"Of course, even before Flaubert one did not doubt the existence of stupidity, but it was understood a little differently, it was considered as a simple absence of knowledge, a defect correctable by instruction. In the novels of Flaubert, stupidity is an inseparable dimension of human existence, but the most shocking, the most scandalous in Flaubert's perspective of stupidity is this: stupidity does not fade away in front of science, technology, progress, modernity, on the contrary, with progress, it progresses too."

Milan Kundera, La Pléiade Tome II

“Against such foolishness we are defenseless. Reasons fall on deaf ears; facts that contradict one’s prejudgment simply need not be believed – in such moments the foolish person even becomes critical – and when facts are irrefutable they are just pushed aside as inconsequential, as incidental. In all this the foolish person, in contrast to the malicious one, is utterly self satisfied and, being easily irritated, becomes dangerous by going on the attack.”

Dietrich Bonhoeffer, Letters and Papers from Prison

"The time is almost here — and ignorance, falsehood, cruelty, greed and lust of power were never stronger in the hearts of any ruling class in history than they are in those who constitute the Invisible Government of America today. Day by day the money-masters of America become more aware of their danger, they draw together, they grow more class-conscious, more aggressive."

Upton Sinclair, The Brass Check, 1919

“I am patient with stupidity, but not with those who are proud of it.”

Edith Sitwell

"We have severely underestimated the Russians, the extent of the country and the treachery of the climate. This is the revenge of reality."

Heinz Guderian, as quoted in Images of Kursk: History's Greatest Tank Battle, July 1943

The economic data this morning was very soft on the GDP and labor force area.

This provided more fuel for the dovishness of the Fed.

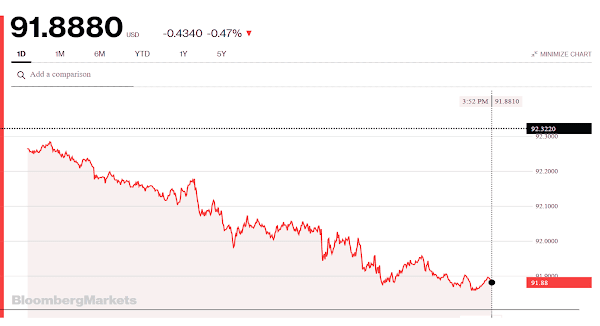

The Dollar declined, giving up the 92 handle.

Gold and silver rallied strongly, recovering significant ground from the recent price suppression in observantce of their option expiration.

A fair chunk of physical gold departed from the Comex Hong Kong warehouses.

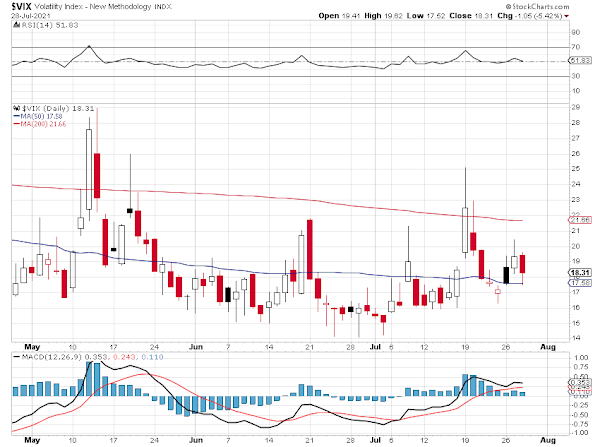

Stocks rode the wave of easy money expectations higher, but gave up quite a bit of their gains in the afternoon, with the NDX finishing unchanged, and the SP 500 only a minor gain.

When a pricing pool collapses, especially in the case of a commodity, the resulting price increases required to clear the market can be quite impressive.

As the old rock song goes, 'you ain't seen nothing yet.'

Have a pleasant evening.