skip to main |

skip to sidebar

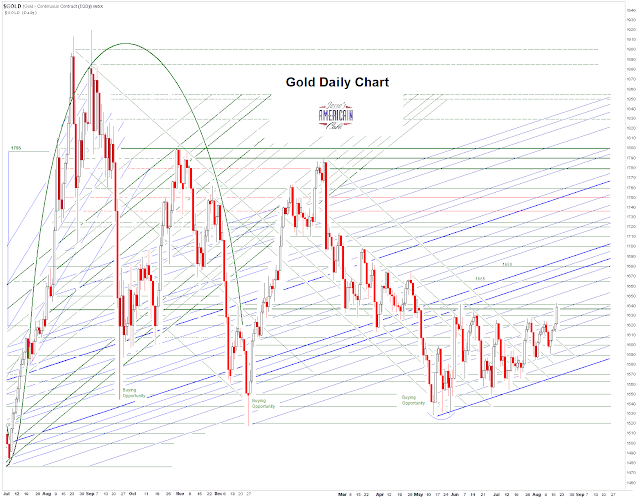

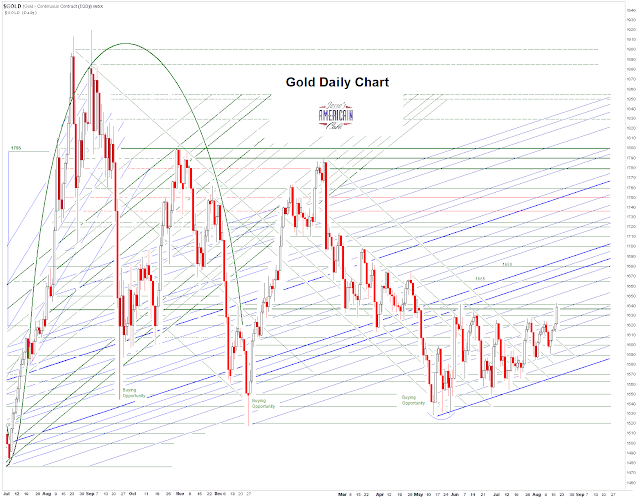

Gold and silver had a nice rally today, and ran up into hard resistance as one can see from the charts.

I published a note on the Net Asset Value Premiums today that shows that for the first time in my memory the premiums on gold versus silver had turned decisively in favor of gold.

This has occurred before, when a fund was expanding its size using a shelf offering for example. They sell units and raise cash to buy metals, and the size of their cash reserves go up and then down. This affects the NAV premium quite a bit.

Sprott's PSLV has recently completed a large expansion which showed up in the premiums in the end of July and August. These expansions have caused PSLV to underperform SLV for the year to date.

And in early August we saw the premiums at par in the Central Funds as well. That might be a drag on effect as investor enthusiasm for silver become subdued.

But now gold is clearly edging out silver. I'm not sure why, but I suspect that if this trend continues and deepens then the market is pricing in some event as yet unforeseen, at least by us.

A change in monetary policy, war, a new trade regime? All these exogenous events are possible, in addition to endogenous factors such as a big official buyer or two in gold.

Let's see what happens.

Stocks ran up to resistance around 1425, and then the buying seemed to fall apart for no reason.

Stocks gave up all their gains and ended the day with a slight loss.

For now this is just a pullback since stocks did not violate any key support.

After the bell Dell cut its forecasts. Even though the company is troubled, the economy is certainly not robust in the states.

My net asset value premium indicator shows that gold is commanding a higher premium over NAV as compared to silver, for the first time that I can ever recall.

I do not remember seeing the premium on gold higher than the premium on silver, as shown in the Sprott precious metal funds. Ever.

At least not while the funds are not in the midst of implementing a shelf offering. Sprott silver (PSLV) recently completed a major buy and the premium there often lags in such a period of time.

When I saw the results my jaw dropped. I have checked and rechecked them. And my own estimates of their NAV track perfectly with their indicative intraday indicators, so I am fairly sure there is not an error in the fund calculations.

And as confirmation, the premium of the Central Gold Trust (GTU) is higher than the premium of the Central Fund of Canada (CEF), which is a mix of silver and gold. That is also strange.

In early August the premiums in the funds had pulled equal, but I tended to dismiss that as a drag on effect from the Sprott silver expansion. CEF and PSLV have some correlation in premiums with the larger PSLV being the price leader.

Something is a bit odd in this market.

Last week someone notified me of some unusual trading patterns in the gold funds. I have been keeping an eye on them, but never expected this.

Silver has a much higher beta than gold. If this continues, if the gold premium continues to exceed silver, it would suggest a clear signal that at least some market participants are pricing in an unusual financial event.

What that might be, I cannot say. I do not even know if it is positive or negative for the precious metals market or their related markets, except to speculate.

On one hand it could represent some manipulative action in the silver market, some unusual effort to cap its tendency to rally.

On another hand it might be a precursor to a dramatic market decline in equities, with a safe haven move into gold ahead of time.

And it could also merely be particular buying pressure from official sources in gold that has not yet spilled over into the silver market.

Take your pick. They are all equally defensible at this point, until we obtain more data.

Unnaturally tight upward ranges like this are generally the sign of a 'market operation' to take equities higher.

The question of course is by whom and for what reason.

It could just be the tendency of the wiseguys to take it higher in the absence of real activity, just because they can, until it becomes priced for fantasy.

Or it could be some of the better connected banks and trading desks front running the Fed.

It certainly is not justified by the economic fundamentals. But that may be an artifact from the old days in which the market reflected the real economy, and allocated capital according to its needs to enable efficient use of productive resources.

In these days of fading empire when the major activity of the US is making money from money, the market is the economy, and its primary function is to redistribute wealth from the bottom to the top.