skip to main |

skip to sidebar

Gold and silver rallied back from the bear raid yesterday.

The correlation between metals and stocks is still troubling, but it does provide a ready hedge to bullion positions. This suggests that the metals are rising with liquidity and expectations of money printing, and that short term reductions in liquidity will drive the price lower.

Speaking of gold and money, here is a recent video interview with Jim Grant and Jim Rickards, in which they discuss these topics and others.

It is well worth a look, although I admire him greatly, I fear Jim Grant makes a stand on somewhat shaky ground when he calls out Paul Krugman to explain how monetary and fiscal policy worked with regard to 'the depression of 1920-21' and compares it to the current US economy.

Jim forgets to mention that a significant driver for that particular slump was the end of World War I, the return of the soldiers from overseas, and the adjustment from a wartime to a peace time economy.

There is also the little detail that Europe had been ravaged, but the US infrastructure and industrial machine was untouched, and only in need of retooling. The US needed a strong currency to control inflation, and the Fed's primary task was to manage money supply in the face of a naturally growing aggregate demand and rising incomes in the post-war period.

Krugman might be tempted to have some fun with that example and the prescription that raising interest rates now and tightening money supply is the right thing to do. Far from comparable, the situation is almost the opposite! The US is now a net debtor and importer of goods, and domestic demand is slack due to a stagnant median wage.

Yes, the Fed was overly accomodative in the 1920's as can be shown in the last chart in this blog, but the discussion is much more complex than time allows.

Rickards is on case with his discussion of the mispricing of the gold standard back then, and with regard to the SDR as a possible successor to the dollar, although he likens it too much to the US dollar, and says that the IMF has a printing press. He ignores the fact that the SDR is tied to an external standard, in this case a basket of currencies. And there is a contentious discussion amongst the trade powers with regard to the change in that basket. China and Russia are lobbying for other currencies and gold and silver to be included.

So it is a bit glib to suggest that the IMF can print SDR's at will. They *could* do that at some point, but not under the current system. That change in the composition of the SDR could be a key development in the currency war.

Speaking of Currency Wars, it is the title of Rickards new book, and I am waiting patiently for my copy to arrive.

In the meanwhile I started reading Jack Kennedy by Chris Matthews. It is very well written. Matthews is a natural story-teller, and he offers a fresh view of Kennedy based on first person information from JFK's friends, colleagues, and family.

It is a delight to read so far. It is a little light on 'scholarship' for some tastes, but it rings true, and includes an enormous amount of primary source interviews. It is insightful, a unique perspective, and a great read. It answers the question, "Who was Jack Kennedy, and what was he like?" I am thoroughly enjoying it. Matthews hit this one out of the park.

The situation with MF Global is an absolute disgrace. I am spending quite a bit of time looking into it, and will try to keep you apprised of any developments.

Have a pleasant weekend.

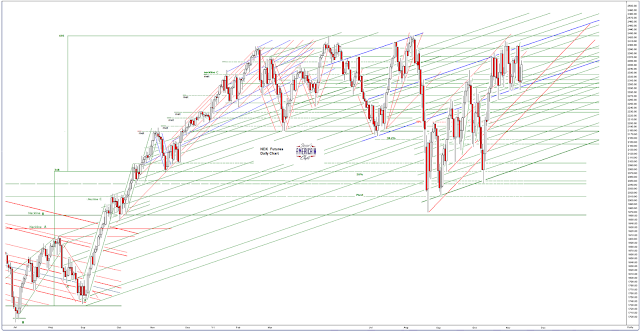

There was intraday commentary on the SP 500 chart that shows some important chart formations and levels of support and resistance.

The market rallied today on relief that Italy's bond prices relented somewhat, and consumer confidence came in 'better than expected.'

Volumes were light and the bond market and banks were closed for Veteran's Day.

Keep an eye on the European situation, as it will continue to drive the markets.

The last few times these symmetrical triangles at rally tops have broken decisively to the downside.

We are in such a formation now. I have marked levels that might be good indicators of a breakout or breakdown and some short term targets.

I think the greater risk is to the downside while the European financial and political situation remains unresolved, but I do not wish to get ahead of this.

A lot of guys are expecting this to move up to a high around 1275 which is only about 15 points away. They might get the rug pulled out from under them. Some pundits are also talking book to 1310. That is possible. But first they need to take out the triangle, and then they have a clearer shot, but with a lot of overhanging headline risk. I'd rather stay out than risk it, and have to sleep with one eye on Italian and Spanish bonds.

Volumes in today's rally are laughably light. The adults in the bond market have taken the day off.

This is a story about the first, albeit selective, potential default in the US by a major clearing exchange in the postwar period. And the cause of it remains a mystery, possibly by intent.

In the essay excerpted below, analyst Ted Butler brings out a key aspect of the failure of MF Global that has received far too little attention.

The self funding by the players of their industry's insurance seems to be one of the main sticking points in this impasse.

Why should the CME members pay back the MF Global customers, when they know full well what large institution took the collateral, probably illegally, sold it, and is refusing to give the money back and take the loss?

"Once you have their money, you never give it back,"

Ferengi - First Rule of Acquisition

And in their greed, they are risking the entire US exchange system in order to get their way with the government. Why not, it has worked before.

The failure of self-regulation, the rabbit hole of other scandals yet to be disclosed, and the political bickering are all matters that complicate the resolution. If MF Global had been a major bank, the FDIC would have immediately stepped in and made the depositors whole, and taken an active hand in the disposition of assets.

Is SIPC little more than a fig leaf, a false protection that fails when it is called upon to act as the insurance it purports to be?

This is a truly shocking scandal. And what may be even more shocking is the scant coverage it is receiving in the corporate media. They don't want to touch it because it brings the rottenness of the financial system out into the light of day. This is not some rogue trader, this is not even Bernie Madoff. This is the heart of the beast.

And that is why we may never hear the actual truth of it, which will be hidden under a smokescreen of 'accounting errors' and 'misunderstanding of risk' and a cloud of legal jargon.

It brings out in sharp relief the flaw in the ideological fairy tale that markets do not require outside regulation, that they are naturally efficient, and that people if left to their own judgement are all virtuous and objectively rational. But anyone who has ever driven on a modern freeway during rush hour knows the ridiculousness of those assumptions.

“It is a far, far better thing to have a firm anchor in nonsense than to put out on the troubled seas of thought.”

John Kenneth Galbraith

If this is not resolved, customers might be correct in assuming that nothing in the US financial system is safe. Someone needs to pass a note to Turbo Tim that this could be a big one, Elizabeth, if it is allowed to continue to fester. And maybe a copy of The Panic of 1907 by Robert F. Bruner.

Silverseek

An Unmitigated Disaster

By Theodore Butler

11 November, 2011

"Let me cut to the chase here and pinpoint the real problem – the CME Group. I know I have continuously criticized the CME, even calling it a criminal enterprise on many occasions, but in truth I may have understated the case. Yes, I would agree that the immediate cause of the MF Global bankruptcy was MF Global itself; but what turned it into a disaster of unprecedented proportions was the CME Group.

The CME Group was the front line regulator for MFG, responsible for auditing and insuring the safety of customer funds and for guaranteeing those funds in a worst case scenario. The CME failed at every turn. Not only did its auditing fail miserably, the CME failed to step up to the plate to safeguard customer funds after it was discovered that $600 million was missing. This is like a case of paying premiums for years on an insurance policy only to be denied coverage when presenting a claim for the first time. I know that the federal commodity regulator, the CFTC, has been negligent in the case of MF Global as well, but that does not mitigate the CME’s failures.

Of the twin failures by the CME in the MF Global bankruptcy, clearly of more significance is its failure to stand up and guarantee that all MFG customers would be immediately made whole by the clearinghouse system run by the CME.

The clearinghouse system, a consortium of financial firms whose collective finances stand behind every trade, has been the main backstop to all futures trading for many decades. It was widely understood by all market participants that if a clearing member failed, all the other clearing members and the exchange itself would step in to guarantee customer funds and prevent contract default.

The CME boasts on its web site that anywhere from $8 billion to $100 billion in protection is available in the event of a clearing member failure. If it was telling the truth, it would seem $600 million should be no problem.

Instead, we all have a very big problem, thanks to the CME Group. Our financial and credit systems are based upon trust and belief. The word credit itself comes from the Latin word “credere” or to believe.

What the CME Group has done by not immediately guaranteeing all MF Global customers and positions is to undermine belief in the futures market clearing system. So important is this issue that I am at a loss to explain how the CFTC hasn’t yet mandated that the CME do the right thing. And I have been somewhat dumbfounded that the analytical community and media haven’t been all over this, but there was an article in today’s NY Times that discusses the CME’s failures for the first time. In addition, there was a well-written article on the Internet that did describe the problem and the CME’s role. Please pay particular attention to the comments submitted on both articles.

Worst of all, even MF Global customers who held no open futures positions and only cash and unencumbered assets, like registered warehouse receipts for silver, gold and other commodities, have found those assets under the control of the bankruptcy trustee. If you do own warehouse receipts on silver or other commodities that are tied up in the MF Global bankruptcy, you must run, not walk, to a securities attorney to secure your legal rights to your property. This is not a matter of what is right or wrong, as the unauthorized appropriation of private property is never correct. This is a matter of law, which sometimes is not the same as what seems right or wrong. Please don’t delay. The CME is to blame for all of this, but blame must be saved for later...

One other small bonus that has emerged from this disaster is that the event has revealed as a lie all the nonsense that CME leaders have publicly proclaimed about the integrity of their markets. For the past few years, the smug and arrogant leaders of the CME have testified publicly before congress and the media about how the exchange’s clearinghouse system withstood and avoided the failures of the non-clearinghouse financial system as typified by AIG.

CME officials trumpeted the advantages of it being a Self-Regulatory Organization (SRO), quite capable of handling regulatory matters without the need for further government regulation. Unfortunately, even high officials of the CFTC were apparently sucked in by the appearance of financial strength and integrity portrayed by the CME’s clearinghouse system of guarantees and the wisdom of letting it continue to regulate itself. That has now all been shown to be a lie. What good are guarantees if they are not honored when need be? What good is self-regulation if it leads to the wholesale abandonment of the customers’ financial interest?"

Read the entire piece here.

Based on this shocking lapse in insurance and stewardship, it appears that some people whom I have spoken to and read about plan to shift the focus of their US dollar funds out of certain non-banking Wall Street institutions, and instead to place them in more conventional banking accounts and other assets held by safer hands.

The average person cannot tolerate such a precipitous loss of capital and freezing of funds. This is unacceptable. I was stunned at the trial balloons floated in the financial media that customers might have to accept haircuts and years of delay and litigation in receiving back their money.

MF Global Customers Have Few Options to Access Frozen Cash