skip to main |

skip to sidebar

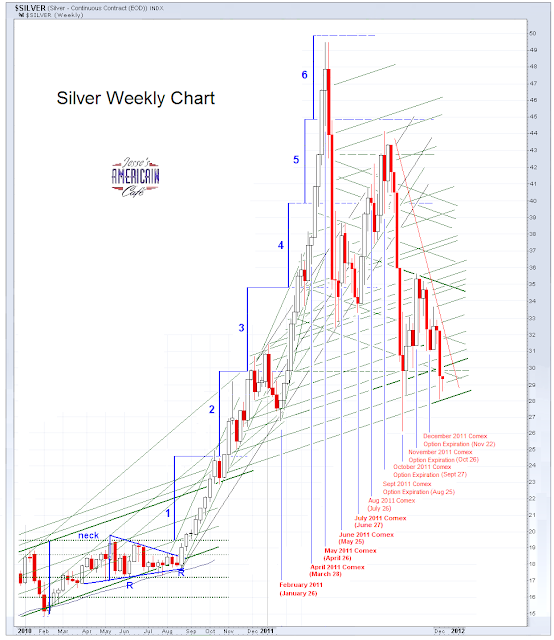

The long only funds were promoting their end of year stock results today on very light volumes. Miners and metals are such a slight holding amongst them that they are easily ignored in favor of a paper-only policy.

The market sat on the price of gold and silver all day throughout the paper rally to keep a lid on them. It could be getting easier in the short term as individual investors shun the Comex.

There is no additional commentary that is required: pure unadulterated market manipulation of the real world by the paper markets. It will have its time, and then it will fail.

Like watching paint dry on a virtual house in Farmville.

The only real excitement was an announcement that SP had cut Goldman's debt rating from their web site that took the stock down. That was a disavowed a few hours later and the stock rebounded.

The NDX is lagging from the SP which has been leading the rally higher. This sort of 'broad rally' is often driven by the buying of the SP futures to drive the market higher on light volumes, a patented ploy of Robert Rubin when he was running the Exchange Stabilization Fund as Treasury Secretary.

This rally would inspire more confidence if we all did not know that it is insubstantial, like cotton candy, and that a single headline could send it all tumbling lower rather quickly.

Tomorrow will be even slower, with the action all but over once they strike a level they wish to hit by around noon NYC time.

There is nothing 'modern' at all in Modern Monetary Theory. It is the same old fish wrapped in slightly different paper. The godfathers of Modern Monetary Theory are John Law, G.F. Knapp, J.M. Keynes, and most lately Alan Greenspan. But its roots go back to any ruling group that ever debased a currency or seized private property by fraud.

It is in the nature of a Ponzi scheme. As long as its sphere of influence can keep expanding, and the force by which people are compelled to accept it is maintained, a fiat currency will 'work.' But as its expansion slows, as outlying regions begin to resist it, the currency begins a slow but deadly spiral of collapse that accelerates into a final reckoning and reissuance.

Fiat currencies *can* work well in theory, but in reality they require the indefatigable dedication of people of extraordinary virtue, courage, and wisdom. And so they have failed. Always.

And it most certainly will not work with the craven and self-serving leadership which the Anglo-Americans have today. It is almost a cruel joke to promote such a system. And yet there it is and here we are. What comes next will be interesting.