29 April 2013

27 April 2013

Weekend Reading

"God beholds you individually, whoever you are. He calls you by your name. He sees you and understands you, as He made you. He knows what is in you, all your own peculiar feelings and thoughts, your dispositions and likings, your strength, your weakness.

He views you in your day of rejoicing, and your day of sorrow. He sympathises in your hopes and your temptations. He interests Himself in all your anxieties and remembrances, all the rising and failings of your spirit. He has numbered the very hairs of your head and the height of your stature.

He compasses you round and bears you in His arms; He takes you up and sets you down. He notes your very countenance, whether smiling or in tears, whether healthful or sickly. He looks tenderly upon your hands and your feet; He hears your voice, the beating of your heart, and your very breathing.

You do not love yourself better than He loves you. You cannot shrink from pain more than He dislikes your bearing it; and if He puts it on you, it is as you would put it on yourself, if you would be wise, for a greater good afterwards....

God has created you to do Him some definite service; He has committed some work to you which He has not committed to another. You have your mission -- you may never know it in this life but you shall be told it in the next.

You are a link in a chain, a bond of connection between persons. He has not created you for naught. You shall do good, you shall do His work. You shall be an angel of peace, a preacher of truth in your own place while not intending it if you do but keep His commandments.

Therefore I will trust Him. Whatever I am, I can never be thrown away. If I am in sickness, my sickness may serve Him; in perplexity, my perplexity may serve Him. If I am in sorrow, my sorrow may serve Him. He does nothing in vain. He knows what He is about.

He may take away my friends. He may throw me among strangers. He may make me feel desolate, make my spirits sink, hide my future from me -- still He knows what He is about."

John Henry Newman

Category:

Christian humanism

Matt Taibbi Discusses the Market Rigging in the Swaps and LIBOR Markets By the Banks

Derivatives and many real world calculations of risk and price are based on a relatively few published data, such as LIBOR.

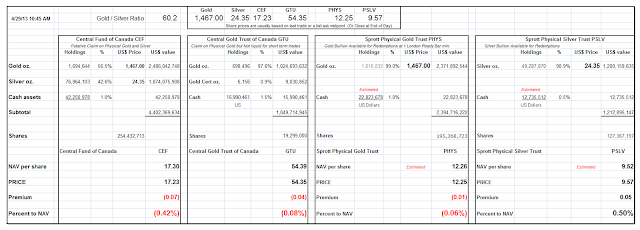

Similarly, the 'spot' price of gold and silver is based in large part on the front month contract for gold and silver on the Comex. And those prices in turn have enormous leverage over the price of mining stocks.

Some have pointed to the 'physical market' in London for metals at the LBMA as the true price market for physical bullion, with their AM and PM 'price fix.' And while it is true that the LBMA is a market dominated by insiders, with less disclosure than many exchanges, it has come out that even on the LBMA the price is largely based on paper trading with leverage approaching 100 to 1.

And LBMA is heavily interconnected with the Comex.

Since those making markets on the Comex in metal futures deliver a very small percentage of the actual gold and silver that is traded on paper, and much of that is settled for cash, the opportunity for price rigging is significant, hugely so.

And as in the case of other long running market schemes, like Bernie Madoff's, the stony silence and arrogant denials of any irregularities, despite very unusual trading activity in quiet hours and around key dates, is disconcerting considering the opaque nature of some unusually large market positions and significant circumstantial evidence with regard to motive and opportunity.

"All of these stories collectively pointed to the same thing: These banks, which already possess enormous power just by virtue of their financial holdings in the United States, the top six banks, many of them the same names you see on the Libor and ISDAfix panels, own assets equivalent to 60 percent of the nation's GDP are beginning to realize the awesome possibilities for increased profit and political might that would come with colluding instead of competing. Moreover, it's increasingly clear that both the criminal justice system and the civil courts may be impotent to stop them, even when they do get caught working together to game the system.

If true, that would leave us living in an era of undisguised, real-world conspiracy, in which the prices of currencies, commodities like gold and silver, even interest rates and the value of money itself, can be and may already have been dictated from above.

And those who are doing it can get away with it. Forget the Illuminati this is the real thing, and it's no secret. You can stare right at it, anytime you want."

Matt Taibbi: Everything Is Rigged

Category:

gold manipulation,

Madoff,

market manipulation

26 April 2013

Gold Daily and Silver Weekly Charts - Post-Expiration Gut Check - Taibbi: Everything Is Rigged

From last night's gold and silver commentary:

Today was option expiration on the Comex and it was quiet. After the recent bloodbath I cannot imagine it would be otherwise. If I were of a manipulative mind I would hit the metals again hard tomorrow."

So what next? There will not be any halt to QE for the forseeable future.

Gold and silver are lightly owned. When they break out and the common person becomes more aware of what is going on, there will be a huge shift in buying to the upside.

And those who manage the markets fear this. They not only fear their loss of control, but also the exposure of their market antics and the widespread corruption in the system. We are in a credibility trap, after all.

If you have not yet seen it, the most recent piece by Matt Taibbi, Everything Is Rigged, is worth reading.

Have a pleasant weekend. See you Sunday evening.

Subscribe to:

Comments (Atom)