skip to main |

skip to sidebar

In case your domestic financial press fails to deliver this important message to you so clearly, as the World Bank has done for the rest of the world's leadership.

Hope for the best, and prepare for the worst.

Equities are pricing in a rosy scenario, but the bonds and precious metals are saying 'beware.'

The western central banks will contine to print money in response to this financial crisis, both before and certainly after the fact.

'How much' is a policy decision, but the choice seems compelling. Rather than limiting their printing, they will most likely attempt to manipulate and mask the perception and awareness of their actions through programs of buying sovereign debt, engaging in disinformation campaigns, and allowing blatant price manipulation in the markets by insiders.

The problem with this is that insiders stand to profit enormously while the public is used and abused rather badly. Power really does corrupt, not all at once, but in stages, one rationale at a time, with a privileged outlook or groupthink that comes to be widely separated from the shared reality of the public. And the opportunity to turn this to pillage is not wasted on the worst elements of those in the halls of power.

"And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control. History has proven that."

Lord Acton

There are others ways to do this that do not benefit the few at the cost of the many in such a disproportionate manner.

Financial Times

World Bank warns emerging nations

By Chris Giles in London

January 18, 2012 2:00 am

Developing countries should take steps to plan for a global economic meltdown on a par with 2008-09 if the European sovereign debt crisis escalates, the World Bank warned on Wednesday in its latest economic forecasts.

Predicting significantly slower global growth in 2012 than it expected last summer even if the eurozone muddles through its crisis, World Bank economists said that if financial markets deny funds to eurozone economies, global growth would be about 4 percentage points lower than even these figures, with poorer economies far from immune.

Andrew Burns, head of macroeconomics at the Bank, told journalists in London: “Developing countries should hope for the best and prepare for the worst.”

Stressing the importance of contingency planning, he added: “An escalation of the crisis would spare no one. Developed and developing-country growth rates could fall by as much or more than in 2008-09.”

The world economy would find it much more difficult to grow out of a new economic crisis, the World Bank warned, because rich countries had little monetary or fiscal ammunition available to stem any vicious circle and poorer countries now have “much less abundant capital, less vibrant trade opportunities and weaker financial support for both private and public activity [than in 2009]”...

Read the rest here.

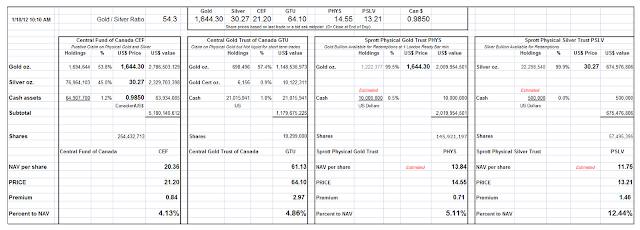

Sprott is bringing their deal out at the low end of the range. Quite a haircut for those who held the trust before the offering announcement, as I had warned. That thirty percent premium to NAV was completely undeserved and was most likely the result of a short squeeze.

It is a bullish deal for the silver market in general since it will take more than ten million ounces of silver out of the market and into the hands of longer term investment in the trust.

Sprott is giving the underwriters 15 percent of the offering in the over allotment if they choose to take it. They are Morgan Stanley and RBC Capital Markets in the United States and RBC Capital Markets and Morgan Stanley in Canada.

(RTTNews) - Sprott Physical Silver Trust (PSLV: News , PHS_U.TO) announced that it has priced its follow-on offering of 23 million transferable, redeemable units of the Trust at a price of US$13.20 per Unit.

As part of the Offering, the company said that it has granted the underwriters an over-allotment option to purchase up to 3.45 million additional Units. (15 percent)

The gross proceeds from the Offering will be US$303.60 million or US$349.14 million if the underwriters exercise in full the over-allotment option.

The company stated that it will use the net proceeds of the Offering to acquire physical silver bullion in accordance with the Trust's objective and subject to the Trust's investment and operating restrictions described in the prospectus related to the Offering.

Under the trust agreement governing the Trust, the net proceeds of the Offering per Unit must be not less than 100% of the most recently calculated net asset value per Unit of the Trust prior to, or upon determination of, pricing of the Offering.

As predicted. The cash reserves of the Trust had fallen to less than $350,000 by my estimates.

Let's see how this affects the price of silver.

According to a message to the Sprott Private Wealth clients:

PRICING: will be between $13.10 to $13.75 USD, which is a 5.6% to 10.0% discount from last trade, but a 12.3% to 17.9% premium to the latest Net asset value per unit.

PSLV closed regular trading today at $14.56, but traded as low as 13.33 after hours.

And as anticipated those buying the Trust at those 30 percent premiums will take about a ten percent hit on this offering. The premiums must have been indicative of a short squeeze and not of a shortage in physical silver per se. And the premiums were clearly at the outer bound of the historic range.

Of particular interest will be the allotment if any to the underwriters and at what prices. I would be surprised if deliverable silver has not already been discussed and arranged if this is going to be a deal in size. The trust may be attractive once again at a more normal premium according to historic standards.

Press Release

Sprott Physical Silver Trust Announces Follow-on Offering of Trust Units

TORONTO, Jan. 17, 2012

(NYSE: PSLV) (TSX: PHS.U), a trust created to invest and hold substantially all of its assets in physical silver bullion and managed by Sprott Asset Management LP, announced today that it has launched a follow-on offering (the "Offering") of transferable, redeemable units of the Trust ("Units").

The Trust will use the net proceeds of the Offering to acquire physical silver bullion in accordance with the Trust's objective and subject to the Trust's investment and operating restrictions described in the prospectus related to the Offering.

Under the trust agreement governing the Trust, the net proceeds of the Offering per Unit must be not less than 100% of the most recently calculated net asset value per Unit of the Trust prior to, or upon determination of, pricing of the Offering.

From a Message Sent to Clients of Sprott Private Wealth

Sprott Physical Silver Trust (TSX: PHS.U, NYSE: PSLV) is issuing new units via an overnight follow-on offering. Anyone interested, please get back to me by 7:30 a.m. EST tomorrow (Wednesday, January 18) with their order quantity. Details are below.

The offering is expected to be for between $250 - $350 million USD. Eric Sprott will be participating as Sprott Inc., the Sprott Foundation and related entities or clients will invest at least $45 million in the offering.

PRICING: will be between $13.10 to $13.75 USD, which is a 5.6% to 10.0% discount from last trade, but a 12.3% to 17.9% premium to the latest Net asset value per unit.

Please note for Canadian investors, you can purchase silver at net asset value by buying the Sprott Silver Bullion mutual fund. Silver is Eric Sprott’s top investment thesis and as such, most of you already hold a substantial amount of silver through his Funds. As at December 30, 2011, 24% of the holdings in Sprott Canadian Equity Fund were silver bullion and for Eric’s Canadian hedge fund strategies, silver bullion makes up between 29-33% of the long portfolio.

If interested in this offering, if you have any questions or if you would like to take any other action with your portfolio, please send me an e-mail or call me.