Time to Put Investment Banking Back in Its Box

Commentary by Mark Gilbert

June 5 (Bloomberg) -- ``The rulers of the exchange of mankind's goods have failed,'' U.S. President Franklin D. Roosevelt told a Depression-blighted nation in his 1933 inauguration address. ``There must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing.''

Fast-forward three-quarters of a century. Financial markets are in disarray. The global economy is throwing a tantrum that could spell recession for some nations. Central banks are publicly pumping billions of dollars into the money markets to keep the banking system afloat, and privately doing God knows what to avert the next Bear Stearns Cos. or Northern Rock Plc.

Fast-forward three-quarters of a century. Financial markets are in disarray. The global economy is throwing a tantrum that could spell recession for some nations. Central banks are publicly pumping billions of dollars into the money markets to keep the banking system afloat, and privately doing God knows what to avert the next Bear Stearns Cos. or Northern Rock Plc.

The importance of the finance sector to the global economy has swollen along with the bonuses it awards itself. Standards of behavior, however, have failed to mature at anything like the same pace. And, so far, nobody in banking has apologized for the chaos caused by lax lending standards and monumental hubris.

``One of the innumerable problems with Wall Street and the City is that they never do seem to learn from their mistakes,'' says Tim Price, director of investments at PFP Wealth Management in London. ``Each generation seems obligated to re-experience the errors of its predecessors. There is little or no `race memory' that might at least mean this year's crisis is brand-new rather than a tired retread of past embarrassments.''

Gathering Force

The backlash is gathering force. Every day brings fresh threats of increased oversight and tighter rules from blindsided regulators and angry lawmakers. The credit-rating companies have finally woken up, with the gradings of Morgan Stanley, Merrill Lynch & Co. and Lehman Brothers Holdings Inc. all cut this week by Standard & Poor's. Finance-industry chiefs are being pushed onto their swords, albeit with a thick padding of compensatory dollars to dull the blow.

The finance industry ceded its dominant role in the Standard & Poor's 500 Index to U.S. technology companies last month. Banks, led by Bank of America Corp. and JPMorgan Chase & Co., now account for about 15.77 percent of the index, second to the 16.63 percent weighting for computer and software makers such as Apple Inc., Microsoft Corp. and International Business Machines Corp.

The finance industry ceded its dominant role in the Standard & Poor's 500 Index to U.S. technology companies last month. Banks, led by Bank of America Corp. and JPMorgan Chase & Co., now account for about 15.77 percent of the index, second to the 16.63 percent weighting for computer and software makers such as Apple Inc., Microsoft Corp. and International Business Machines Corp.

In the past three years, finance companies contributed about 20 percent of the S&P 500 Index, with the technology industry a distant second at about 15 percent. Eight other industries, including energy and health care, make up the remainder.

`Overblown Importance'

Fifteen years ago, just 11 percent of the benchmark stock index derived from the finance industry. Companies that relied on discretionary consumer spending, such as McDonald's Corp. and Walt Disney Co., were the most important, with a 16 percent index share. Industrial companies had 14 percent of the index, followed by consumer staple-goods companies with 12 percent.

``Finance is supposed to be a service industry, an aid to the business of genuine wealth creation,'' says Sean Corrigan, who oversees more than $8 billion as chief investment strategist at Diapason Commodities Management SA in Lausanne, Switzerland. ``Once we accord banks the sort of overblown importance they have enjoyed this past quarter of a century, we become hostage to the megalomania of their executives and head traders.''

``Finance is supposed to be a service industry, an aid to the business of genuine wealth creation,'' says Sean Corrigan, who oversees more than $8 billion as chief investment strategist at Diapason Commodities Management SA in Lausanne, Switzerland. ``Once we accord banks the sort of overblown importance they have enjoyed this past quarter of a century, we become hostage to the megalomania of their executives and head traders.''

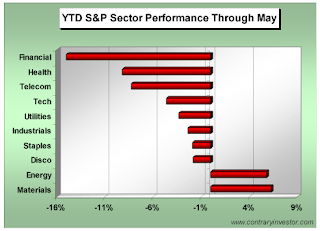

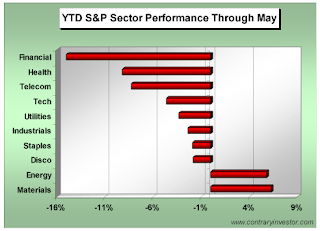

Collapsing share prices have eroded the importance of financial stocks. Banks are the worst-performing of the 10 groups in the S&P 500 index this year, posting a decline of 17 percent while the index itself is down just 6 percent.

Creative Destruction

Total writedowns in the banking industry are now running at more than $386 billion, according to data compiled by Bloomberg. To patch up their balance sheets, banks have tapped their shareholders for $283 billion of fresh capital.

There's more to come. Deutsche Bank AG, which has reduced its asset values by $7.6 billion, may report a further $5.5 billion of writedowns, analysts at JPMorgan said this week. Credit Suisse Group may add $2 billion to the $9.6 billion already posted, while Societe Generale SA's $6.2 billion hit may be exacerbated by an additional $2.8 billion, the analysts said.

Meantime, Societe Generale, BNP Paribas SA and Barclays Plc may have to get out their begging bowls to replenish capital, Fitch Ratings said this week. Barclays may need to raise almost $12 billion, the credit-rating company said.

The deals done in the good times are threatening to sour. In Europe's leveraged-buyout space, the ratio of cash that companies have to cover their debts has melted to 2.2 times, from 2.5 last year and 4.0 in 2003, according to figures from S&P. Dwindling cash to pay debts makes defaults all the more likely. So much for claims that the end of the credit crunch might be in sight.

`Unfettered Finance'

``Banking in a fractional reserve, fiat money world is inherently a non-market exercise in legalized deceit,'' says Corrigan at Diapason. ``The unfettered finance which it allows is all too prone to wreak a devil-take-the-hindmost havoc once it becomes unanchored from reality and succumbs instead to the intense, positive feedbacks which operate within it on both a systematic and a psychological level.'' (Can a brother get an "Amen?" Amen! - Jesse)

``Banking in a fractional reserve, fiat money world is inherently a non-market exercise in legalized deceit,'' says Corrigan at Diapason. ``The unfettered finance which it allows is all too prone to wreak a devil-take-the-hindmost havoc once it becomes unanchored from reality and succumbs instead to the intense, positive feedbacks which operate within it on both a systematic and a psychological level.'' (Can a brother get an "Amen?" Amen! - Jesse)

It is time to put investment banking back in its box. Treat finance as an end to a means, rather than an end in itself. Encourage our brightest and best to become physicists and biologists, programmers and mathematicians, playwrights and artists, surgeons and architects.

Stop glamorizing the conjurors who propagate the confidence trick of banking by magicking shiny coins from behind our ears. Bankers have betrayed Roosevelt's ``sacred trust.'' Until they redeem themselves, that trust should remain withheld from the finance crowd.

(Mark Gilbert is a Bloomberg News columnist. The opinions expressed are his own.)

To contact the reporter on this story: Mark Gilbert in London at magilbert@bloomberg.net