"Quite unexpectedly, except perhaps among a handful of long-time gold advocates, gold is quietly and gradually moving back to its centerpiece role in international reserves. Stretched and threatened financially, nation states have begun accumulating gold for the same reason private individuals do -- as portfolio insurance to cover a wide assortment of economic uncertainties.

What's more, this restoration has not occurred formally as a result of an international agreement as has so often the case in the past, but informally as a natural evolution in the way nation states think about and react to the long-term value of currency reserves. As such, it suits the times and suggests an authenticity that is likely to transform the gold market at its core.

In my view, this swing in the supply-demand fundamentals will come to be recognized in future years the most important gold market event since the Central Bank Gold Agreement (CBGA) of 1999 -- the accord that many believe kicked-off the secular gold bull market."

Michael Kosares, The Most Important Gold Event Since 1999, USA*Gold

Quite a few of the uncivilized entered the markets today, and sparked a rally in gold and silver in what appeared to be an obvious 'flight to safety' and also a powerful relief rally after the awful pounding the metals and the miners had taken into the Comex expiries and delivery dates.

Some of the dividend paying gold and silver stocks had impressive gains even moreso than the metal, with at least one royalty trust up 11 percent or so. Yes I flipped one from yesterday, and even trimmed my entirely outsized bullion positions bought on the dips back to something a little more 'normal' and comfortable. Of course I never touch my long term holdings in place since 2000. It is not raining nearly hard enough yet.

During hard times a solid dividend paying miner is hard to beat, unless you get lucky with one of those lottery tickets known as junior miners. When the right time comes I hope to be there. But for now I will play it a bit more safe. I see more potential downside in stocks until the banks step up and print it up harder. No telling how well they will fare against the splash from across the sea.

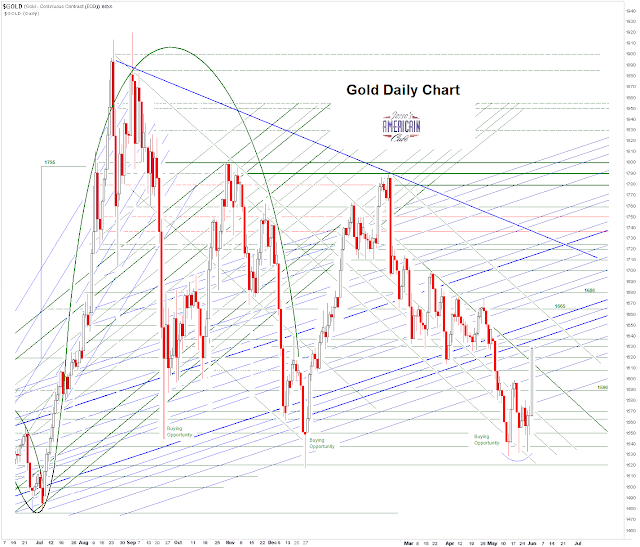

After a triple spiked test of support, the gold market went vertical today, marking perhaps what might be regarded by some of the more astute as a well-rounded bottom. I live for days like today. Much of this was due to a reversal of the sheer manipulation for short term gains, that broke in the face of the unfolding global currency crisis. Bam!

Never underestimate the power of the CFTC to stand idly by while the markets, taken in hand by the titans of Wall Street, degenerate into something that resembles a round of golf at the Piedmont Driving Club, or an impromptu fight club meeting at the New York Athletic Club.

Well, boys will be boys, in proportion to their toys.

Chart-wise follow through is everything. Yes we have a short term rounded bottom, and the potential for much larger formations including a broad cup and handle the likes of which we have not seen in quite some time. But do not underestimate the baseness of desperate men accustomed to having their way.

But first things first. We must see if gold can break the intermediate downtrend and then establish at least a broad trading range, which will form the lid of the potential cup. It could happen in a rush, given some exogenous trigger event and the right convergence of circumstances, but I suspect it will be a long and arduous climb, fought in stages and levels.

Chart porn-wise, the cup and handle, should it work, would take gold well over $2,000 by year end or so, and probably set up a new leg into the 3000's.

But that is all speculation. Time to do the hard climbing work for now, one day at a time.

Have a pleasant weekend.