The Fed is hiking rates into one of the slowest growing economies in U.S. history. Previous such events didn't work out well. Whatever economic growth US has had recently has been driven by increased debt & dissaving. If interest rates are raised brakes automatically applied.

Dr. Harald Malmgrem

There is no doubt that the projections of the future growth of GDP are estimates based on the estimates of estimates, and that the results may vary greatly from expected outcomes. Especially if your paycheck depends on a range of outcomes acceptable to your superiors.

They seem to have already lined up a set of potential scapegoats, who despise us for our freedom and seek to undermine us, the paragons of virtue, in all of our efforts. For how else could we have not succeeded?

Once again stocks were lower and the Dollar was stronger, because the accepted orthodoxy of popular media and Federal Reserve economics is that interest rates are going to k33p going higher, to the tune of four such hikes this year (at least).

The Trump tax cuts and infrastructure spending programs are going to stimulate a recovered economy, bringing the risks of wage inflation to bear. Never mind asset inflation because that is a good thing to the stock owning and value-reaving elites.

To the victors go the spoils.

Winning....

But real wage income increases are a threat to the economic order that was established back in the 1980's, that order being:

them that's got shall have, them that's not shall lose....

I'll stick with my own theory that the Fed just wants to get as far away from the ZIRP as is possible, before the latest asset bubble and phony recovery collapses around their ears. But seriously, only time will tell.

But the tax cuts are not really going to the people who are going to be growing aggregate demand organically, but for the most part and despite corporate propaganda to the contrary, that money is going to the same old cats who have been getting the most for as far back as most can remember.

And as for the stimulus of infrastructure, that one does not even quality for the derogatory term 'paper tiger.' It is a $200 billion Trojan horse of privatization and neo-liberalism come home to roost, at long last.

Today was the six months anniversary of the passing of the queen from this world into the next.

Ex umbris et imaginibus in vitam.

March is the month where silver is favored on the Comex, and we saw a mighty surge in the exchanging of paper claims for March 1 delivery in silver, as noted in the Comex clearing report below.

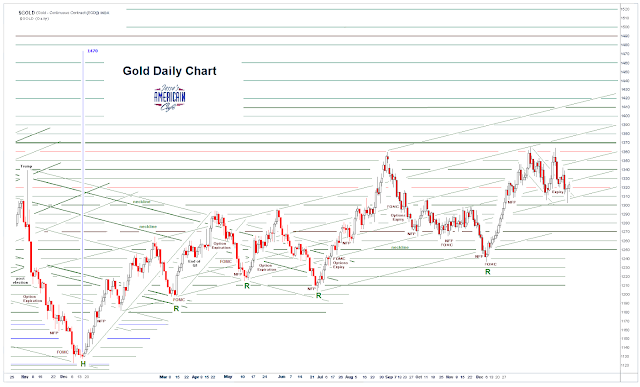

Gold is dullsville in March, at least on the Comex if not in Asia, so we may not see it continuing to hold the price lead, and silver may take up the slack.

A bigger change is coming, that may creep up on those who hold most of the public speaking platforms these days.

And what rough beast, it's hour come round at last,

Slouches towards Bethlehem to be born?

W. B. Yeats, The Second Coming, 1919

Have a pleasant evening.