“It appeared that the whole world was one elaborate system, opposed to justice and kindness, and set to making cruelty and pain. Their frail human nature was subjected to a strain greater than it was made for; the fires of greed had been lighted in their hearts, and fanned to a white heat that melted every principle and every law.”

Upton Sinclair,

Oil

“A laissez-faire economic theory is maintained in an industrial era through the ignorant belief that the general welfare is best served by placing the least possible political restraints upon economic activity. The history of the past hundred years is a refutation of the theory; but it is still maintained, or is dying a too lingering death."

Reinhold Niebuhr,

Moral Man and Immoral Society, 1932

"For wherever your treasure is, there also your heart will be."

Matthew 6:21

t never really gets old, does it? Evil that is. It just keeps coming back, with different names and faces. But the basic proposition remains surprisingly simple and the same.

You cheat, you win, you cash in, and there are no consequences.

Perhaps a stance supporting little to no regulation in the markets and in life in general might be reconsidered when one sees the abuses to which powerful insiders, aka 'market forces,' may engage.

Some might say that history shows that this is the very reason why men and women combine to create a least some semblance of the rule of law, and not the rule of money and power.

Today was a quadruple stock option expiration in US markets.

Stocks tried hard, but failed to hold a solid rally off the oversold condition from yesterday.

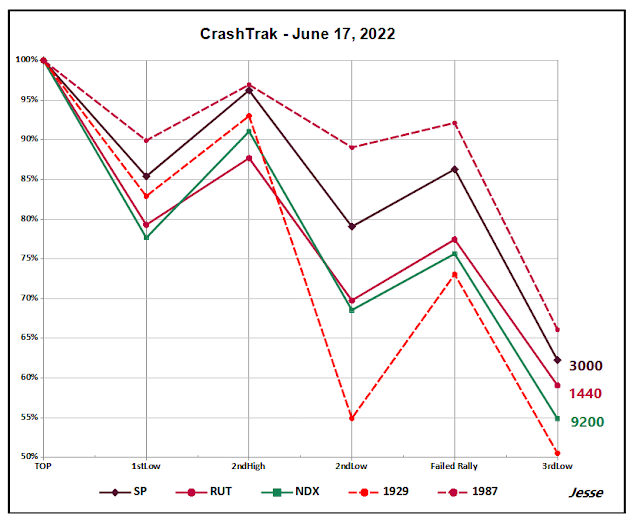

There may be more work to be done on the downside.

Gold and silver gave back some of yesterday's gains.

The Dollar rallied.

So all in all, a reversal wash and rinse for the quad option expiration.

Three day weekend.

See you on Tuesday.

Have a pleasant weekend.