skip to main |

skip to sidebar

The Producer Price Index (PPI) is running hot showing some goods cost inflation.

Wells Fargo reported record earnings this morning, but a worse than expected net margin from the low interest rate environment. JPM made their numbers, but they did it by tapping loan loss reserves.

And all that led to weakness in the banking sector which led to a weak SP 500.

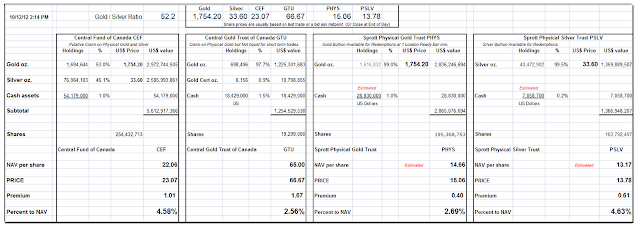

Gold and silver were under pressure after the London PM fix, and the selling went on into the afternoon. Both metals went out lower for the day.

What next? Europe, to bail or not to bail.

I took a silver position this afternoon on the if/come. It's been a while.

Let's see what happens.

Stocks were weak today as Wells Fargo reported record earnings, but also showed net margins that were much lower than expected on the interest rate squeeze of the QE kind, which make banks and therefore SP weak.

Let's see if the bulls can rally it next week. If not, down we go.

Today's 30 year Treasury auction was described as 'soft' as the cover rates were not as robust as yesterday's ten year. Ten-year notes started the day yielding 1.679% and were recently yielding 1.684%, while 30-year bonds were up 12/32 in price to yield 2.875%.

Personally I think that buying a 30 year bond yielding under 3 percent is insanity.

Negative real yields on Treasury debt is a highly bullish indicator for gold.