"History teaches us that the capacity of things to get worse is limitless."

Chalmers Johnson, Nemesis: The Last Days of the American Republic, 2007

"Indeed there can be no criterion, no other standard than gold. Yes, gold which never changes, which can be shaped into ingots, bars, coins, which has no nationality and which is eternally and universally accepted as the unalterable fiduciary value par excellence."

Charles de Gaulle

"Those who can make you believe absurdities, can make you commit atrocities."

Voltaire

"George Osborne, the shadow chancellor, demanded that the information was published immediately. 'Gordon Brown's decision to sell off our gold reserves at the bottom of the market cost the British taxpayer billions of pounds,' he said. 'It was one of the worst economic judgements ever made by a chancellor. The British public have a right to know what happened and why so much of their money was lost. The documents should be published immediately.' Between 1999 and 2002, Mr Brown ordered the sale of almost 400 tons of the gold reserves when the price was at a 20-year low.

It is understood that Mr Brown pushed ahead with the sale despite serious misgivings at the Bank of England. It is not thought that senior Bank experts were even consulted about the decision, which was driven through by a small group of senior Treasury aides close to Mr Brown. The Treasury has been officially censured by the Information Commissioner over its attempts to block the release of information about the gold sales."

Holly Watt and Robert Winnett, Explain why you sold Britain's gold, Gordon Brown told, UK Telegraph, 24 Mar 2010

"Gold is absolute objectivity. It is blind, like justice. It has no politics and ideology, no likes or dislikes, no friends or enemies. All it recognizes is its possessor, whom it serves faithfully as long as he has it."

Charles de Gaulle

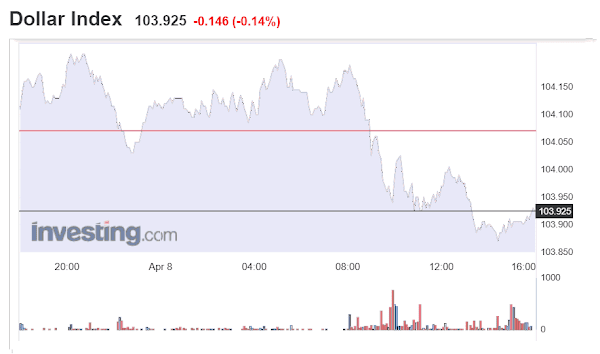

Stocks did their usual yo-yo wash and rinse.

Inflation data coming out tomorrow has the markets on edge.

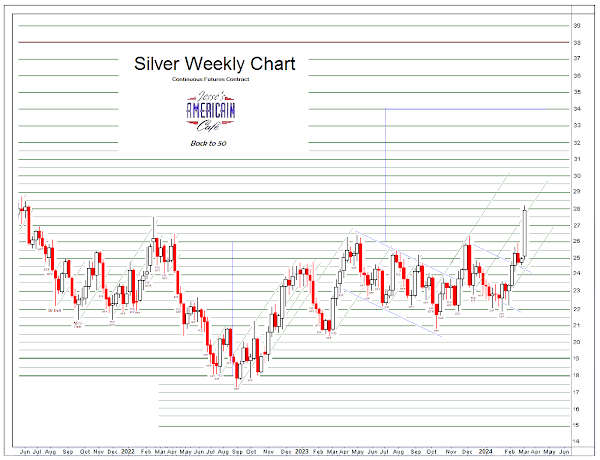

Every night in Asia gold and silver rise strongly, and then are slowly sold back during the day in London and New York.

Has you ever noticed how the United Kingdom has an aversion to owning gold?

A current list of the official gold reserves by country is attached below.

What the heck, Canada, you have NO gold? Where are you hosers keeping your wealth? Season hockey tickets, extra sharp cheddar, and smoked meat?

Geopolitical situation is simmering, but closer to boil than most realize.

Someone wake up Uncle Joe.

Have a pleasant evening.