"Day by day the money-masters of America become more aware of their danger, they draw together, they grow more class-conscious, more aggressive. The [first world] war has taught them the possibilities of propaganda; it has accustomed them to the idea of enormous campaigns which sway the minds of millions and make them pliable to any purpose.

American political corruption was the buying up of legislatures and assemblies to keep them from doing the people's will and protecting the people's interests; it was the exploiter entrenching himself in power, it was financial autocracy undermining and destroying political democracy. By the blindness and greed of ruling classes the people have been plunged into infinite misery."

Upton Sinclair, The Brass Check

"Greed is a bottomless pit which exhausts the person in an endless effort to satisfy the need without ever reaching satisfaction."

Erich Fromm

“We must alter our lives in order to alter our hearts, for it is impossible to live one way and pray another.

If you have not chosen the kingdom of God first, it will in the end make no difference what you have chosen instead.”

William Law

Stocks had a wide-ranging day, driven to and fro by macroeconomic and geopolitical rumors, on a sea of Fed-provided liquidity.

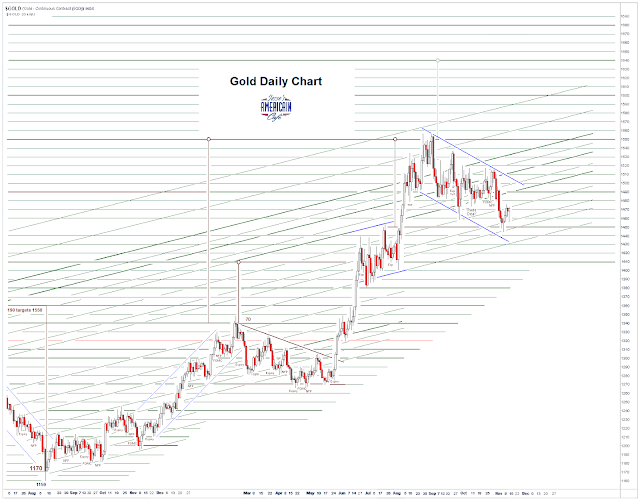

The Dollar finished lower as gold and silver were slightly higher.

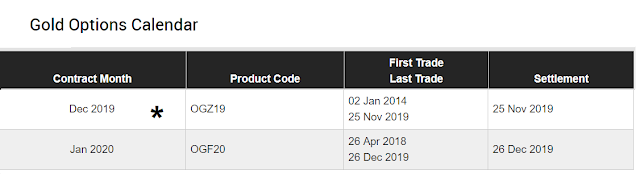

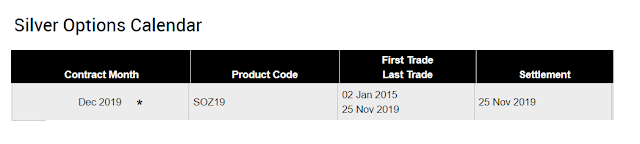

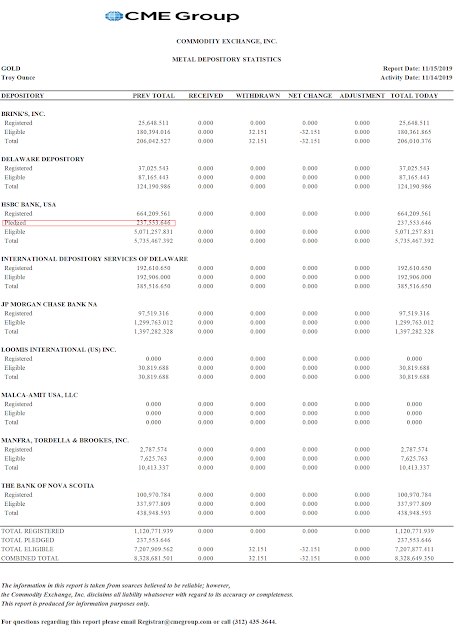

There is room for thought on the charts this week regarding how the wiseguys might be trying to play the price of gold and silver, in anticipation of the December futures contracts options expiration next Monday, November 25th.

Stocks seem rather fully valued here. But value is relative, and the Dollar is the yardstick, heavily seasoned with duplicity and coercion.

Have a pleasant evening.