FEMA says Gustav soon to be rated Category 5 storm

Aug 30 03:34 PM US/Eastern

By JENNIFER LOVEN

Associated Press Writer

WASHINGTON (AP) - The government's disaster relief chief says Hurricane Gustav is growing into a monster Category 5 storm. The storm that hit Cuba Saturday could reach landfall along the Gulf Coast by early Tuesday.

Federal Emergency Management Agency chief David Paulison told reporters several times at a briefing Saturday that the storm was strengthening into a Category 5 hurricane.

FEMA officials said Bill Read, the director of the National Hurricane Center, interrupted an afternoon teleconference involving the agency, Gulf Coast states and the National Weather Service to say he is going to issue a special advisory statement raising Gustav to Category 5. That means winds greater than 155 mph and a storm surge greater than 18 feet above normal.

Word about the Category 5 development reached FEMA shortly before Paulison briefed reporters.

THIS IS A BREAKING NEWS UPDATE.

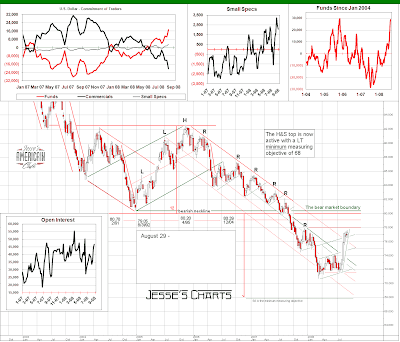

Courtesy of Joe Bastardi, chief hurricane forecaster for AccuWeather – www.AccuWeather.com – here is the map every investor needs to keep at his or her fingertips. It shows the hurricane path that Bastardi says would cause the greatest damage to offshore and onshore energy facilities in the U.S. Gulf of Mexico. In an interview with EnergyTechStocks.com, Bastardi called it the path of the “Ultimate Storm.”

Energy experts say the ultimate storm would send spot oil and gas prices up sharply and keep them there for an extended period unless, by some miracle, the damage inflicted was only minor. (It would probably be several days before oil company personnel could conduct a full assessment.)