"When the international monetary system was linked to gold, the latter managed the interdependence of the currency system, established an anchor for fixed exchange rates and stabilized inflation. When the gold standard broke down, these valuable functions were no longer performed and the world moved into a regime of permanent inflation.

What will be the character of the international monetary system in the next century and how will gold intersect with it? This subject may strike modern audiences as a strange topic, but back in the 1960s, when people were deliberating about the future of the international monetary system, gold figured importantly in the discussions.

Even today, the importance of gold in the international monetary system is reflected in the fact that it is today the only commodity held as reserve by the monetary authorities, and it constitutes the largest component after dollars in the total reserves of the international monetary system."

Robert A. Mundell, Nobel Prize in Economics 1999

There is a fairly tight cap on silver.

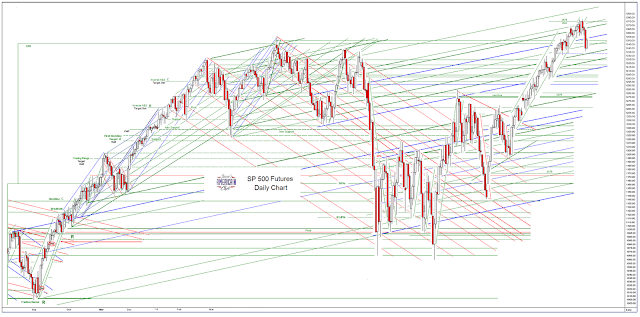

The equity market seems to be pricing in a Greek settlement that is favorable to the paper markets. It is not yet clear that this is valid.

Let's see if this proves out, and how the precious metals react.