“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.”

Antony C. Sutton, historian

"When a government overvalues one type of money and undervalues another, the undervalued money will leave the country or disappear from circulation into hoards, while the overvalued money will flood into circulation."

Gresham's Law

"'We didn't truly know the dangers of the market, because it was a dark market,' says Brooksley Born, the head of an obscure federal regulatory agency -- the Commodity Futures Trading Commission [CFTC] -- who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. 'They were totally opposed to it,' Born says. 'That puzzled me. What was it that was in this market that had to be hidden?'"

PBS Frontine, The Warning

"You have to choose between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold."

George Bernard Shaw

"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

Bernard M. Baruch

Charles De Gaulle, February 4, 1965

"Gold will be around, gold will be money when the dollar and the euro and the yuan and the ringgit are mere memories."

Richard L. Russell

"Like liberty, gold never stays where it is undervalued."

J. S. Morrill, historian

"Synthetic gold, sourced in pyramids of credit extended to bullion bankers by central banks with little or no claim on physical substance, have provided a more efficient, better-camouflaged form of intervention. The volumes traded are huge, and bear little resemblance to actual flows of physical metal. Demand for physical gold has exceeded new mine supply for several years running; and while above-ground 400-ounce .995-gold bars located in London, New York, and other financial capitals (in cohabitation with speculative trading activity in paper markets) have steadily dwindled and disappeared into Asian financial centers reformulated as .9999 kilo bars."

Tocqueville Newsletter, 2Q 2015

"Gold is unique among assets, in that it is not issued by any government or central bank, which means that its value is not influenced by political decisions or the solvency of one institution or another."

Salvatore Rossi, Central Bank of Italy, 30 Sept 2013

“Gold is money. Everything else is credit.”

John Pierpont Morgan, 1912

And this is why the central banks are quietly buying it, in size, and why gold has been steadily flowing from West to East.

Stocks fell off a bit, as the rinse cycle in the latest wash and rinse kicked in.

Gold rallied, silver rocketed.

The Dollar was the usual chop.

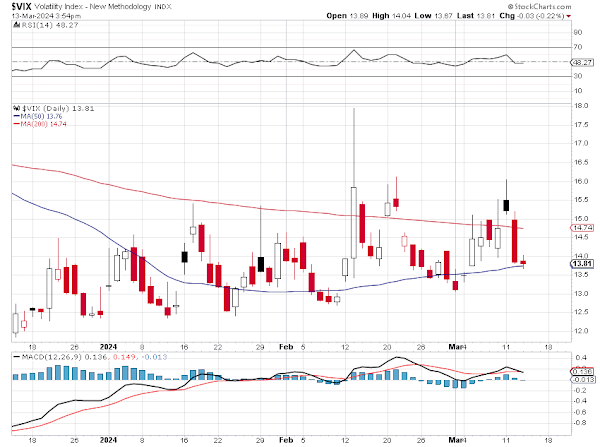

VIX is seriously underrepresenting risks.

PPI tomorrow.

Fed next week.

This is like watching a train wreck in slow motion, memories of the asset bubbles of 1999.

Have a pleasant evening.