"It is possible to make people contented with their servitude. I think this can be done. I think it has been done in the past. I think it could be done even more effectively now because you can provide them with bread and circuses and you can provide them with endless amounts of distractions and propaganda.

Aldous Huxley

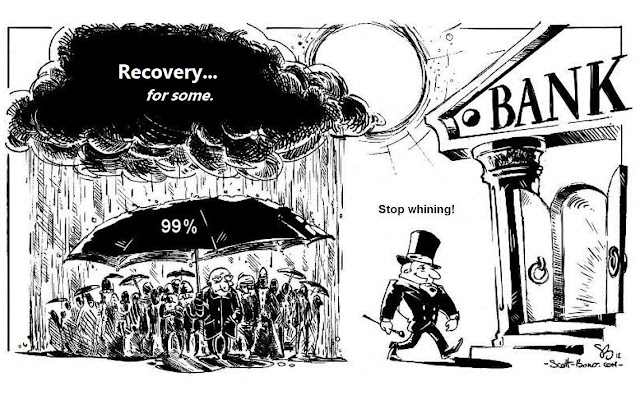

"It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud.

The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident."

Charles H. Ferguson

"The preposterous claim that deviations from market efficiency were not only irrelevant to the recent crisis but could never be relevant is the product of an environment in which deduction has driven out induction and ideology has taken over from observation.

The belief that models are not just useful tools but also are capable of yielding comprehensive and universal descriptions of the world has blinded its proponents to realities that have been staring them in the face. That blindness was an element in our present crisis, and conditions our still ineffectual responses.

Economists – in government agencies as well as universities – were obsessively playing Grand Theft Auto while the world around them was falling apart."

John Kay, An Essay on the State of Economics

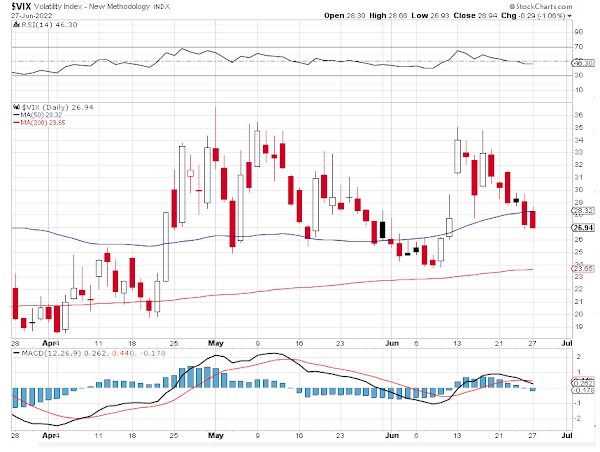

Stocks reversed an early rally, and failed badly, going out on the lows.

This is not constructive action for a bear market bottom.

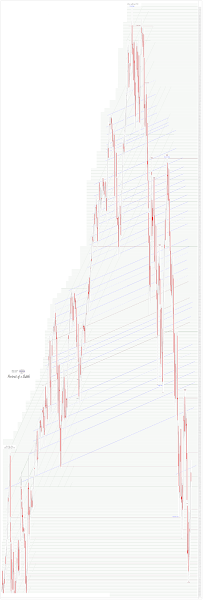

Gold and silver especially were slammed lower in a follow up to yesterday's expiration.

Let's see if they can find a bottom around support here.

The VIX rose.

The Dollar rallied sharply higher in what looked like a 'risk off' reaction.

"The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery."

Jesse, May 2009

The high ground right now is cash.

The winner in a grinding bear market, if that indeed is where we find ourselves now, are those who lose least.

Have a pleasant evening.