29 August 2008

Bank Consolidation in Germany

Expect to see this continue as the credit crises continues to batter the financial industry. The actions of the Fed and Treasury have slowed the process a bit in the US by providing individual bailout services especially for the investment banks.

The 'wild card' will be the regional banks, and the potential loss of diversity and competition in the financial services sector.

Fewer corporations are holding more of the power in the media, communications and finance. We are probably nearing the end of this long term move of centralization.

Commerzbank set to buy Allianz's Dresdner

29 Aug, 2008, 1431 hrs IST

The Economic Times

FRANKFURT (Reuters) Allianz has agreed in principle to sell its Dresdner Bank unit to Commerzbank, a source familiar with the situation said on Friday, a deal that will fuse Germany's second- and third-biggest banks.

Commerzbank plans to take an initial 51 percent stake in Dresdner, then buy the remaining 49 per cent at a later stage, the source said.

Commerzbank had no comment. Allianz was not immediately available.

28 August 2008

Lower Prices Send Sales of Physical Gold 'Skyrocketing' in India

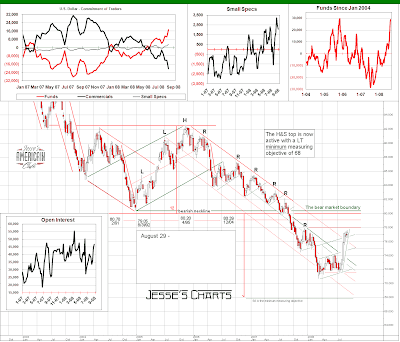

Although it is tempting to view charts as abstractions with their own sets of rules, we need to remind ourselves occasionally that they are merely representations of the interactions of price with supply and demand in real markets as part of the price discovery process.

The lower price of gold in New York and London has caused sales of physical bullion to 'skyrocket' in India, a significant market.

These sales will tend to underpin the futures markets as more dealers take delivery. And so the physical market will react and possibly provide some discipline to the metal bears of Wall Street.

And this is why any attempt by Central Banks to permanently suppress the price of gold are doomed to eventual failure as long as markets remain open and buyers are allowed to take physical delivery. Gold Makes Glittering Comeback

Gold Makes Glittering Comeback

29 Aug, 2008, 0606 hrs IST,

Amrita Nair-Ghaswalla

Times of India

MUMBAI: Gold is enjoying a modern-day renaissance in the country. From retail sales of 300-400 kgs of gold bar per day at the start of 2008, demand has surged to 3,000 to 4,000 kgs per day. Barring the slight rise in price at the start of this week, most counters registered an unprecedented sale.

Gold's dip below Rs 12,000 per 10 grams early this month has sparked off widespread buying. From a high of Rs 13,900 for 10 grams around a month and half ago, the price of the yellow metal slipped to Rs 11,850 on Wednesday, ensuring droves of customers.

The demand for the metal has skyrocketed to such an extent that imports for the month of August alone are set to cross 100 tonne. Last August, the country imported 69 tonne of gold.

'' Ten days ago, the price was Rs 11,300 and retail outlets recorded consumer demand many times higher than that witnessed during 'Dhanteras' , the first day of Diwali, or 'Akshaya Tritiya' , when buying gold is considered auspicious,'' said Suresh Hundia of the Bombay Bullion Association.

India, the world's biggest buyer of bullion, is also set to increase its gold imports for the first time in nearly 12 months, analysts told TOI. Given that the first half of 2008 saw volatile gold prices driving down demand, the last few weeks have witnessed a sudden rush of imports....

World's Largest Refiner Runs Out of Krugerrands

By Claudia Carpenter

Bloomberg

Aug. 28 (Bloomberg) -- Rand Refinery Ltd., the world's largest gold refinery, ran out of South African Krugerrands after an ``unusually large'' order from a buyer in Switzerland.

The order was for 5,000 ounces and it will take until Sept. 3 for inventories to be replenished, said Johan Botha, a spokesman for Rand Refinery in Germiston, east of Johannesburg. He declined to identify the buyer.

Coins and bars of precious metals are attracting investors as a haven against a sliding dollar and conflict between Russia and its neighbor Georgia. The U.S. Mint suspended sales of one- ounce ``American Eagle'' gold coins, Johnson Matthey Plc stopped taking orders for 100-ounce silver bars at its Salt Lake City refinery and Heraeus Holding GmbH has a delivery waiting list of as long as two weeks for orders of gold bars in Europe...

Broad Money Supply Growth in the US Remains Robust and Inflationary

Considering the slowing GDP, the growth of the broad money supply figures, MZM and M2, remains exceptionally strong. We would expect the growth of the broad money supply to be a little closer to a steady growth in GDP. From the charts it appears obvious that the Fed stimulates money supply when the economy slows.

The money supply growth has been achieved in spite of the declining growth of commercial bank credit thanks in large part to the Fed, the Treasury and several of the foreign Central Banks. Money supply expands from many sources other than commercial bank lending.