skip to main |

skip to sidebar

The margin call was predicted here about day two as I recall. The question in my mind is the extent that JP Morgan and any of their other bankers and credit line holders played in this.

It will be interesting to see how this case progresses from the Giddens-Freeh bankruptcy team and into the hands of the regulators and Justice Department.

So far (for the past three years) the Obama Administration has been adverse to looking too far into these sorts of cases before throwing a waiver or settlement without admission of any guilt on the table.

Bloomberg

MF Global’s $310 Million Margin Call Exceeded Its Market Value

By Matthew Leising

February 06, 2012, 8:33 PM EST

Feb. 7 (Bloomberg) -- MF Global Holdings Ltd., the futures broker that filed the eighth-largest bankruptcy in October, faced a $310 million margin call on its final day that exceeded its market value.

Calls for payments tied to bets MF Global made on European sovereign debt increased Oct. 24 and continued through Oct. 31, the day the futures broker formerly run by Jon Corzine filed for bankruptcy protection, according to a report yesterday from James Giddens, a trustee overseeing the brokerage’s liquidation. MF Global had a market value of $198 million on Oct. 28 as it held $6.3 billion in European sovereign-debt trades.

After tracing 840 transactions of $327 billion in the company’s final days, Giddens is still analyzing where some of the $1.2 billion in missing customer money “ended up,” he said in the report. Corzine’s firm failed after credit-rating downgrades, a record quarterly loss and revelations about its $6.3 billion European debt trade unnerved investors. The missing money has sparked Congressional hearings and former customers have said it undermined confidence in the futures industry.

“For three months, our investigative team has worked to understand what happened during the final days of MF Global when cash and related securities movements were not always accurately and promptly recorded due to the chaotic situation and the complexity of the transactions,” Giddens said in a statement.

The trustee didn’t disclose the identity of the counterparties making the margin calls. The trades were cleared through LCH.Clearnet Ltd., according to an MF Global contingency plan drafted before its failure. In the plan, which was designed to address the effects of a credit-rating downgrade on the company’s solvency and liquidity, MF Global questioned whether it should move the debt trades out of LCH.Clearnet.

“How will LCH respond, how much in excess margin will be required, time period, can/will they force us out?” the brokerage questioned in a section of the plan titled “immediate decision making required.” The undated plan indicated the company could move some of the cleared positions to the over- the-counter market, where it could get more favorable terms.

Congress, the Commodity Futures Trading Commission, Securities and Exchange Commission and the Justice Department are investigating events surrounding the collapse of MF Global, including the disappearance of the customer funds...

Gold was hit hard by a selling flurry around 3 AM Eastern Time, with most of the selling timed to events in London.

Check out the plunge in gold lease rates on 2 February in the last chart.

Silver proved to be more resilient.

If and when the metals brokers and their pyramid of leverage breaks, be careful about any holdings you may have that are mingled with theirs, otherwise your victory may be marred by a loss of funds related to the collateral damage of a default and a financial reorganization.

I hope for the best, but if there is another financial dislocation in the markets it is going to be quite ugly. They are running a little low on scapegoats and patsies, and the pain to be distributed will be great.

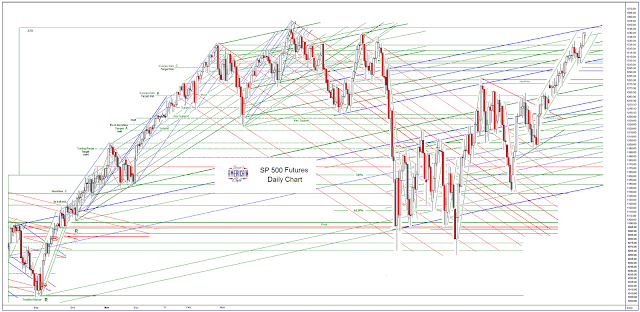

Another light volume day saved the market from rolling over, which it seemed ready to do early on.

I think it is time now to take a maximally defensive position, which for me at least means hedged gold bullion positions and cash. The bullion hedge is to guard against a liquidation event as opposed to an equity correction.

If volumes stay light the wiseguys can keep lifting this up, burning the shorts. So do not get ahead of this, but keep your powder dry if you trade, and if not, start packing up in advance of a move to higher ground.

|

| Hail to the Real Chief |

It sure is taking them a long time to spit this one out, isn't it? We stole your money, we own the system, and there is nothing you can do about it, you pipsqueaks, so just STFU and take what we choose to give you.

Given the timing and the likely parties involved, these transfers, even when they do not involve the theft of customer funds, with the withholding of third party cash transfers by the intermediaries, done among insiders in the last week of a bankruptcy, have the appearance of a fraudulent conveyance.

Given that quite a bit of this money was undoubtedly held by MF Global's bankers, who were almost certainly aware of and may have helped to precipitate the bankruptcy, we might even have a criminal conspiracy to defraud the customers and other creditors in addition to the civil actions appropriate in a fair and unbiased bankruptcy proceeding.

There is also some evidence that certain customers were privately warned by the bankers, or perhaps even parties in the company itself, a few weeks in advance, and were able to withdraw their funds from the company before it failed. Some right wing money men come to mind, among others.

This suggestion by the trustee that the MF Global personnel took the customer money unknowingly, ie. by mistake, would be hilarious if it was not being used to describe so malicious and unspeakable lapse in stewardship by the privileged, wealthy people in stealing the livelihoods from farmers and cattle ranchers among others.

What surprises me almost more than anything is that these jokers are willing to risk bringing down the financial system for a measly billion dollars, which is a fraction of what they take in personal bonuses in a good year. Is this some sort of perverse adherence to the Ferengi rules of acquistion? "Once you have their money, never give it back."

If this stands, then nothing, no assets, held by the Anglo-American financial system are safe. When the next crisis comes, they will take what they want, starting with foreign holdings, working their way up the power and influence pyramid from there. And you can talk to the back of their hand if you don't like it.

Reuters

MF Global shortfall worsened as bankruptcy neared

Mon Feb 6, 2012 2:18pm EST

Feb 6 (Reuters) - The trustee liquidating MF Global Holdings Ltd's broker-dealer unit said the shortfall in commodity customer accounts began five days before the company's bankruptcy and grew in the days leading up to the Chapter 11 filing.

James Giddens, the trustee for MF Global Inc, said in a statement that his investigation has revealed that MF Global personnel might not have known of the shortfall at the time. (Anyone in the business must be rolling on the floor laughing at this one. Oops, sorry, we inadvertently took the customer money by mistake, a simple $1.2 billion error, and its too late to give it back to the right persons. But we're dreadfully sorry for our innocent mistake. - Jesse)

He said he has traced a majority of cash transactions, totaling more than $105 billion, made in the last week prior to MF Global's bankruptcy on Oct. 31, 2011. Giddens said he is working with third parties to seek more complete information about transfers to "select" parties prior to that bankruptcy.

Giddens also said it is unknown when he will be able to make more distributions to former customers.