When will we stop allowing the organized looting of our country by a relatively small number of greedy and unscrupulous men?

S&P emails slammed mortgage debt products

Sat Aug 2, 12:36 PM ET

by Jim Marshall

CHICAGO (Reuters) - Analysts at Standard & Poor's Rating Services warned against mortgage-related debt products in internal e-mails that, in one case, called the complex financial deals "ridiculous," the Wall Street Journal reported in its weekend edition.

The Journal cited a draft revision of a U.S. Securities and Exchange Commission report on bond-rating firms that was first released on July 8.

In one email message, an S&P analyst called a mortgage or structured finance deal "ridiculous" and wrote "we should not be rating it."

In another email, an S&P manager said ratings agencies were helping to create an "even bigger monster -- the CDO (collateralized debt obligation) market. Let's hope we are all wealthy and retired by the time this house of card falters."

Rating agencies struggled with the growth of asset-backed securities and saw breaches in their conflict-of-interest policies, according to the report released early last month on an industry blamed for helping contribute to the subprime mortgage crisis.

An SEC examination "uncovered serious shortcomings," SEC Chairman Christopher Cox said when the report was released, adding that the problems are being fixed.

The SEC spent 10 months looking at the biggest ratings firms: Moody's, Standard & Poor's and Fimalac SA's Fitch Ratings.

A spokesman for Standard & Poor's, a unit of McGraw-Hill Companies Inc (MHP.N), was not immediately available to comment on the Journal report.

02 August 2008

The Mortgage Crisis Is a Replay of the TechBubble, Enron, the S&L Crisis...

A Review of the Gold Bull - 2 August 2008

Here is a long term view of this gold bull market back to the major upturn. Note the periodic corrections and consolidations.

Things happen for a reason. The reason there are corrections and consolidations in these long term trends is that there are contrary opinions among traders which engage the push and pull of the market. Also, and importantly, different traders have different positions operating on different timeframes and different agendas.

Within a long term trend there are opportunities to squeeze the shorts and shake out the weak hands on the long side. With 8000 desperate hedge funds out there, and ten or more outsized banks flush with hot money and a shrinking pool of opportunities, we can expect more short term volatility as traders try to set up gambits, squeezes and traps. There is also a bias among the central banks against gold, which is the antithesis of an arbitrary power to determine the value of money. This is at the root of their greatest policy error. For all the reason noted, the bigger players will shove against the price trend when they can, but as is obvious from the chart they cannot resist the pressure of a valid trend indefinitely at least while markets function.

Here is a closer look with a simpler line. Again note the corrections. Charts are not modern art. They are symbolic representations of reality. Of course at some point the long bull trend will end, but until then it will often correct and consolidate. It is our task to try and set some reasonable criteria to see what is happening as closely to when it happens. As the progress of the trend proceeds we buy weakness and sell strength as best we can, managing leverage and our emotions above all.

Here is a look at the same closeup but on a percentage basis. Note the wavering, the push and pull of the bulls and bears, the big trading desks and the small speculators and funds. We have friends and acquaintances who abhor gold, because they think that they have missed the bull trend and wish to see it fail, so that they might be proven 'correct.' The only correct thing to do in trading and investing is to make a profit fairly, with justice.

Here is a closeup view, the daily chart which we post every day. Although we cannot be sure, it does look as though we are closer to the end of this correction than the beginning, and that we are testing some strong support. The dollar is also at a key juncture in its countertrend rally. The FOMC will make their August policy statement next Tuesday 5 August. This will probably be a decisive moment. Gold has strong support at 875 and 860. The dollar has strong support at 68.

We will not be surprised to see gold test the psychological barrier of 900 severely. That does not matter. It does not change the trend. When the market realizes that the test is over and the trend is in control again the move higher may be impressive. This is the same for all bull markets, whether they be gold, oil, swiss francs, euros, silver, whatever. Bear markets have a slightly different character, although the bear market in the dollar is being managed artificially so as to even its decline. Bear markets are normally more violent than bull markets.

01 August 2008

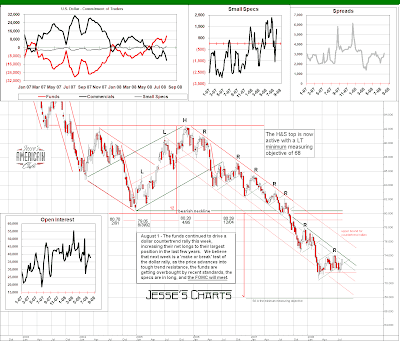

Charts in the Babson Style for the Week Ending 1 August 2008

Next week may be important for the stocks and dollar rally as the FOMC will meet on Tuesday 5 August.