex today.

Let's see if we get any post-FOMC, post-expiration shenanigans for the rest of the week. Once gold breaks out it could be tough to stop, although I am not liking the small advances it has been making on such steady dollar weakness.

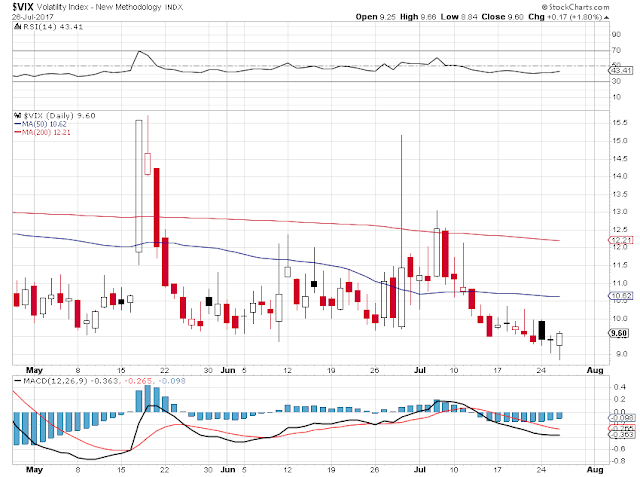

Stocks are continuing to edge higher, although with a big less verve than previously.

Pundits are now saying that a crash is probably at least two months away, so now is a good time to buy more stocks.

You cannot make this stuff up.

I think the theory is that when the Fed starts unwinding their balance sheet in September, that the air of liquidity, which is one of key components of these bubbles, is going to start coming out of the markets much faster than it went in.

And the result may be terrific— not with a bang, but a whimper.

"She walks in beauty, like the night

Of cloudless climes and starry skies;

And all that’s best of dark and bright

Meet in her aspect and her eyes;

Thus mellowed to that tender light

Which heaven to gaudy day denies."

George Gordon Lord Byron

Have a pleasant evening.