The Senate seat that the highly unpopular Democratic Governor was attempting to 'sell' is the one being vacated by President-elect Barack Obama. There is no linkage to Senator Obama, and we are sure that if there was the slightest taint the Justice Department would be putting it forward vigorously. Or pocketing it for a rainy day. Obama must address this quickly.

The Senate seat that the highly unpopular Democratic Governor was attempting to 'sell' is the one being vacated by President-elect Barack Obama. There is no linkage to Senator Obama, and we are sure that if there was the slightest taint the Justice Department would be putting it forward vigorously. Or pocketing it for a rainy day. Obama must address this quickly.

The first Democrat to be elected governor of Illiniois in 30 years, Blagojevich has been the target of multiple federal investigations. If Blagojevich is found guilty he should be punished severely. We will not jump to any conclusions, but Chicago politicians are often notorious for playing it on the edge, similarly but more crudely than their more sophiticated northeastern and southern cousins.

As the administration, and the Justice Department, turns from Republican to Democratic, looks for an increasing series of indictments for Republican corruption. There will be a pre-emptive series of pardons by the outgoing President Bush.

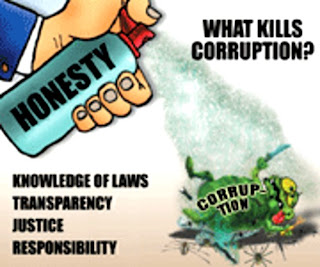

Such are the ways in times of general corruption. Anyone who thinks this is the domain of either party in particular is greatly mistaken. We are in a cultural crisis of integrity and honesty, overwhelmed by greed.

“I want to make money,” adding later that he [Blagojevich] is interested in making $250,000 to $300,000 a year, the complaint alleges. (Joe the Governor? - Jesse)

Top Five Candidates for Obama's Senate Seat

US Department of Justice

ILLINOIS GOV. ROD R. BLAGOJEVICH AND HIS CHIEF OF STAFF JOHN HARRIS ARRESTED ON FEDERAL CORRUPTION CHARGES

Patrick Fitzgerald, US Attorney

December 9, 2008

Blagojevich and aide allegedly conspired to sell U.S. Senate appointment, engaged in “pay-to-play” schemes and threatened to withhold state assistance to Tribune Company for Wrigley Field to induce purge of newspaper editorial writers

CHICAGO – Illinois Gov. Rod R. Blagojevich and his Chief of Staff, John Harris, were arrested today by FBI agents on federal corruption charges alleging that they and others are engaging in ongoing criminal activity: conspiring to obtain personal financial benefits for Blagojevich by leveraging his sole authority to appoint a United States Senator; threatening to withhold substantial state assistance to the Tribune Company in connection with the sale of Wrigley Field to induce the firing of Chicago Tribune editorial board members sharply critical of Blagojevich; and to obtain campaign contributions in exchange for official actions – both historically and now in a push before a new state ethics law takes effect January 1, 2009.

Blagojevich, 51, and Harris, 46, both of Chicago, were each charged with conspiracy to commit mail and wire fraud and solicitation of bribery. They were charged in a two-count criminal complaint that was sworn out on Sunday and unsealed today following their arrests, which occurred without incident, announced Patrick J. Fitzgerald, United States Attorney for the Northern District of Illinois, and Robert D. Grant, Special Agent-in-Charge of the Chicago Office of the Federal Bureau of Investigation. Both men were expected to appear later today before U.S. Magistrate Judge Nan Nolan in U.S. District Court in Chicago.

A 76-page FBI affidavit alleges that Blagojevich was intercepted on court-authorized wiretaps during the last month conspiring to sell or trade Illinois’ U.S. Senate seat vacated by President-elect Barack Obama for financial and other personal benefits for himself and his wife. At various times, in exchange for the Senate appointment, Blagojevich discussed obtaining:

- a substantial salary for himself at a either a non-profit foundation or an organization affiliated with labor unions;

- placing his wife on paid corporate boards where he speculated she might garner as much as $150,000 a year;

- promises of campaign funds – including cash up front; and

- a cabinet post or ambassadorship for himself.

Just last week, on December 4, Blagojevich allegedly told an advisor that he might “get some (money) up front, maybe” from Senate Candidate 5, if he named Senate Candidate 5 to the Senate seat, to insure that Senate Candidate 5 kept a promise about raising money for Blagojevich if he ran for re-election. In a recorded conversation on October 31, Blagojevich claimed he was approached by an associate of Senate Candidate 5 as follows: “We were approached ‘pay to play.’ That, you know, he’d raise 500 grand. An emissary came. Then the other guy would raise a million, if I made him (Senate Candidate 5) a Senator.”

On November 7, while talking on the phone about the Senate seat with Harris and an advisor, Blagojevich said he needed to consider his family and that he is “financially” hurting, the affidavit states. Harris allegedly said that they were considering what would help the “financial security” of the Blagojevich family and what will keep Blagojevich “politically viable.” Blagojevich stated, “I want to make money,” adding later that he is interested in making $250,000 to $300,000 a year, the complaint alleges.

On November 7, while talking on the phone about the Senate seat with Harris and an advisor, Blagojevich said he needed to consider his family and that he is “financially” hurting, the affidavit states. Harris allegedly said that they were considering what would help the “financial security” of the Blagojevich family and what will keep Blagojevich “politically viable.” Blagojevich stated, “I want to make money,” adding later that he is interested in making $250,000 to $300,000 a year, the complaint alleges. On November 10, in a lengthy telephone call with numerous advisors that included discussion about Blagojevich obtaining a lucrative job with a union-affiliated organization in exchange for appointing a particular Senate Candidate whom he believed was favored by the President-elect and which is described in more detail below, Blagojevich and others discussed various ways Blagojevich could “monetize” the relationships he has made as governor to make money after leaving that office.

“The breadth of corruption laid out in these charges is staggering,” Mr. Fitzgerald said. “They allege that Blagojevich put a ‘for sale’ sign on the naming of a United States Senator; involved himself personally in pay-to-play schemes with the urgency of a salesman meeting his annual sales target; and corruptly used his office in an effort to trample editorial voices of criticism. The citizens of Illinois deserve public officials who act solely in the public’s interest, without putting a price tag on government appointments, contracts and decisions,” he added.

Mr. Grant said: “Many, including myself, thought that the recent conviction of a former governor would usher in a new era of honesty and reform in Illinois politics. Clearly, the charges announced today reveal that the office of the Governor has become nothing more than a vehicle for self-enrichment, unrestricted by party affiliation and taking Illinois politics to a new low.”

Mr. Fitzgerald and Mr. Grant thanked the Chicago offices of the Internal Revenue Service Criminal Investigation Division, the U.S. Postal Inspection Service and the U.S. Department of Labor Office of Inspector General for assisting in the ongoing investigation. The probe is part of Operation Board Games, a five-year-old public corruption investigation of pay-to-play schemes, including insider-dealing, influence-peddling and kickbacks involving private interests and public duties...