"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Eddie George, Governor Bank of England, in a conversation with the CEO of Lonmin, September 1999

“The men of the higher circles are not representative men; their high position is not a result of moral virtue; their fabulous success is not firmly connected with meritorious ability. Those who sit in the seats of the high and the mighty are selected and formed by the means of power, the sources of wealth, the mechanics of celebrity, which prevail in their society.

When institutions are corrupting, many of the men who live and work in them are necessarily corrupted. Within the corporate worlds of business, war-making and politics, the private conscience is attenuated— and the higher immorality is institutionalized. It is not merely a question of a corrupt administration in corporation, army, or state; it is a feature of the corporate rich, as a capitalist stratum, deeply intertwined with the politics of the military state.”

C. Wright Mills, The Power Elite, Oxford Press, 1956

"If at the start this cancerous growth in the nation was not particularly noticeable, it was only because there were still enough forces at work that operated for the good, so that it was kept under control. As it grew larger, however, and finally in an ultimate spurt of growth attained ruling power, the tumor broke open, as it were, and infected the whole body."

The White Rose, Second Leaflet, Munich 1942

“We are little flames poorly sheltered by frail walls against the storm of dissolution and madness, in which we flicker and sometimes almost go out.”

Erich Maria Remarque, All Quiet on the Western Front, 1928

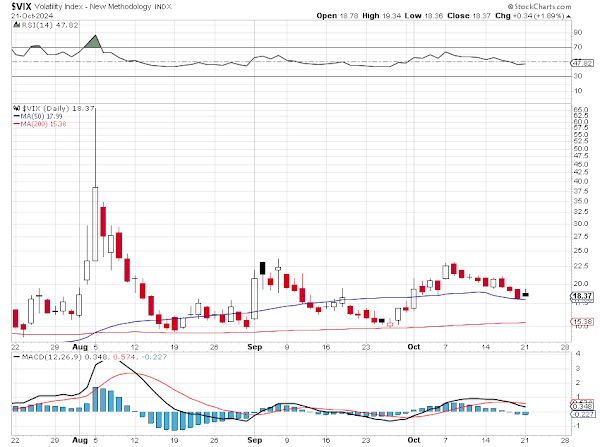

Stocks had another wobbly, wide ranging trading day.

But fortunately they ended up a little lost, to mostly unchanged.

Gold and silver continued their breakouts higher.

Silver has taken the 35 handle.

Gold is punching higher towards its next measuring objective.

The Dollar dropped and then came back, holding on to 104.

The gold and silver rally is not dollar related. It looks like a flight to safety.

Let's see if anything substantial comes out of the BRIC summit.

Leaked intelligence documents purport to show the IDF plans to attack Iran.

Curioser and curioser.

As JFK noted to Pierre Salinger in private conversation during the lead up to the Cuban Missile Crisis, "I said, 'Mr. President, you don't have a cold. There’s something going on.' He said, 'You bet there is something else going on.' And then he said, 'When you find out, grab your balls and run.'

Pierre Salinger, On the Cuban Missile Crisis, 1995

Have a pleasant evening.