"The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revival, but finally giving up in the final collapse."

Charles Kindleberger

"They run all away, and cry, 'the devil take the hindmost'."

Beaumont and Fletcher, Philaster, or Love Lies a-Bleeding

“It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes. This is apparent from a social pathology: psychopaths rally followers.”

Nassim Nicholas Taleb, The Black Swan

"Through a set of economic policies designed to bail out and subsidize failed and often tainted corporate enterprises, while actively promoting a false sense of confidence to support those policies, the public has become exposed, by those very people entrusted to protect them, to dangerously high levels of hidden counterparty risks.

The cautionary functions of the media, the political class, and the regulatory bodies have been routinely directed, distorted, and even silenced for the benefit of a highly compromised and increasingly self-serving elite. And this corruption has begun feeding on its own momentum, resulting in increasingly blatant examples of deception, distortion, and outright theft. This is crony capitalism, and its deadly credibility trap."

Jesse, April 2012

Stocks retraced the bounce from yesterday, but managed to hold at key support levels.

We may be one exogenous event away from a significant market dislocation.

Precipitous declines of 10+% are always lower probability events, but sometimes the tails are little fatter than at other times.

Gold and silver bounced. Silver in particular was impressive since it diverged from stocks.

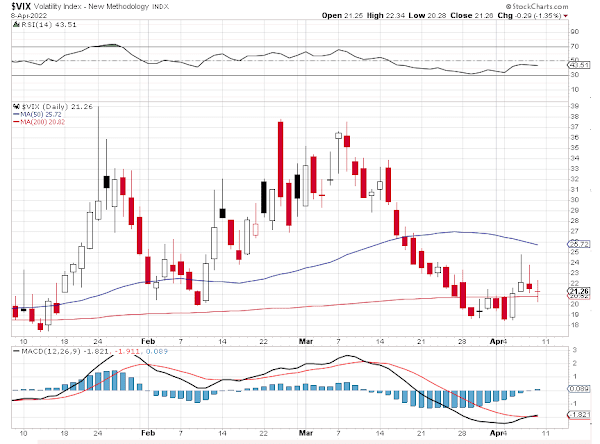

The VIX fell.

There is not panic selling yet. I suspect the specs are buying the dips.

I came in short from last night and got a little shorter on the early bounce. I trimmed back a bit for the weekend.

If the major stock indices break below further key supports with the right kind of tension on the tape I will try to start calculating just what kind of decline we may be facing.

The Fed is active in the markets. But even they have a limited ability to respond to a significant event.

Stock index option expiration next Thursday.

As next week is Holy Week I will be posting but it may be late or abbreviated.

Have a pleasant weekend.