skip to main |

skip to sidebar

I would like to see a flat financial transaction tax enacted, applicable to any exchange. The tax would be $1 (or £1 or €1 or ¥100 for example) for any trade on any exchange public or private, for any registered security including derivatives, without regard to the size of the trade. I would even consider a lesser amount, say $.25 for example, based on better tax revenue estimates.

The real economy is being slowly strangled by an outsized financial sector that has purchased a politically sanctioned franchise for outsized fees and public subsidies.

The financial transactions tax would be paid on the buy side. No exemptions. None. Zip. Not even for 'wholesale' traders or banks, or those who own 'seats' on the exchange. It is a cost of doing business. You buy, you pay $1 for each purchase.

The purpose of the tax would be to fund the regulation of the financial industry and the Consumer Protection in the financial industry.

The tax 'burden' would fall most heavily on those engaged in High Frequency Trading. It would not halt the phony 'bid stuffing' phenomenon which would have to be dealt with in other ways. But it would help.

The money would be 'earmarked' for the Regulatory bodies. The government would not be able to divert it to other uses. This is similar in concept to the gasoline tax in the US which is a flat rate per gallon of gasoline, which is used to expand and maintain their Interstate Highway System.

The most common objection is that it would make the domestic exchanges less competitive, and that people would find ways to 'cheat.'

If this rule were to drive more fruitless speculation out of country, then perhaps one might add some incentives for these speculative companies to leave, and take more of their white collar con men with them. Let them see how they fare in Asian countries when they are caught in a fraud. Perhaps their could be a pay per view for the punishments.

Liquidity objections are a red herring, a joke. HFT adds no liquidity, it amplifies short term movements. It is not the same as the specialist system, not at all.

As for cheating, with a more fully funded set of regulatory bodies with professional career employees with an in depth understanding of the industry and continuity in position, not these revolving door suits who can't wait to work again for the industry companies they regulate, the cheating might become more manageable.

By the way, and in an somewhat unrelated discussion, I would use these funds to immediate tighten the regulations and enforcement against naked short selling, especially in the US and Canada.

Next up, reform of the transfer pricing abuses that allow international corporations to realize revenues in the country of their choice.

As for personal taxes, significantly raising the income triggers a flat 25% AMT to let's say $400,000 but tightening the exemptions until they include any 'income' of any sort from any source would be a good place to start. That is quickly achievable. We might also consider a modest AMT for corporations based not on 'income' but on reported revenues from whatever sources.

Businesses do not 'create jobs' like benificent gods. They respond to market opportunity and consumer demand for products and services. Incenting business in the face of failing demand cause by stagnant median wages and high unemployment is just a variation of the trickle down economic theory.

Create sustainable demand, and independent businesses will rush to fill it. The problem lies with the inefficient businesses, the zombie cartels, monopolies, and rentiers who have 'purchased' public franchises to take fees by buying politicians and favorable legislation.

These reforms would be almost easy to achieve, given a functioning political system responsive to the voters, compared to the biggest and most intractable problem facing the US, which is campaign finance reform, and the crowding out of the individual from the political process.

Never happen you say? I would agree that any proposals along these lines would be ignored, and if they gained notice, ridiculed and shouted down. It would be fun and informative to watch who screams the most, and who they do it for.

Well, all right then, but do not expect there to be any sustainable economic recovery.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

As Hermann Hesse oberved, "When the suffering become acute enough, one moves forward."

A nice bounce in the metals with gold up to key resistance.

The trusts and funds are responding as well as the mining companies, ahead of tomorrow's important September Non-Farm Payrolls report.

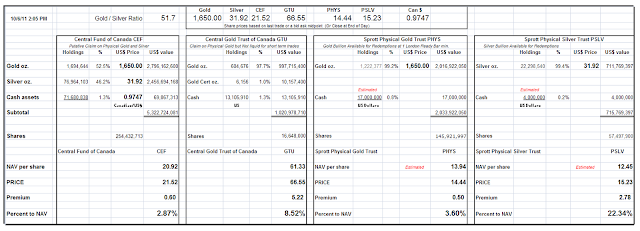

One notable variant in this is the unusually large premium being given to the Central Gold Trust. This is almost certainly due to a short squeeze as it is one of the least 'liquid' of the closed end funds with only 16.6 million units. The premium on PSLV is expansive but it is usually so.

I have done some redrawing of the daily Gold chart which will be released this evening.

"...the unforgiven

Fire which Prometheus filch'd for us from heaven."

Lord Byron, Don Juan, Canto I.

"So we went to Atari and said, 'Hey, we've got this amazing thing, even built with some of your parts, and what do you think about funding us? Or we'll give it to you. We just want to do it. Pay our salary, we'll come work for you.' And they said, 'No.' So then we went to Hewlett-Packard, and they said, 'Hey, we don't need you. You haven't got through college yet.'"

"Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It’s not about money. It’s about the people you have, how you’re led, and how much you get it."

“Innovation distinguishes between a leader and a follower.”

“I didn’t see it then, but it turned out that getting fired from Apple was the best thing that could have ever happened to me. The heaviness of being successful was replaced by the lightness of being a beginner again, less sure about everything. It freed me to enter one of the most creative periods of my life.”

"The cure for Apple is not cost-cutting. The cure for Apple is to innovate its way out of its current predicament.” (1999)

"Almost everything -- all external expectations, all pride, all fear of embarrassment or failure -- these things just fall away in the face of death, leaving only what is truly important. Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You are already naked. There is no reason not to follow your heart."

“Do you want to spend the rest of your life selling sugared water, or do you want a chance to change the world?”

Steve Jobs

"The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or Euro.

Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries towards reserving more gold."

China World News Journal, Shijie Xinwenbao, 04/28/2009

The market rallied today again on headline hopes of an orderly resolution to the Greek default.

There is likely to be a Greek debt default and restructuring. What the market does not yet understand is how it will be packaged and the extent of the damage to the debtholders, in particular some of the European banks.

According to Bloomberg the Europeans are running new bank stress tests based on a range of scenarios. I think the biggest variable is a haircut on the debt ranging from 21 to 50 percent.

What is a bit disappointing is that gold and silver continue to move with stocks, in the 'risk on risk off' trade. It would be better if gold were to rise as a risk aversion flight to safety trade. But of course there is quite a bit of perception management going on.

Non-farm payrolls coming up, and it may remind the markets of other risks. Be careful. The downtrend is not yet broken.

I tend to view 1540 to 1580 as key support for the gold futures based on the third chart.

Depending on how they wrap the rescue I am still thinking that a rally and some spikes will take gold back into a track to hit $2000 by year end. But let's not get ahead of ourselves.

Another low is possible at the supports indicated. And there is significant risk yet in the year end target. But once the ball gets rolling a $150 up day could break the usual pattern of capping rallies at 2%. The western central banks have used quite a bit of their reserves in this latest beat down of bullion.

And I still think the silver Comex market will resolve into a de facto default with forced cash settlements. I am not sure how they will justify this travesty. I think a case could be made that we are already there with so many deliveries being pushed into paper settlements with GLD and SLV.

But let's allow this to play out to the almost inevitable bitter end. There will be a story, and there will have to be some provision to head off an avalanche of litigation.