"A multibillion-dollar bailout and Wall Street’s swift, subsequent reinstatement of gargantuan bonuses have inspired a narrative of parasitic bankers and other elites rigging the game for their own benefit. And this, in turn, has led to wider—and not unreasonable—fears that we are living in not merely a plutonomy, but a plutocracy, in which the rich display outsize political influence, narrowly self-interested motives, and a casual indifference to anyone outside their own rarefied economic bubble."

Chrystia Freeland, The Rise of the New Global Elite, January 2011

"The 20th century has been characterized by three developments of great political importance: the growth of democracy, the growth of corporate power, and the growth of corporate propaganda as a means of protecting corporate power against democracy."

Alex Carey

"In the 1970s, a wave of young liberals, Bill Clinton among them, destroyed the populist Democratic Party they had inherited from the New Dealers of the 1930s. The contours of this ideological fight were complex, but the gist was: Before the ’70s, Democrats were suspicious of big business. They used anti-monopoly policies to fight oligarchy and financial manipulation.

Bill Clinton’s generation, however, believed that concentration of financial power could be virtuous, as long as that power was in the hands of experts. They largely dismissed the white working class as a bastion of reactionary racism.

Obama is simply the latest in a long line of party leaders who have bought into the ideology of these 'new' Democrats, and he has governed likewise, with commercial policies that ravaged the heartland."

Matt Stoller, How Bad Obama’s Financial Policies, Washington Post, 12 January 2017

We must begin at the beginning. Each truth has its own order; we cannot join the way of life at any point of the course we please; we cannot learn advanced truths before we have learned primary ones. I know we shall find it very hard to rouse ourselves, to break the force of habit, to resolve to serve God, and persevere in doing so.

And assuredly we must expect, even at best, and with all our efforts, perhaps backslidings, and certainly much continual imperfection all through our lives, in all we do. We live here to struggle and to endure: the time of eternal rest will come hereafter.

John Henry Newman

Stocks were on a rally track this morning as the Non-Farm Payrolls Report came in with a 'Goldilocks' flavor.

But alas, during the day Russia decided to shut off the gas to Europe and so markets reversed, and hard.

It's the exogenous events that get you. Bet the masters of the universe didn't see they usual setup falling apart.

Well, it's a three day weekend, and when unforeseen risk rears its head, you hit the exits.

Gold and silver were rallying along with everything else, but gave up much of their gains.

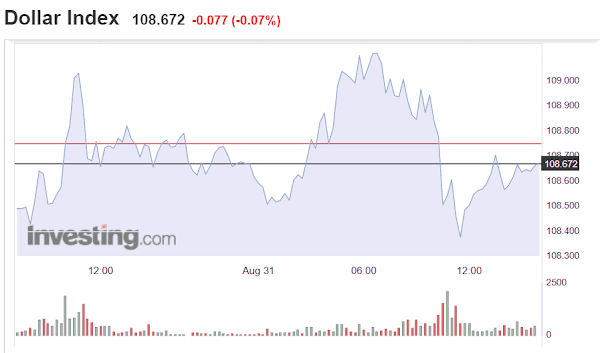

The US Dollar, which dumped in the morning, did a snappy rallyback on the plight of the Europeans.

"The most important problem in the world today is your soul, for that is what the struggle is about."

Fulton J. Sheen

Monday will be a national holiday in the US. So see you Tuesday.

Have a pleasant weekend.