``What's troubling the market'' is concern about ``the solvency and losses of major institutions. The market is uneasy because it doesn't have a lot of information on what the depth of those losses will be."

Bloomberg

Fed, ECB, Central Banks Cut Rates in Coordinated Move

By Scott Lanman

Oct. 8 (Bloomberg) -- The Federal Reserve, European Central Bank and four other central banks lowered interest rates in an unprecedented coordinated effort to ease the economic effects of the worst financial crisis since the Great Depression.

The Fed, ECB, Bank of England, Bank of Canada and Sweden's Riksbank each cut their benchmark rates by half a percentage point. The Bank of Japan, which didn't participate in the move, said it supported the action. Switzerland also took part. Separately, China's central bank lowered its key one-year lending rate by 0.27 percentage point.

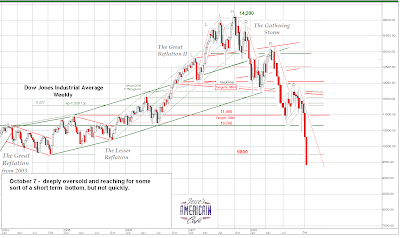

Today's decision follows a global meltdown that sent U.S. stock indexes heading for their biggest annual decline since 1937; Japan's benchmark today had the worst drop in two decades. Policy makers are also aiming to unfreeze credit markets after the premium on the three-month London interbank offered rate over the Fed's main rate doubled in two weeks to a record.

``They are throwing the kitchen sink in to try to find stability,'' said Gregory Miller, chief economist at SunTrust Banks Inc. in Atlanta. ``They are clearly trying to get the transmission started again'' after a freeze-up of money markets.

The Fed reduced its benchmark rate to 1.5 percent. The ECB's main rate is now 3.75 percent; Canada's fell to 2.5 percent; the U.K.'s rate dropped to 4.5 percent; and Sweden's rate declined to 4.25 percent. China cut interest rates for the second time in three weeks, reducing the main rate to 6.93 percent.

Official Statement

Official Statement``The recent intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further the upside risks to price stability,'' according to a joint statement by the central banks. ``Some easing of global monetary conditions is therefore warranted.'' ...

In more typical market conditions, stocks rally when a Fed chief indicates he'll reduce rates. Now, Bernanke's message may have less power because traders already anticipated for weeks that policy makers would need to make that move, and because of rising concern even rate cuts may do little to immediately help banks scrambling to reduce their vulnerability to loan losses.

``In normal times, a rate cut would have a positive effect,'' Gary Schlossberg, senior economist at Wells Capital Management in San Francisco, said yesterday. ``What's troubling the market'' is concern about ``the solvency and losses of major institutions. The market is uneasy because it doesn't have a lot of information on what the depth of those losses will be.''