Its good to be aware that we are not the only ones saying things like this. It is a general theme being repeated throughout the international media, if not in the domestic media in the States. There will be no resolution of the credit crisis until there is meaningful systemic reform.

Jul 31, 2008

The Asia Times

Paulson still doesn't get it

By Peter Morici

Once again, we have good news and bad from Wall Street.

US Treasury Secretary Henry Paulson has announced that Citigroup and three other banks will begin issuing covered bonds in an effort to rejuvenate commercial bank mortgage lending and the housing market.

Concurrently, Merrill Lynch announced it is taking yet another big write down on its subprime securities, selling paper with a face value of US$30.6 billion to private equity firm Lone Star for $6.7 billion. It will dilute its common stock 38% through the sale of additional shares to make up the losses.

Paulson's covered bonds would be backed by specific mortgages held by the banks. In essence, these would be large certificates of deposit. Though not necessarily insured, the bonds would be backed by specific assets on the banks books, and the banks would to take steps to ensure these mortgages were good - not the junk Merrill Lynch, Citigroup and others have been hoisting on investors.

Whether the bond market accepts these securities - essentially whether insurance companies, pension funds and other fixed-income investors take the plunge - comes down to trust in the banks. Recent events at Merrill Lynch, Citigroup and others indicate that such trust will require a bold leap of faith.

The basic problem at the big banks is compensation schemes that encourage bank executives to make risky bets that allow them to profit when things go well and to push the losses on bond and stockholders when things go sour. Upon taking over Merrill Lynch, John Thain increased executive bonuses but established a risk management scheme. That hasn't worked.

At Citigroup, chief executive Vikram Pandit is selling off assets to cover losses, but he has not given back the $165 million he took from shareholders in his sale of the Old Lane hedge fund to his employer. The bank subsequently took more than $200 million in losses, yet the Citigroup bonus machine continues to payout to its executives.

USB is under investigation for fraud in the sale of auction rate securities.

It seems hard to find a major bank without some a record of sharp practices.

Paulson is trying to sell trust in the banks with his new covered bonds. It's tough to sell trust in a Wall Street bank these days because there is not much to trust.

An insurance company that buys Paulson's covered bonds will likely be all right, but it is taking an imprudent risk. That should tell you something about the competence of its management, and it would be signal to dump its stock.

Paulson's scheme to reopen the bond market to banks for mortgage lending will only work, if the commercial banks clean up the management practices that caused the subprime crisis, and massive losses imposed on shareholders and bond customers. (and taxpayers, and all holders of US dollars - Jesse)

The federal government is imposing new a regulator on Fannie Mae and Freddie Mac, which will have authority to regulate executive compensation. The Federal Reserve has loaned hundreds of billions to Wall Street banks and securities companies without any real commitments for management reform. The asymmetry is puzzling.

Paulson will only get the mortgage market, housing crisis and economy turned around when he resolves the confidence gap on Wall Street. That requires systemic reform in the business practices and compensation structures. What's good for Fannie and Freddie would be good for Citigroup, Merrill Lynch and the others.

Peter Morici is a professor at the University of Maryland School of Business and former chief economist at the US International Trade Commission.

03 August 2008

US Credit Crisis: There Will Be No Resolution Until There Is Reform

02 August 2008

The Mortgage Crisis Is a Replay of the TechBubble, Enron, the S&L Crisis...

When will we stop allowing the organized looting of our country by a relatively small number of greedy and unscrupulous men?

S&P emails slammed mortgage debt products

Sat Aug 2, 12:36 PM ET

by Jim Marshall

CHICAGO (Reuters) - Analysts at Standard & Poor's Rating Services warned against mortgage-related debt products in internal e-mails that, in one case, called the complex financial deals "ridiculous," the Wall Street Journal reported in its weekend edition.

The Journal cited a draft revision of a U.S. Securities and Exchange Commission report on bond-rating firms that was first released on July 8.

In one email message, an S&P analyst called a mortgage or structured finance deal "ridiculous" and wrote "we should not be rating it."

In another email, an S&P manager said ratings agencies were helping to create an "even bigger monster -- the CDO (collateralized debt obligation) market. Let's hope we are all wealthy and retired by the time this house of card falters."

Rating agencies struggled with the growth of asset-backed securities and saw breaches in their conflict-of-interest policies, according to the report released early last month on an industry blamed for helping contribute to the subprime mortgage crisis.

An SEC examination "uncovered serious shortcomings," SEC Chairman Christopher Cox said when the report was released, adding that the problems are being fixed.

The SEC spent 10 months looking at the biggest ratings firms: Moody's, Standard & Poor's and Fimalac SA's Fitch Ratings.

A spokesman for Standard & Poor's, a unit of McGraw-Hill Companies Inc (MHP.N), was not immediately available to comment on the Journal report.

A Review of the Gold Bull - 2 August 2008

Here is a long term view of this gold bull market back to the major upturn. Note the periodic corrections and consolidations.

Things happen for a reason. The reason there are corrections and consolidations in these long term trends is that there are contrary opinions among traders which engage the push and pull of the market. Also, and importantly, different traders have different positions operating on different timeframes and different agendas.

Within a long term trend there are opportunities to squeeze the shorts and shake out the weak hands on the long side. With 8000 desperate hedge funds out there, and ten or more outsized banks flush with hot money and a shrinking pool of opportunities, we can expect more short term volatility as traders try to set up gambits, squeezes and traps. There is also a bias among the central banks against gold, which is the antithesis of an arbitrary power to determine the value of money. This is at the root of their greatest policy error. For all the reason noted, the bigger players will shove against the price trend when they can, but as is obvious from the chart they cannot resist the pressure of a valid trend indefinitely at least while markets function.

Here is a closer look with a simpler line. Again note the corrections. Charts are not modern art. They are symbolic representations of reality. Of course at some point the long bull trend will end, but until then it will often correct and consolidate. It is our task to try and set some reasonable criteria to see what is happening as closely to when it happens. As the progress of the trend proceeds we buy weakness and sell strength as best we can, managing leverage and our emotions above all.

Here is a look at the same closeup but on a percentage basis. Note the wavering, the push and pull of the bulls and bears, the big trading desks and the small speculators and funds. We have friends and acquaintances who abhor gold, because they think that they have missed the bull trend and wish to see it fail, so that they might be proven 'correct.' The only correct thing to do in trading and investing is to make a profit fairly, with justice.

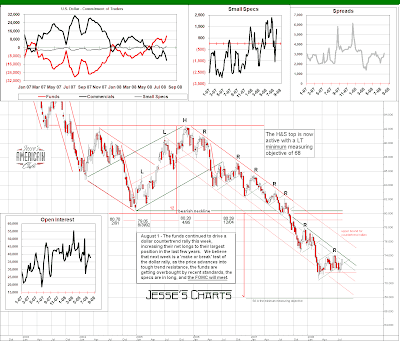

Here is a closeup view, the daily chart which we post every day. Although we cannot be sure, it does look as though we are closer to the end of this correction than the beginning, and that we are testing some strong support. The dollar is also at a key juncture in its countertrend rally. The FOMC will make their August policy statement next Tuesday 5 August. This will probably be a decisive moment. Gold has strong support at 875 and 860. The dollar has strong support at 68.

We will not be surprised to see gold test the psychological barrier of 900 severely. That does not matter. It does not change the trend. When the market realizes that the test is over and the trend is in control again the move higher may be impressive. This is the same for all bull markets, whether they be gold, oil, swiss francs, euros, silver, whatever. Bear markets have a slightly different character, although the bear market in the dollar is being managed artificially so as to even its decline. Bear markets are normally more violent than bull markets.